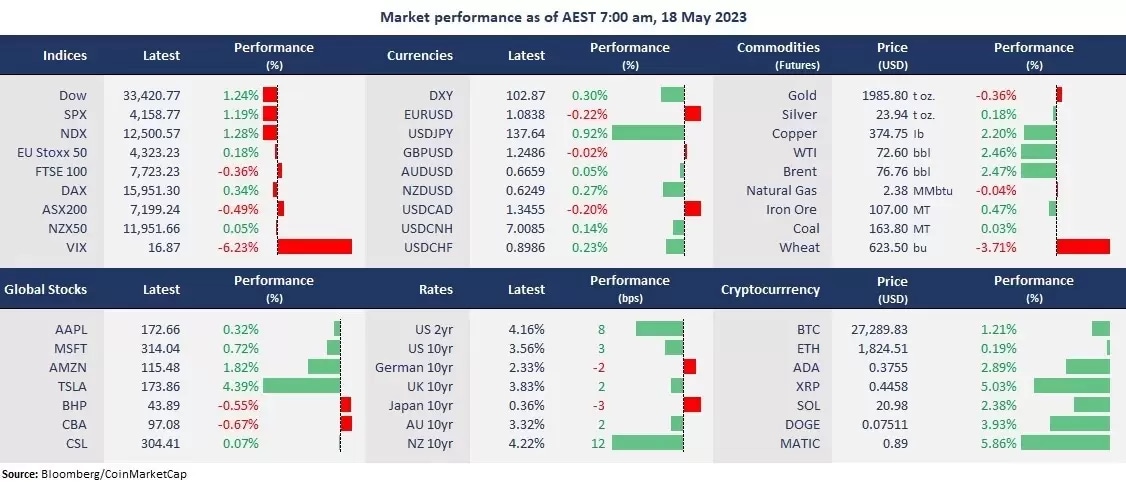

US stocks finished higher following positive progress of the debt ceiling talk between the two parties, with a possible deal to be reached by the end of the week. Risk-on prevailed on Wall Street, with three benchmark indices ending in the green, while the US bond yields continued to rise. The relief rally caused a sharp rebound in cyclical stocks, such as energy, financial, and industrial sectors, along with a comeback in growth-sensitive commodities, including oil and copper. Gold, however, continued to fall due to a further strengthened USD and rising bond yields.

In Asia, Japan’s Topix extended gains after hitting an all-time high on Wednesday. The Nikkei 225 also rose to the highest level since September 2021. The rally suggests that foreign investment returns to the monetary policy-supported economy with relatively low inflation and a better liquidity environment, leading to a likely upgrade in stock valuations and growth outlooks. The 10-year Japanese government bond yields fell 3 basis points to 0.36%, sending the Japanese Yen lower as investors may buy bonds to hedge their positions in equities.

On the other hand, the Chinese stock markets again lost their shine after Tencent’s earnings missed estimates, dragging on other Chinese tech shares, such as Alibaba, JD.com, and Baidu. Alibaba’s earnings report will be on close watch later today. However, most Asian markets are set to open higher following Wall Street’s rally, with the ASX 200 futures up 0.55%, the Hang Seng Index futures advancing 0 98%, and Nikkei 225 rising 1.53%.

Price movers:

- 9 out of 11 sectors in the S&P 500 finished higher, with financials, energy, and consumer discretionary leading gains, all of which were up more than 2%. Defensive sectors like utilities and consumer staples were the only sectors that finished lower on risk-off sentiment.

- Tesla’s share jumped more than 4% following the shareholders’ annual meeting. CEO Elon Musk said Tesla would deliver its first Cybertrucks this year, expecting 250,000 to 500,000 deliveries this year.

- Target’s shares bounced 3% from a session low amid its earnings report. The retailer beat expectations on both earnings per share and revenue in the first quarter but expected sales to remain sluggish, anticipating a low-single-digit decline to a low-single-digit increase for the fiscal year.

- The Chinese internet giant Tencent’s shares fell slightly on the Hong Kong stock market due to a miss on net income expectations, despite the fastest revenue growth of 11% in more than a year. The company is also engaging with AI development amid the heating up ChatGPT-alike race, calling technology a “growth multiplier”. However, China’s economic uncertainty may continue to press on sentiment in the Chinese market.

- Yuan weakened further against the USD, with USD/CNH rising above 7 for the first time since December 2022. Due to the divergent monetary policy, the US dollar firmed against most of the other major currencies, particularly in Asia. The uneven Chinese economic recovery also added to the downside pressure on Yuan.

- Gold prices fell below key support of the 50-day moving average due to a firmed USD and a jump in the US bond yields. A potential double-top pattern may take the metal price to approach further potential support of 1,900.

- Crude oil jumped amid an improved demand outlook and the broad relief rally in risk assets. While the double-bottom reversal pattern is still in play, WTI oil futures could rebound further toward resistance at the 50-day moving average of $75.

ASX and NZX announcements/news:

- Australian Agricultural Company (ASX: AAC) reported revenue at A$313.4 million for FY23, up 14% from a year ago. The operating profit rose 35% to A$67.4 million.

- Nufarm Limited (ASX: NUF) ‘s underlying net profit increased 7% to A$142 million for the 6 months ended 31 March 2023, declaring an interim dividend of A5 cents, up 25% from a year ago.

- Xero (ASX/NZX: XRO) reported a net loss of $NZ113.5 million, compared to $NZ9.1 million from a year ago. The software company’s revenue grew 28% to $NZ1.4 billion the FY23 due to subscriber growth.

Today’s agenda:

- Australian employment change for April.

- New Zealand Annual Budget.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.