All key benchmark US stock indices managed to advance but at a lower volume. The S&P 500 added +0.4% but volume was less that its 10-day average. The outperformers were the Nasdaq 100 (+0.8%) and Russell 2000 (+0.8%) while the Dow Jones Industrial managed to squeeze out a meagre gain of 0.2%.

The current key overall theme for markets was a 'tug of war' between optimism for Covid-19 vaccine developments versus the actual rising coronavirus infected cases in the US and Europe. On a positive front, a phase 2 vaccine trial data from the AstraZeneca/Oxford collaboration showed encouraging immune responses in older patients.

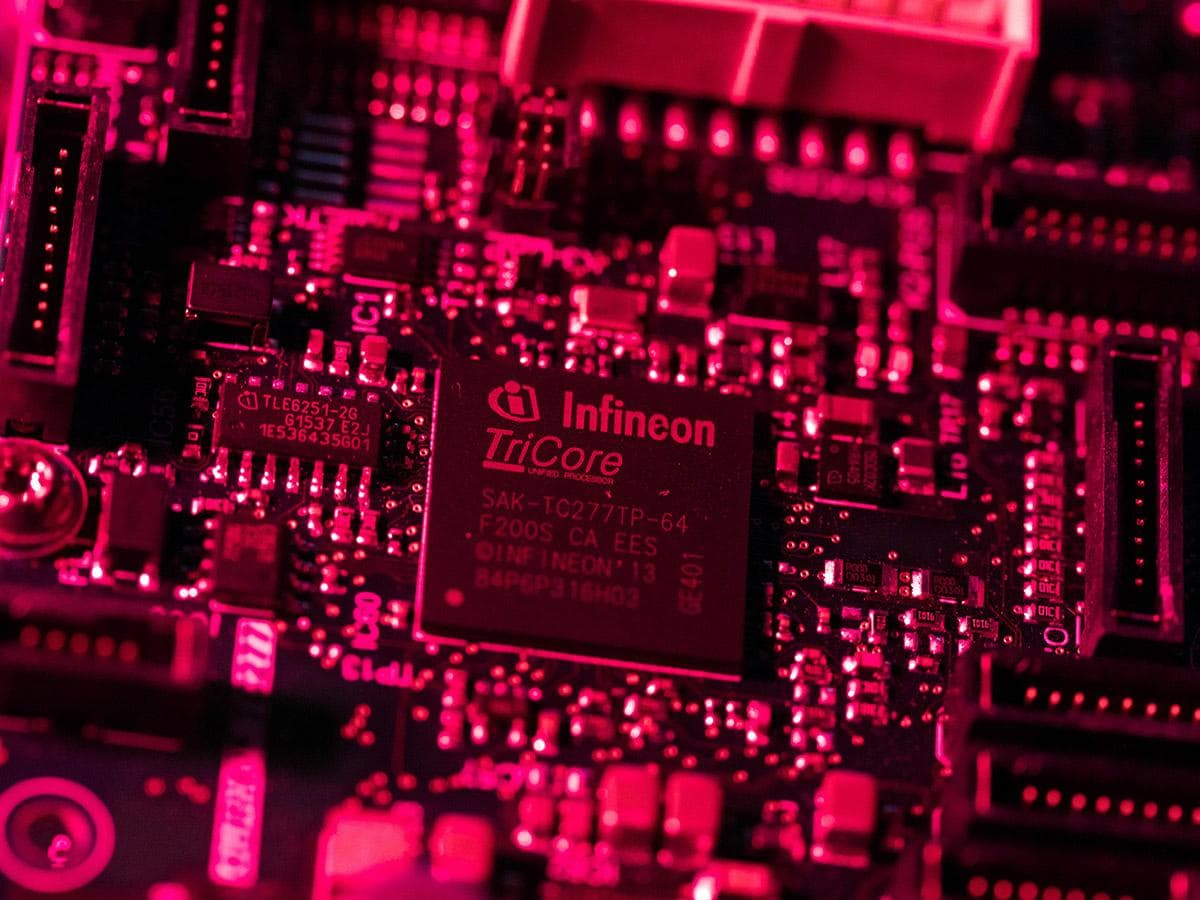

The leading US S&P sectors were energy (+1.5%) and information technology (0.8%). Interestingly, semiconductor & equipment, one of the industries within the IT sector, continued to post stellar gains (+1.3%), while the Philadelphia (PHLX) Semiconductor Index rallied by +1.6%, only1.3% away from its current all-time high of 2,604, printed on 9 November.

On the US political front, the Senate Democrat minority leader and Republican majority leader agreed to restart fiscal stimulus talks. Not so positive was the news that Treasury Secretary Mnuchin said that he would not extend several Federal Reserve’s emergency loan programmes enacted during the pandemic: corporate credit, municipal lending and Main Street lending programmes would not be renewed when these programmes expire on 31 December. Overall, such actions may hamper the ability of the incoming Biden administration to gain economic support from the Fed to combat the ongoing pandemic.

The US dollar continued to wobble against the majors currencies, as the USD Dollar Index, which ended yesterday’s US session at 92.29, threaded dangerously close to the 92.15 major ascending support in place since the April 2011 low. In addition, the US Treasury 10-year yields spreads with the German Bunds, UK Gilts and Japanese Government Bonds continued to narrow, which also does not support a USD revival in the near-term.

It was a mixed bag for Asian benchmark stock indices: Japan’s Nikkei 225 (-0.7%), South Korea’s KOSPI (+0.01%), Hong Kong’s Hang Seng Index (+0.4%), Hang Seng Tech Index (+1.2%), China’s CSI 300 (+0.1%), Australia’s ASX 200 (+0.1%), and the Singapore’s Straits Times Index (0.9%).

Chart of the day: PHLX Semiconductor ETF (SOXX)

The PHLX Semiconductor ETF (SOXX) is poised for another potential fresh all-time high.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.