US stocks extended losses for the fourth consecutive trading day as recession fear continued to weigh. The Cleveland Federal Reserve President Loretta Mester sees the Fed fund rate rising above 4% in the coming months.

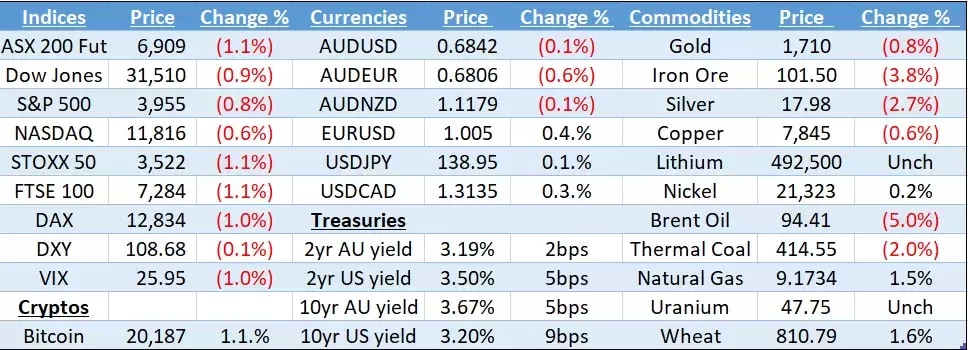

- Dow fell 0.88%, S&P 500 down 0.78%, and Nasdaq declined 0.56%. The three averages ended August with a more than 4% loss. 10 out of the 11 sectors in the S&P 500 closed in red, with material and consumer discretionary stocks leading losses. The Communication services sector is the only sector that finished slightly higher, up 0.01% as Snap’s shares popped 8% after the company announced to cut 20% of employees, which lifted other social media’s shares, with Meta Platforms up 3.67%, and Pinterest jumping 5%.

- Asian markets are set to open lower, dragged by the global risk-off sentiment. S&P/ASX futures fell 1.04%, Nikkei 225 futures slid 0.92% Hang Seng Index futures were down 0.42%. The S&P NZ 50 index slid 0.1% at the open.

- BYD (HK: 01211) shares slumped 7% on the news that Warren Buffett’s Berkshire Hathaway is to sell 1.33 million shares worth $47 million, cutting its holdings from 20.04% to 19.92%.

- China’s manufacturing PMI contracted for the second straight month in August. In fact, the data contracted for 4 months in the last 5 months since March.

- Crude oil futures fell further despite a larger-than-expected draw in the inventory data as OPEC +’s output cut expectations faded on a demand upgrade for 2022. The organisation will meet on 5 September to discuss future production plans. On the other hand, President Biden is engaging in the Iran nuclear negotiation, which could return Iran’s supply by 1 million barrels per day. Both base metal and precious metals also slid for the second trading day due to a strong US dollar, rising bond yields, and recession worries.

- The Eurodollar strengthened further on the ECB’s hint for a 75-bps rate hike in September. The Eurozone CPI rose to 9.1%, while Core CPI was up to 4.3% in August vs. 8.9% and 4.0% in July. The EUR/USD rose for the third trading day, to 1.0050 this morning, heading to a key resistance level of 1.01.

- Commodity currencies continued to weaken against the US dollar due to weak China’s manufacturing PMI and a downbeat in the commodity prices.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.