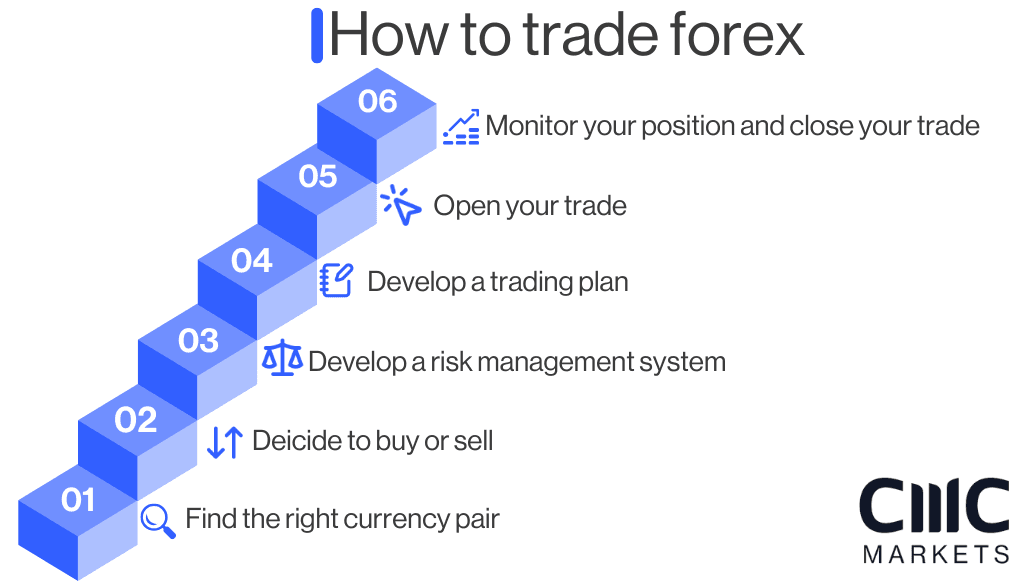

How to trade forex

Want to learn how to trade forex, but not sure how to start? In this article, we cover the basics of what you need to know to get started trading in the forex (FX) market. From analysing the forex market and reading FX quotes, to a step-by-step guide on how to start trading in the forex market. We will cover all this and more, to get you started on your forex trading journey.

How to trade forex pairs

Before you start forex trading, it’s essential to follow these key steps:

Find the right Currency Pair

Decide to buy or sell

Develop a trading plan

Develop a risk management system

Open your trade

Monitor your position and close your trade

Ways to trade forex

There are several ways you can trade the forex market, each depending on your trading style and goals. The three most common methods include:

Derivative Trading: Trading forex via financial instruments like CFDs (contracts for difference), allowing traders to speculate on price movements without owning the underlying asset.

Spot Trading: Buying and selling currency pairs at the current market price, commonly used by banks and institutional traders.

Futures and Options: Contracts that allow traders to buy or sell forex at a future date and pre-agreed price.

1. Finding the right currency pairs

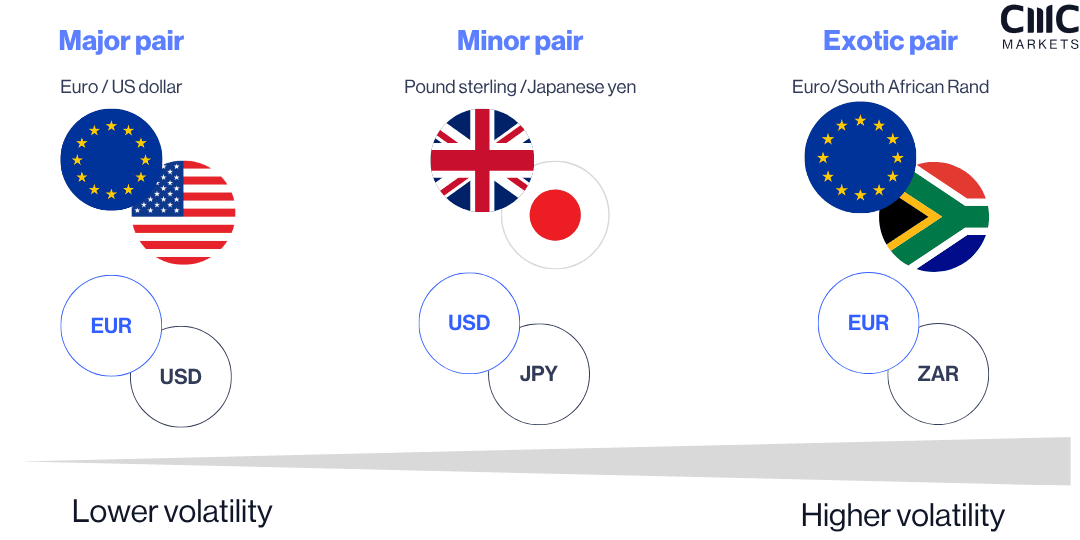

Before placing a trade, choosing the right currency pair is crucial. The forex market offers a wide range of pairs, categorised into the following 3 categories :

Major Pairs- The 7 most liquid and widely traded against the US dollar, such as EUR/USD, GBP/USD, and USD/JPY

Minor Pairs- Pairs that don’t include the US dollar but still have high trading volume, like EUR/GBP or AUD/NZD

Exotic Pairs- Pairs that include emerging market currencies, such as USD/TRY (US Dollar/Turkish Lira) or EUR/ZAR (Euro/South African Rand). These can be more volatile and carry higher risk

Selecting a currency pair depends on several factors, such as the following:

Market Conditions – Are there strong trends or clear price patterns?

Volatility – Do you prefer stable major pairs or more volatile exotic pairs?

Your trading style – Scalpers and day traders may prefer liquid pairs, while long-term traders might focus on fundamentals.

News & economic events – Some pairs react more strongly to global events than others.

Understanding currency pairs and their movements is essential before executing trades.

2. Decide to buy or sell

Once you've chosen your currency pair, the next step is deciding whether to buy (go long) or sell (go short). This decision is based on market analysis, where traders rely on two key methods:

Technical analysis is the study of past prices and patterns to speculate on future price movements.

Fundamental analysis is the study of the factors that drive valuation, such as economic and political trends.

Understanding both forms of analysis can help you make informed trading decisions.

Forex technical analysis

Technical analysis focuses on historical price data and market patterns to predict future movements. Traders use various tools and strategies, including:

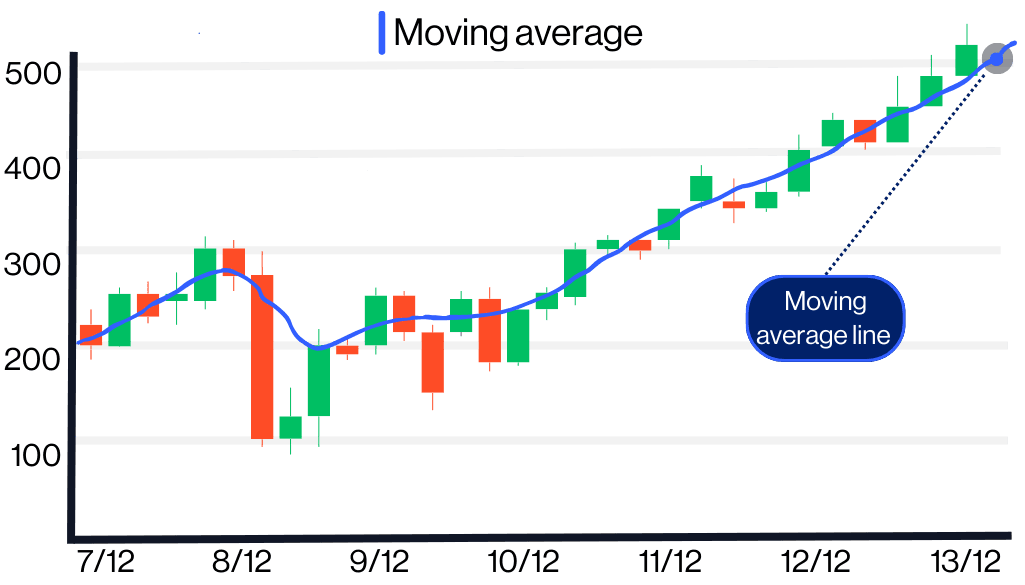

Moving average

Patterns

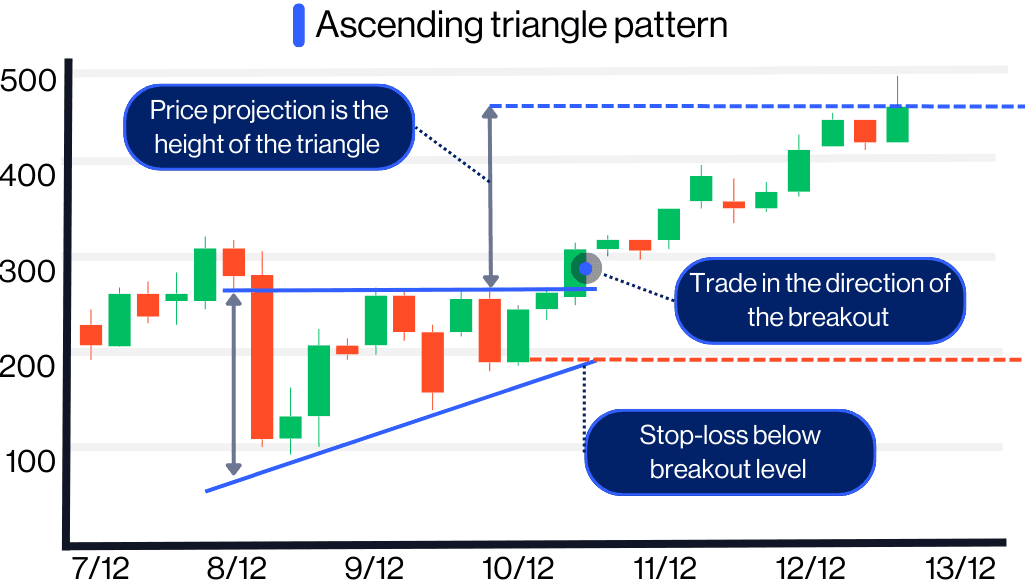

There are various chart formations that signal potential future price movements. Common patterns include head and shoulders, ascending and descending triangles, and flags, which can be used to anticipate market direction.

Support and resistance

Correlation

Fibonacci retracements

Fibonacci retracement levels are price levels, often represented as dotted lines on a chart, that show where possible support and resistance zones may occur. The levels are based on the Fibonacci sequence, with commonly used levels including 23.6%, 38.2% and 61.8%.

Moving average

A moving average smooths out price data by creating a constantly updated average price. This makes spotting trends easier, as it removes day-to-day price fluctuations.

Patterns

There are various chart formations that signal potential future price movements. Common patterns include head and shoulders, ascending and descending triangles, and flags, which can be used to anticipate market direction.

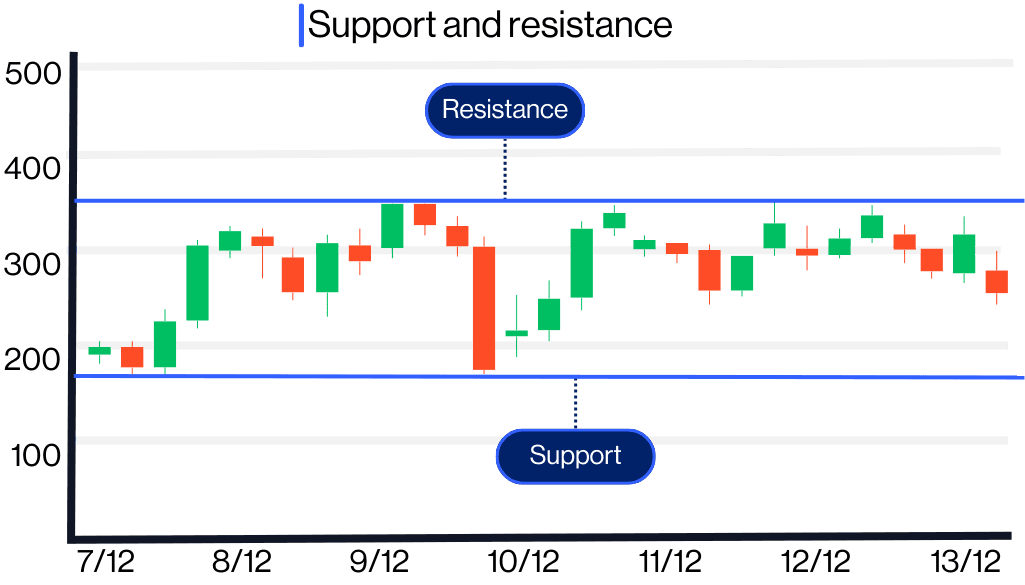

Support and resistance

Support levels are areas where prices may stop falling, and resistance levels are areas where prices may stop rising, based on historical data. Identifying these levels can help you decide at which point to enter or exit a trade.

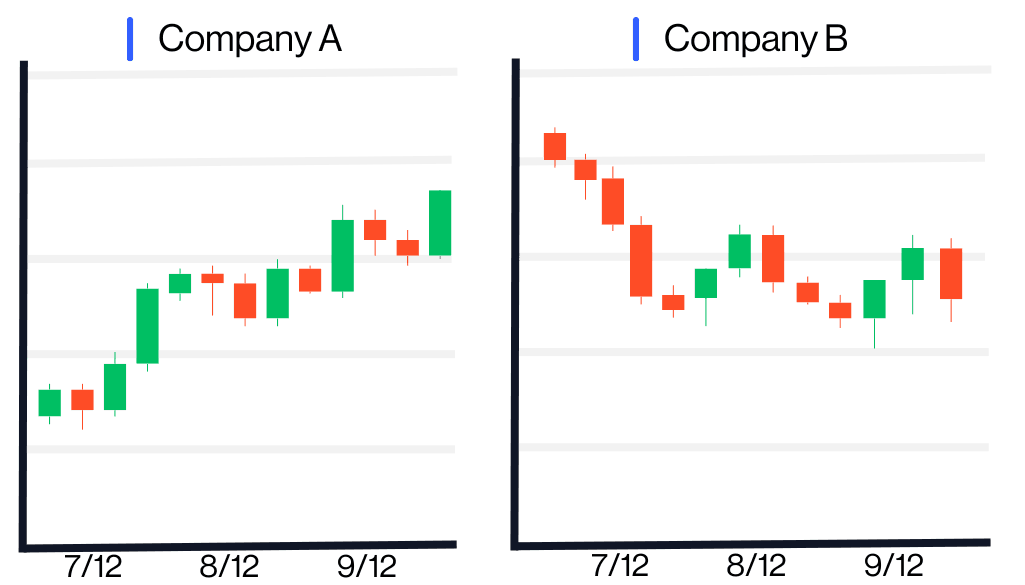

Correlation

Correlation is a measure of how two or more markets or assets move in relation to each other. By understanding market correlations, you may be able to diversify your portfolio or hedge your trades more effectively.

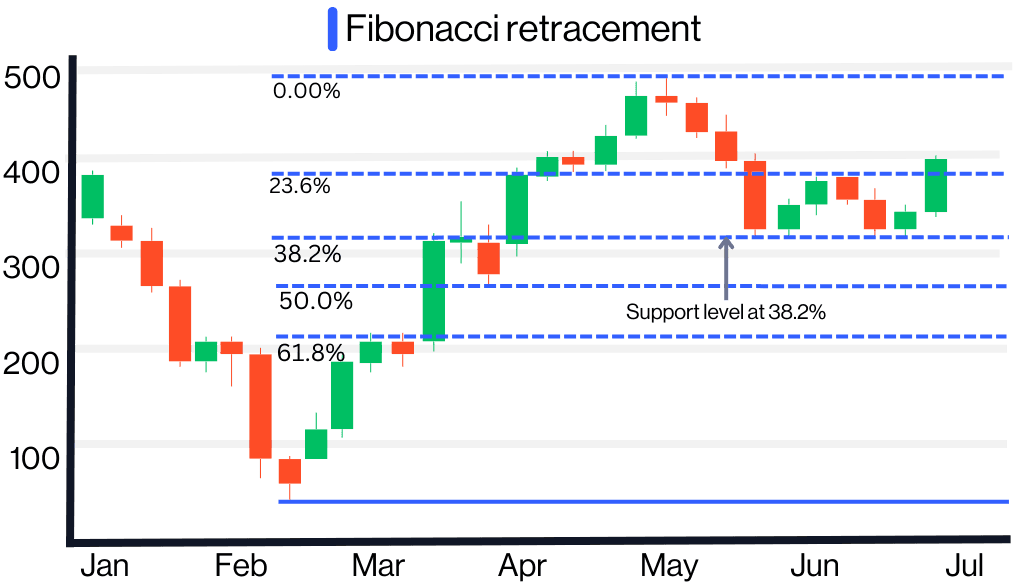

Fibonacci retracements

Fibonacci retracement levels are price levels, often represented as dotted lines on a chart, that show where possible support and resistance zones may occur. The levels are based on the Fibonacci sequence, with commonly used levels including 23.6%, 38.2% and 61.8%.

Our article on advanced technical analysis contains more information about each of these theories, all of which can be applied when learning to trade the forex market. Some of the more popular Forex candlestick patterns used for analysis include dojis, hammers, hanging man, morning and evening stars and engulfing candles.

Fundamental analysis in forex

Fundamental analysis involves studying economic indicators and government policies to determine the intrinsic value of a currency. Once determined, you can make a trade based on whether you think a currency is undervalued or overvalued.

Common economic indicators that are used to analyse the forex market include:

Political instability and economic performance

Interest rates

Inflation rate

Terms of trade

Debts

A country’s current account, inflation rates, and interest rates are among the main factors that drive foreign exchange currency valuation. There can be a considerable and immediate market impact when news and other economic data is released. Many traders utilise fundamental analysis to predict price movements and thus inform their trading decisions.

3. Develop a trading plan

Due to the emotional stress that is natural in any speculative trading situation, successful forex traders have a pre-set method of operation that includes rules by which they operate.

It is important as a successful trader to adhere to your pre-set rules. This will help to protect you from yourself. Very often, your emotions will tell you to do something controversial or contradictory to what your trading plan states.

Traders who adhere to their trading plan are usually in a better position to resist the emotional temptations that are present in speculative markets. Following a trading plan can also help you to reduce stress, maintain objectivity and learn from your mistakes when learning to trade forex.

When designing a forex trading plan, make sure it answers the following:

Are you comfortable holding trades overnight?

When do you like to trade: day or night?

How much do you want to risk per trade?

What is your profit target?

Where do you place your stop-losses?

4. Develop a risk management system

The most common mistake made by FX traders is failing to follow a risk management plan. There are multiple risks to be mindful of when trading forex, including:

Leverage risk- Trading on margin means you’re only putting up a fraction of the full position. If the price moves even slightly against you, it is applied to the entire notional value, so losses can quickly exceed your initial deposit.

Market volatility risk- Forex prices can spike or plunge on the back of news or data releases, and those sudden swings may hit your account balance before you have a chance to respond.

Emotional risk- Fear, greed or the urge to chase losses often leads to snap decisions that deviate from your plan, increasing the likelihood of avoidable mistakes and unnecessary drawdowns.

When trading forex, it is important to devise a systematic trading approach that includes a detailed risk-management system. Under such a system, profits and, in particular, losses, are defined and stop-loss orders are placed, which define how and when your trades should close:

Normal stop-loss orders: These close your position automatically if the market moves against you. They help cap losses, but may not execute at your chosen level during periods of high volatility (this is known as slippage).

Guaranteed stop-loss orders (GSLOs): These close your trade at the exact level you set, regardless of market gapping or volatility. You’ll pay a small premium for this added protection, but it ensures absolute control over your maximum loss.

Trailing stops: These track favourable market moves and lock in gains by adjusting your stop level. If the market reverses, your position closes automatically, helping you capture profits while managing downside risk.

Limit orders: These let you set a target price at which your position will automatically close to secure profits when your chosen level is reached.

When reviewing your risk management system, you should check:

How do you minimise risk in your strategy?

What are your risk/reward ratios for each trade?

Are your stop-loss orders placed at an appropriate level?

For more information on risk management tools, see our guide on risk management in trading.

5. Open your trade

It is recommended to practise trading forex on a demo trading account first, to test your strategies' success and familiarise yourself with our trading platform.

Once you’re fimilair with how our platform and are confident in your strategy using a you may be ready to place your first live forex trade.

Simply search for the FX pair you want to trade, set your position size, and choose to ‘buy’ or ‘sell’ and include your selected stop loss/ limit orders.

If you need some more time learning how to trade FX, additional information can be found on our forex trading for beginners article.

6. Monitor position and close trade

Once your forex trade is open, it's important to monitor your position and stay up to date with market conditions. This helps you manage risk, react to key events, and stay aligned with your trading plan.

Here’s what to consider:

Track price movements: Use real-time charts and indicators to track the currency pair’s performance. Watch for technical patterns or economic news that could impact the market.

Review open P&L: Keep an eye on your floating profit or loss (P&L) to understand how your trade is progressing relative to your entry point.

Adjust stops and limits: If the market moves in your favour, consider adjusting your stop-loss or take-profit levels to lock in gains or reduce risk, known as a trailing stop strategy.

Stay informed: Monitor economic calendars and breaking news. Political events, central bank decisions, and economic data can cause volatility.

Stick to your plan: Avoid emotional reactions. Use your original strategy to guide whether to hold, scale into, or close a trade.

Is forex trading profitable?

Forex trading can be profitable, but all traders will lose money on some trades, with even the best and most-experienced traders never winning 100% of their trades. Being a successful forex trader isn’t necessarily defined by a high percentage of winning trades. Even if you win 90% of your trades, if the remaining 10% are losing trades that wipe out large amounts of your capital, you’ll end up in a worse position. These losses may come down to a lack of experience, planning, discipline, or not implementing appropriate risk management tools, such as stop-loss orders.

When it comes to trading forex, traders should not anticipate to win every trade, or to make large profits with every win. Likewise, it should not be considered a ‘get-rich-quick’ scheme – your forex trading strategy should be nurtured and perfected in order to improve your overall performance.

What can hinder profitability?

Once your forex trade is open, it's important to monitor your position and stay up to date with market conditions. This helps you manage risk, react to key events, and stay aligned with your trading plan.

Here’s what to consider:

Position size- either by opening too big a trade and risking too much capital, or going too small to make a meaningful return

Lack of awareness of the market environment

Not having a trading strategy in place increases the risk of losses

Failing to stay up to date with economic news and being impacted by unexpected volatility, causing a dramatic change in price

Lack of confidence with both fundamental and technical analysis

Abandoning a trading plan – winning a trade when you haven’t got a trading plan in place could make you think it’s not necessary; consequently, it leads to a scattered approach to trading, running a higher risk of losses

The forex pair you choose – Major pairs will have less volatility and higher liquidity due to more stable economic environments, comparatively exotic pairs contain currencies from less developed, less stable countries

Summary

Assuming that every trade with no preparation, prior research or strategy will be profitable, will place more risk upon an already risky environment. Whenever trading, as well as having a well-versed strategy in place, risk management tools like stop-losses should be implemented to prevent significant losses.

Practise your trading with a demo account on our Next Generation trading platform.

There are plenty of online resources out there that can help you learn to trade forex. Discover the basics at our learn forex page, which covers a wide range of topics, including margin and leverage, pips, forex market hours and forex trading strategies.

To get to grips with forex on our trading platform, you can open a forex demo account to practise trading with £10,000 of virtual funds.There isn't necessarily such a thing as the 'best' forex strategy, because what suits one trader might not work for another. Finding a forex trading strategy that works for you depends on a range of factors, including your risk appetite. There are many different types of strategies, including day trading, swing trading, and scalping. Learn more about trading strategies.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.