CBOE Volatility Index (VIX): what it is and how to trade

The VIX index is a popular measurement for traders to quickly judge market volatility. It can also provide trading opportunities, with some traders using it to diversify their portfolio or others as an effective hedging tool.

In this guide, discover what the VIX volatility index is and how you can start trading CFDs on volatility-related instruments, along with key considerations when doing so. Keep reading to discover how it works and how you can use it to trade on volatility.

What is a volatility index?

Real-time market indices such as the VIX (INDEXCBOE:VIX) measure the stock market’s expectation of forward-looking market volatility (in this case, 30 days).

In simplistic terms, the VIX is a measure of how much traders are willing to buy or sell the S&P 500 index, which is a measure of the top 500 companies listed on US exchanges by market cap. The more traders are prepared to risk, the more volatile the market is likely to be. However, it is worth noting that the VIX is about implied volatility — what is likely to happen, not what definitely will happen.

The index was created in 1993 by the Chicago Board Options Exchange (CBOE) and since 2002, it has derived its value from the price inputs of the S&P 500 options, therefore representing the expectation of market risk and volatility. Also known as the CBOE index, it’s unusual in deriving its value not from stocks, but from options prices.

Why is the VIX called the ‘fear index’?

The VIX volatility index is known by other terms such as the ‘fear gauge’ or ‘fear index’. For traders, it provides an efficient method to judge market risk, fear and uncertainty when making trading decisions.

As it essentially measures uncertainty, the VIX volatility index is an appropriate name. But this is a good thing — not only can it indicate whether the market is generally bullish or bearish and therefore influence trading decisions, but it can also provide opportunities for trading itself.

How is VIX calculated?

CBOE’s volatility index was designed to measure the sentiment in the market. The calculations are complicated, but essentially the VIX measures implied volatility by averaging the weighted prices of a wide range of put and call options (respectively, the right to sell or buy a stock) from the S&P 500.

When traders buy and sell options, the positions they take (either puts or calls), the prices they are willing to pay, and the strike prices they choose all reflect how much and how quickly they think the underlying index level will move. By judging how far the put and call prices are distributed from the current price of the S&P 500, the volatility index draws an average, which is represented by VIX’s current price. These calculations produce a quantifiable measure of market outlook and volatility for the following 30 days.

How to read the VIX

The VIX volatility index does not record volatility – it forecasts it, based on data around options. The data it gathers implies how much volatility there is likely to be within the next 30 days and is an extremely useful pointer. But traders should take into account that while it is an effective tool based on solid data, it is a forecast, not a fact.

The greater the risk, the more people are willing to pay for ‘insurance’ in the form of options. This means the higher the perceived level of risk — for example, in times of high uncertainty, such as during the Covid-19 pandemic or the Russian invasion of Ukraine — the higher the VIX price climbs.

When equity markets seem stable and stocks are high, premiums on options decline, alongside volatility instruments like the VIX.

A stable economic environment of low interest rates and steadily rising stock prices would see the VIX index average between 13 and 19.

Any ranking higher than 20 is seen as a reading of volatility – in March 2020 as Covid-19 lockdowns began, it peaked at 66.

The VIX cannot be directly traded. As a result, many traders use exchange-traded funds (ETFs) or exchange-traded notes (ETNs) that are tied to the index to gain exposure to it. Additionally, besides trading the VIX, many traders have adopted it as a useful indicator of market volatility. It is also used as the backbone of many products that are based on volatility indices.

How does the index read market sentiment?

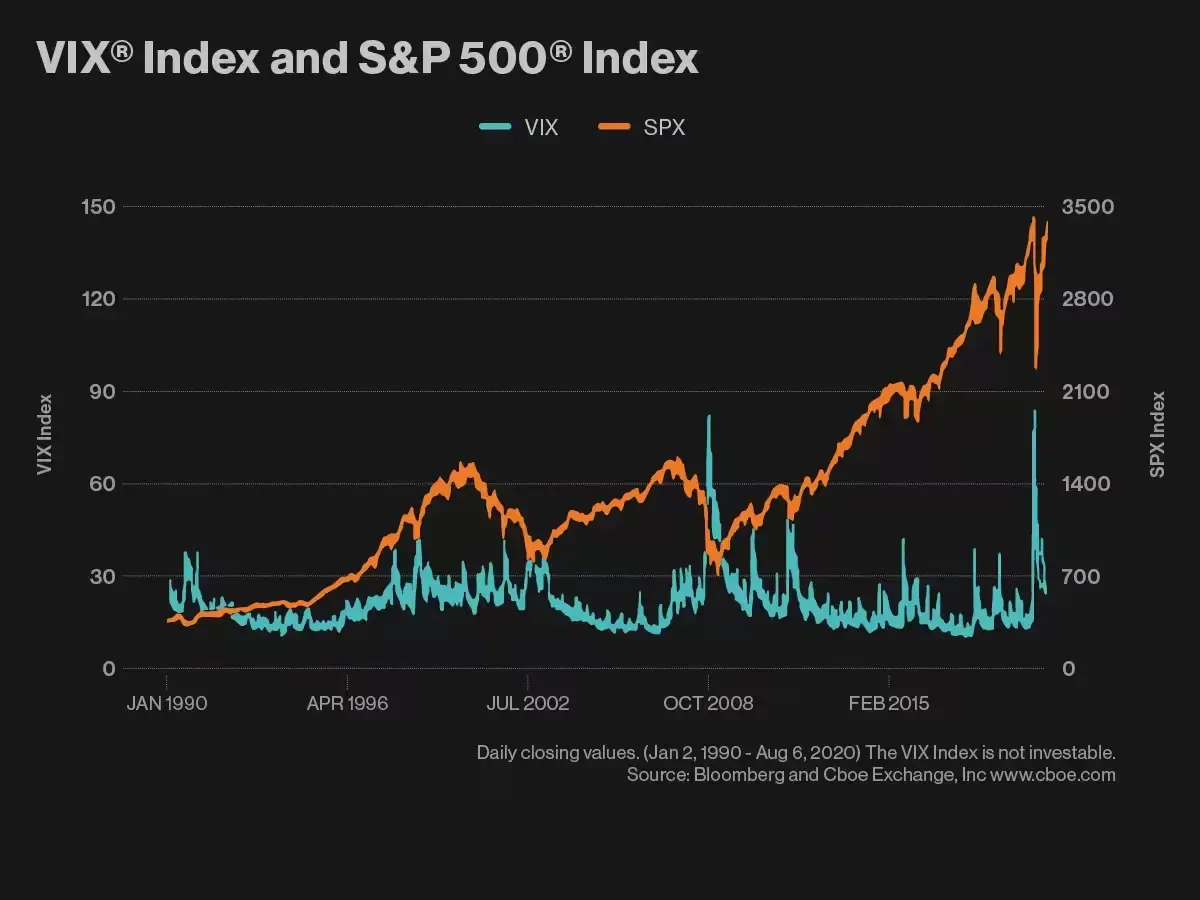

World events in recent years clearly demonstrate how the index works in mirroring the market sentiment — that is, doing the exact opposite of — the S&P 500 and other stock indices. For example, when the Covid-19 crisis hit, the VIX soared to $82, surpassing even the previous high of $80.86 recorded during the financial crisis of 2008.

Please note that past performance is not a reliable indicator of future results.

This caused several instruments tracking the VIX to jump wildly in price. Some of these indices were leveraged, resulting in even sharper fluctuations and providing riskier opportunities for profits and losses. The peak in March 2020 as Covid-19 took hold across the world coincided with the sharpest fall in the S&P 500’s history.

Another example of a significant spike in volatility occurred in March 2022. In the days after Russia invaded Ukraine, the S&P fell to its lowest level since the peak of the Covid-19 crisis, lifting the VIX futures index simultaneously to hit a two-year peak.

How to trade the VIX

Many traders and investors are unsure of the question: ‘can you trade the VIX?’. The answer is yes, but as it’s valued through option averages rather than stocks, you cannot trade it directly. Instead, you can gain exposure through a range of instruments that track the index, including specific purpose-built ETFs and ETNs. Here are some simple steps to getting started.

Practise with virtual funds to get used to volatility. Derivatives can be risky products to trade, so read about how they work, how they are taxed and how to open a demo account in our guides to CFD trading.

Find the VIX-related instrument you wish to trade. Discover instruments related to the index such from our extensive library of over ETFs.

Research your chosen asset. Make important decisions based on your market research, including which direction to place your trade, your market entry points and your position size. You can get inspiration from our news and analysis section and use our insight tools.

Consider risk-management. Having a plan when trading can reduce the likelihood of making irrational decisions. Additionally, the use of stop-loss and take-profit orders can help mitigate your exposure to risk.

Place your VIX index trade and monitor. Open an order ticket and fill out the appropriate fields. Place your trade and track its performance — make sure to close your position when you have reached your target price.

What are some VIX ETFs and ETNs?

ProShares VIX Short-Term Futures ETF

This is an exchange-traded fund providing exposure to the S&P 500 VIX Short-Term Futures Index, which measures the returns of a portfolio of monthly VIX futures contracts with a weighted average of one month to expiration. This VIX ETF is designed for advanced traders and, as the name suggests, is intended for short-term leveraged trading as an effective hedging instrument to the S&P.

As the VIX spikes when market anxiety is high, it tends to rise in value as stocks fall. It’s also linked to an index comprising short-term futures, so it may be most appropriate for those looking to place a short-term bet against the market rather than a long-term hold.

iPath Series B S&P 500 Short-Term Futures ETN

An example of a VIX ETN is the iPath Series B S&P 500 Short-Term Futures ETN. The fund is managed by Barclays Capital Incorporated, which tracks the futures on VIX through the S&P 500 VIX Short-Term Futures Total Return Index. Exchange-traded notes are traded like ETFs but have some differences: they’re unsecured debt securities, with a specific maturity date, issued usually by a bank, that track a particular index. Traders can hold shares until the ETN’s debt security matures but can buy or sell before then.

How to get started

At CMC Markets, we have the educational tools and market insights to support your trades, as well as educational training guides, webinars and platform tutorials. Whether you’re using our website or app, we can guide you through the features and tools available, give you access to market news and charts, help you place different order types, and we also offer a live help chat service. Whether you want to trade on a VIX-related index or elsewhere, our CMC dealers work with you to put into action your decisions and complete the trades you want to make.

Spread betting

VIX spread betting is a form of leveraged trading, which means that you do not physically own the financial instrument but are instead speculating on its price movements. This involves putting down a deposit that could ultimately be outweighed by either a profit or loss. Spread bets carry no capital gains tax in the UK*, which makes it a popular option for traders.

Trading CFDs

The natural divergence of the stock market and the VIX index makes volatility trading an attractive way to manage risk and hedge your bets through options or futures contracts. CFD trading is another method of derivative trading where, as a trader, you agree to exchange the difference in price (positive or negative) between when you open and close your position, and the more the index moves, the more you gain or lose, depending on which way you trade.

Trading strategies

A stable economic environment would ordinarily suggest short-selling volatility. In this case, you would expect little volatility, and the more the markets rise, the more the VIX would fall, putting you in profit. The downside is that unexpected high volatility in such a position could leave you extremely exposed to unlimited losses.

Whereas, if you believe the stock market will fall — and overall investor fear is high — or foresee a social or political event likely to bring uncertainty, then you may choose to take a long position on the VIX if you are expecting a spike. However, if your doomsday predictions don’t pan out and the market stays calm, your VIX volatility index long position may lose you money.

What are some key considerations?

Watch your use of leverage when trading. In particular, leveraged ETFs are complex financial instruments that carry significant risks and certain leveraged ETFs are only considered appropriate for experienced traders.

Manage your risk. You can make a substantial profit but can also make large losses. You can automate parts of your trading and manage your risk exposure with the use of stop-loss and take-profit orders.

Research, and then research some more. Knowing how an asset works and what it is influenced by can give you a large advantage when trading markets. In this case, the more you know, the better.

Summary

When market fear is high, so is the price of the VIX index, whereas a lower VIX price can be a sign of either greed or investor complacency. Using the index alongside other measures of volatility and market outlook can help to provide crucial clues into current investor sentiment and an index’s prospects. Finally, the VIX volatility index is just a single model of volatility. Combining multiple models and inputs in your trading can provide you with less risk exposure when compared with betting on a single variable.

The average price of crude oil can fluctuate due to political, geographical, and social circumstances. Between 2020 and 2022, the price jumped from $-40 to almost $100, suggesting how external events like war and health crises can impact on the commodity. See our Brent price chart and WTI price chart for further analysis.

Some more examples of volatility-based indices that are similar to the VIX include the Russell 1000 Low Volatility Index, Citi Volatility Index Total Return, and S&P 500 VIX Short-Term Futures Index.

When you invest in oil, you take full ownership of the asset and are required to transport and store the commodity, which can be a difficult process. Alternatively, some traders may prefer to speculate on oil’s price movements without owning it outright, although this also comes with risks of leverage and short-term volatility, as the market can turn at any point.

There’s a well-known trading saying: “If the VIX is high, it’s time to buy. If the VIX is low, it’s time to go.” While this is not always true and depends on a number of factors, a high VIX suggests the implied volatility of the market is approaching capacity and is too bearish. If this is the case, it’s probable it will soon turn into a bullish market and alongside the VIX index, this will head back towards average levels.