While the futures or forward markets were originally designed for commodity merchants to sell their product at a future date and lock in the current price, not everyone who trades the futures and commodities markets wants to take ownership of the product that they are trading. For example, a retail trader may buy a crude oil futures contract without taking delivery of 1,000 barrels of oil. Instead, they can trade for the profit potential, which is the difference between the price at the start of the contract and the closing price.

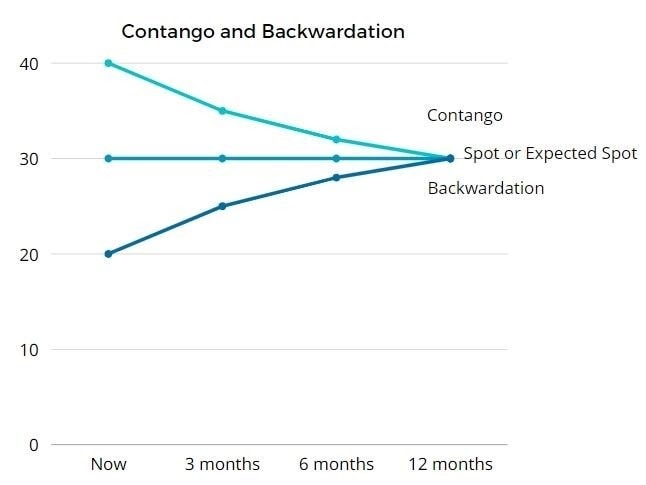

Understanding contango and backwardation can help traders make better trading decisions because they will understand how spot prices relate to future prices, called the futures curve. At CMC Markets, our forward CFD and spread bet contracts are based on the underlying price of a futures contract and are the equivalent product for trading future prices. Learn more about forward trading.