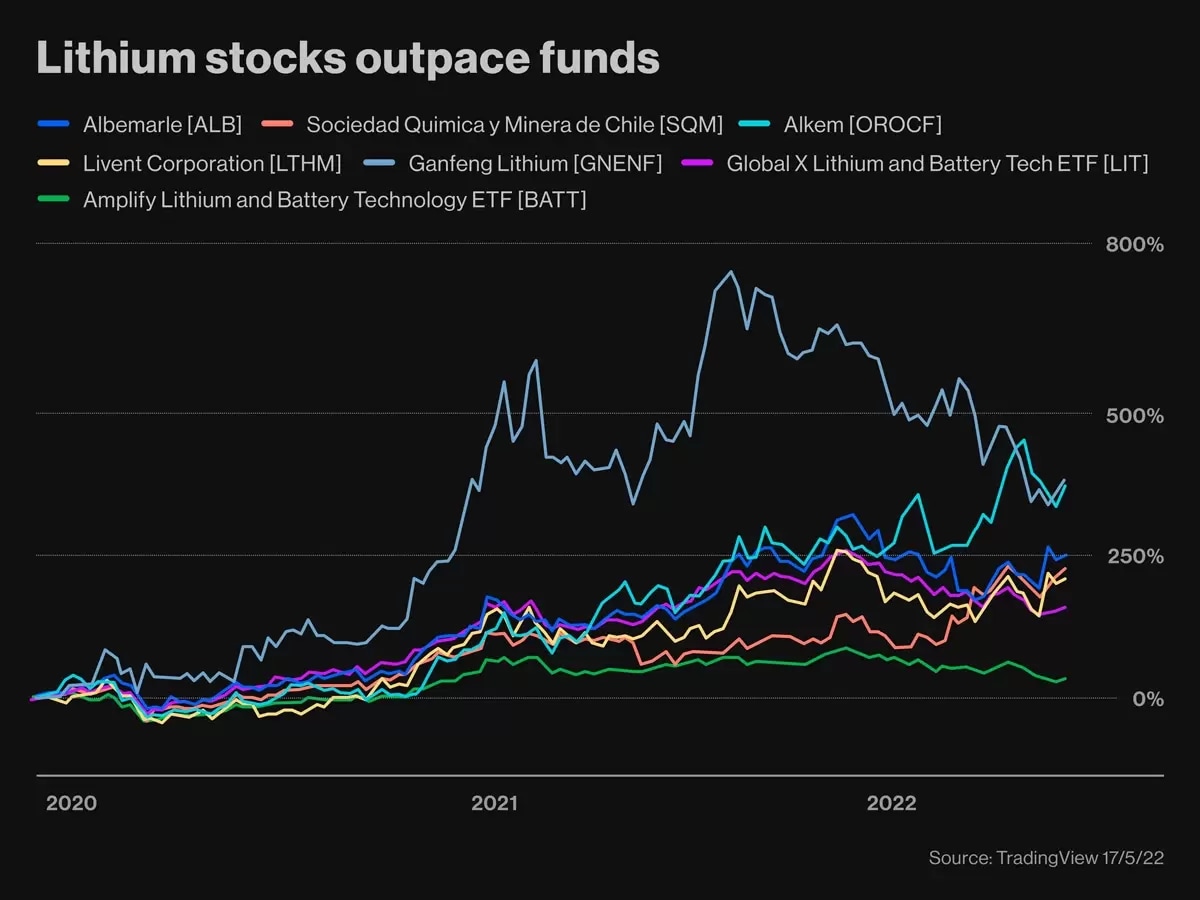

Lithium stocks to watch

Published on: 26/01/2022 | Modified on: 23/01/2023

Lithium is a soft, silver-white alkali metal probably best known to most people as an integral component in the production of rechargeable batteries, but it also has countless other applications including the creation of ceramics and glass, as well as medicines to manage mental health disorders. This makes lithium an increasingly popular precious metal for traders to gain exposure to.

Read on to discover how this can be done through the rise of lithium companies and ETFs, and how you can trade on them via spread bets and CFDs on our award winning* Next Generation trading platform.

KEY POINTS

- The compounds of lithium have numerous industrial applications

- Its light weight and effectiveness in conducting electricity makes it the go-to component for the world’s largest tech firms

- Lithium reserves are mainly found in spodumene mines or underneath salt flats in Australia, South America and China

- You can’t access the commodity directly in physical form, like other precious metals such as gold and silver

- Instead, traders can gain exposure by speculating on the price movements of lithium shares stocks and ETFs