Risers and fallers describe financial instruments that have seen the largest increases or decreases in price within one given trading day. The risers and fallers category tends to refer to the stock market. For example, many traders choose to monitor LSE share risers and fallers or similar securities on the London Stock Exchange in order to find potential trades.

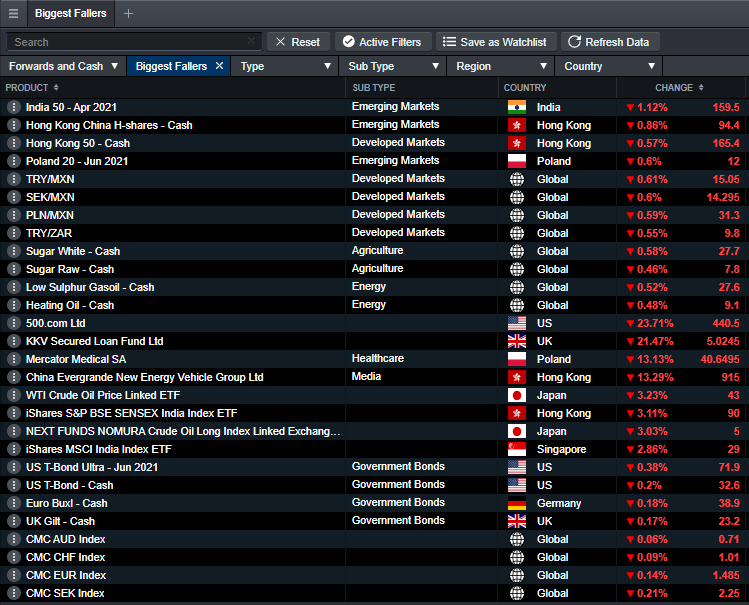

Our watchlists for Biggest Risers and Fallers are updated in real time and contain the top four products in each asset class with the largest daily percentage price rise or fall. This is not the same as volatility, as the assets are usually in a consistent uptrend or downtrend, rather than fluctuating back and forth between the two.

If you’re looking to trade more volatile instruments, you could instead monitor our ‘Price Movers’ watchlist, which can be found within the same section of the Product Library. This watchlist instead monitors products that have had unusual moves up or down, which are more than two standard deviations outside of their average daily price move. Read more about trading on volatility.