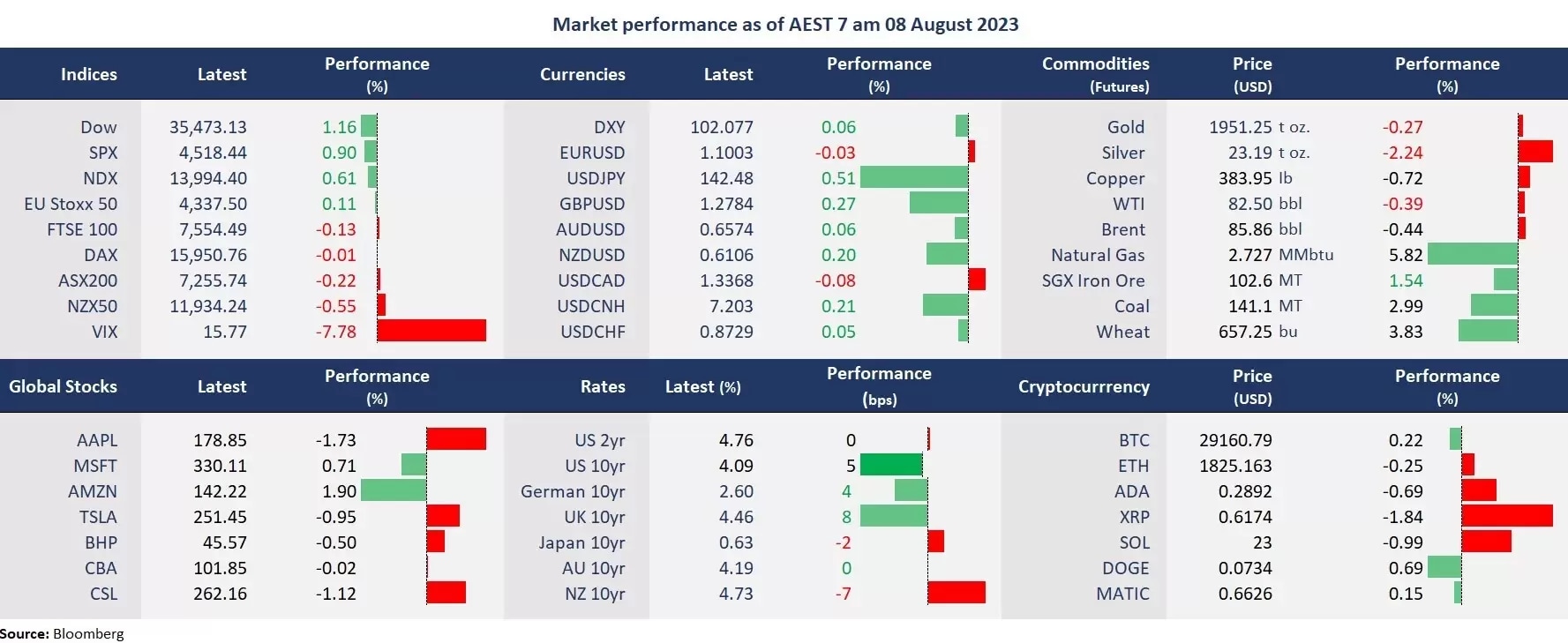

US stocks finished higher after a weekly loss as risk sentiment somewhat recovered from the bond jitter. Dow outperformed broad markets, up 1%, buoyed by industrial and healthcare stocks. On the earnings front, Berkshire Hathaway’s stocks jumped to an all-time high after the company reported strong quarterly performance as the conglomerate’s insurance operations benefited from high-interest rates. Amazon’s shares continued to rally following last week’s positive results, consolidating at a one-year high level.

The surge in bond yields slowed following the US non-farm payroll last Friday on signs of a slowdown labour market. But it is too early to say the market’s correction has been completed. This week’s July CPI data will be critical for market sentiment to provide clues about Fed’s further policy path. Some Fed officials signalled more hikes likely needed to tame inflation on Monday.

In Asia, China’s trade balance will be a focus later today as most markets closed in the red on Monday. Futures point to a mixed open across the region, with Nikkei 225 futures up 0.34%, the ASX 200 up 0.40%, and the Hang Seng Index down 0.59%.

Price movers:

- 10 out of 11 sectors finished higher in the S&P 500, with Communication Services and Financials, leading gains, up 1.88% and 1.36%, respectively. Utilities was the only sector that closed in the red, down 0.02%.

- Tesla’s CFO Zach Kirkhorn stepped down, and Chief Accounting Officer Vaibhav Taneja has been appointed new CFO. Kirkhorn will serve through the end of the year to support the transition. Tesla’s shares initially fell 3% before a rebound and ended 1% lower.

- Apple’s shares continued to fall amid the disappointing earnings report last week. The iPhone makers’ stocks finished lower for the fifth consecutive session, down about 10% from its all-time high. Apple is reportedly set to launch the iPhone 15 on 22 September.

- Berkshire Hathaway’s shares hit a record high following a strong quarterly earnings report. Warren Buffett’s conglomerate reported a 6.6% year-on-year jump in operating earnings to US$10.04 billion as insurance underwriting earnings increased 74% to $1.25 billion, and its cash pile swelled to $147.38 billion at the end of June. Berkshire reported about US$26.6 billion in unrealized investment gains due to Apple’s rally in the second quarter. The company owns 5.8% of the tech giant’s stakes.

- Crude oil’s rally took a breather, facing key technical resistance. The WTI futures fell slightly after being rejected by near-term resistance of about 83, and the imminent support may be near a round number 80. But Saudi and Russia’s production cut could remain a bullish factor to oil markets.

ASX and NZX announcements/news:

- James Hardie Industries plc (ASX: JHX) reported record net sales of US$3.8 billion for fiscal year 2023, up 4% from a year ago. The fourth quarter adjusted net income was US$146.2 million, up 13% sequentially. But global net sales declined 5% to US$917.8 million due to a slowdown in housing markets.

Today’s agenda:

- Australian NAB Business Confidence for July.

- China’s Trade Balance for July.

Maximize your potential gains! Take immediate action and seize the investment opportunities that await you. Login to the platform now!

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.