What are bonds and how do you trade them?

Treasuries are often seen as a relatively stable and low-risk investment within the financial markets, which can be traded in uncertain times. In this article, discover the different types you can trade and worldwide (including tax-free bonds), how to get started, and which can potentially provide stable returns on average. We compare securities around the world to find a bond trading opportunity that may be suitable for you.

Czym są obligacje?

Obligacje to instrumenty o stałym dochodzie (papiery dłużne) będące umową pożyczki pomiędzy nabywcą a sprzedawcą, emitowane przez rząd lub prywatną firmę. W przeciwieństwie do akcji notowanych na giełdzie, większość obligacji skarbowych notowanych jest na rynku pozagiełdowym. Pożyczkobiorca zobowiązuje się do wykupu obligacji w ustalonym terminie i do tego czasu zazwyczaj wypłaca odsetki według stałej lub zmiennej stopy. Inwestorzy, którzy kupują obligacje, pożyczają pieniądze emitentowi na określony czas. Termin wykupu może być krótko‑, średnio‑ lub długoterminowy; środki pozyskane z emisji finansują np. bieżące potrzeby państwa.

Rynek obligacji skarbowych działa 24 godziny na dobę od niedzielnego wieczoru do piątkowego wieczoru dzięki nakładającym się godzinom otwarcia rynków w różnych krajach. Dla wielu inwestorów jest to sposób na dywersyfikację portfela.

Jakie są rodzaje obligacji?

Rodzaje obligacji różnią się w zależności od emitenta, jednak większość ma wspólne cechy:

Cena emisyjna – cena, po której emitent sprzedaje obligacje.

Termin wykupu – data wykupu obligacji przez emitenta.

Wartość nominalna – wartość obligacji w dniu wykupu.

Kupon – oprocentowanie wypłacane od wartości nominalnej.

Data wypłaty kuponu – termin wypłaty odsetek przez emitenta.

Obligacje rządowe

To pożyczki udzielane państwu na ustalony procent. Umowa trwa określony czas, odsetki wypłacane są regularnie, a zainwestowany kapitał zwracany jest w terminie wykupu. W Wielkiej Brytanii nazywane są one gilts, natomiast w Stanach Zjednoczonych – Treasuries (obligacje skarbowe).

Obligacje korporacyjne

Polegają na udzieleniu pożyczki przedsiębiorstwu. Taki papier dłużny służy często finansowaniu działalności lub planowanego projektu. Mogą być uznawane za bardziej ryzykowne, ponieważ firma może nie być w stanie spłacić zadłużenia tak, jak państwo – odzwierciedla się to w wyższych odsetkach.

Obligacje komunalne

Emitowane są przez miasta, powiaty lub inne lokalne jednostki w celu finansowania infrastruktury, np. szkół, mostów czy dróg.

Obligacje o wysokim dochodzie (tzw. „junk bonds”)

To papiery niższej jakości, często emitowane przez nowe lub małe przedsiębiorstwa. Mają niższe oceny kredytowe i większe ryzyko niewypłacalności, ale mogą być sposobem na dywersyfikację portfela.

Czy obligacje to dobra inwestycja?

Obligacje skarbowe mogą służyć jako element strategii zabezpieczającej w okresach zmienności na rynku akcji. Kiedy inne aktywa tracą na wartości, zyski z obligacji mogą częściowo zrekompensować straty. Na ceny wpływa m.in. poziom stóp procentowych: gdy stopy spadają, oprocentowanie obligacji staje się bardziej atrakcyjne; gdy stopy rosną, ceny obligacji zazwyczaj spadają. Przyjmuje się, że średnia stopa zwrotu z obligacji rządowych wynosi ok. 5–6%, co jest mniej niż średnia na rynku akcji (ok. 10%), ale przy mniejszym ryzyku.

Jak przeprowadzać transakcje na obligacjach?

Wybierz produkt

Możesz przeprowadzać transakcje na kontraktach CFD opartych na papierach o stałym dochodzie i korzystać z dźwigni finansowej.

Zbadaj rynek

Zwróć uwagę na czynniki wpływające na ceny: stopy procentowe, rentowność, ryzyko kredytowe, zmiany ratingów.

Zawęź wybór instrumentu

Spośród ponad 50 dostępnych możesz wybrać obligacje z USA, Europy lub fundusz ETF.

Zdecyduj o kierunku

Określ, czy chcesz zająć pozycję długą (kupno) czy krótką (sprzedaż) oraz ustal poziomy wejścia i wyjścia.

Korzystaj z narzędzi zarządzania ryzykiem

Rynek jest zmienny, dlatego warto używać zleceń stop-loss, aby ograniczyć straty.

{{{ SECTION-END }}}

Jakich strategii transakcyjnych możesz używać?

Traders may opt for either short-term or long-term bond trading strategies depending on their overall goals. So, how does bond trading work? We explore several options below to help you get started.

Shorting

As discussed, when interest rates rise, treasuries may become less appealing to a trader as their prices drop. If you believe that this is about to happen, you could ‘sell’ your chosen asset in order to open a short position which will profit when the price moves downwards. Then, if the price indeed drops as predicted, you could close out the trade by opening a long position to ‘buy’ back the asset at a lower price. Your profit would be the difference in price between the two.

Short selling is a risky strategy and may result in losses if the position is not managed properly, so in order to prevent this, you could place a stop-loss order on any open positions, which can help to limit your losses.

Buy-and-hold approach

In an opposite strategy to the one above, if you think that interest rates are about to drop, which will drive bond prices higher, you could open a long position (also known as a buy and hold approach). You would make a profit if your trade increases in value and you close out the trade or ‘sell’ the asset for a higher price. However, remember that the markets can move in either direction and there is no guarantee that your prediction will be correct.

Hedging

Another trading example is one of hedging. As prices can be affected by both interest rates and inflation, opening a trade is usually an efficient way to hedge against possible downturns in the stock and treasuries markets. A trader could potentially make a profit from the movement in prices through income generated from stocks or other assets held in your existing portfolio.

10 bonds to watch

Traders looking to get exposure to fixed income could open a long position on (buy) individual assets. Depending on factors like time horizon, risk profile and available capital, a mutual fund or exchange-traded funds (ETFs) may also be among options worth considering.

1. UK Gilt

Our instrument is based on the underlying security issued by the British government, which can have a maturity of five, ten, or 30 years. The political party has never failed to make interest or principal payments when they are due, therefore this is considered as one of the safest investments a trader can make. The treasury is made up of both conventional and index-linked gilts.

2. US T-Bond

This is a treasury derivative based on the relative value of the fixed-interest, US debt security, which has a maturity of between 10 and 30 years. It often increases in value in times of economic or political instability as investors seek a safe haven to keep their money safe.

3. Euro Bund

This instrument is based on the underlying price of the Euro Bund issued by the German federal government, and it’s one of our most popular treasury products. In most cases, these long-term options have a maturity range of between 8 and 10 years.

4. US T-Note 2 YR

Our treasury note is based on the US debt security with a fixed interest and maturity of around two years. It’s included on the shorter end of the yield curve and provides a good indication of the health of the US economy.

5. Euro Bobl

The Bobl is Germany’s version of gilts and is based on the underlying value of a collection of medium-term German federal issued securities. Its underlying assets have a maturity of between 4 and 6 years. Bobl futures are some of the most popular fixed-income securities in the world.

6. US T-Note 10 YR

Our US T-Note 10 Year – Cash instrument is based on a US debt obligation issued by the government with a maturity of 10 years. These pay interest at a fixed rate once every six months, paying the face value to the holder when it matures.

7. iShares Core UK Gilts UCITS ETF

This ETF’s aim is to track the performance of an index made out of GBP denominated bonds. It has a fixed interest rate and helps investors to have a diversified exposure to government securities, as it provides single country exposure only.

8. Vanguard Total Bond Market ETF

The aim of this fund is to track the performance of a broad, market-weighted index in the US dollar-denominated market. It’s an intermediate-term instrument that can offer a potential for investment income.

9. iShares iBoxx $ High Yield Corporate Bond ETF

This is one of the most commonly used ETFs for high-yield securities. It seeks to track the investment results of an index composed of US dollar-denominated high-yield corporate-grade securities. Investors often use it for income.

10. SPDR Barclays High Yield Bond ETF

This fixed-income instrument provides exposure to US dollar-denominated junk bonds with above average liquidity. The index that it’s based on is a more cost-efficient method than accessing individual treasuries.

What are the advantages?

You receive income through interest payments.

By reselling before the maturity date at a higher price, you can make profits.

They are often considered less risky or volatile than stocks.

Treasuries are fairly liquid assets – gilts, in particular, are liquid, whereas corporate ones are slightly less.

What are the disadvantages?

Rising inflation could also cause the bond value to fall.

Any financial asset being traded, or invested in, carries risk when trading on margin, since profits are magnified equally as losses.

Holding a position overnight via a derivatives broker will incur overnight holding costs, and there could be economic news that affects the treasury’s price.

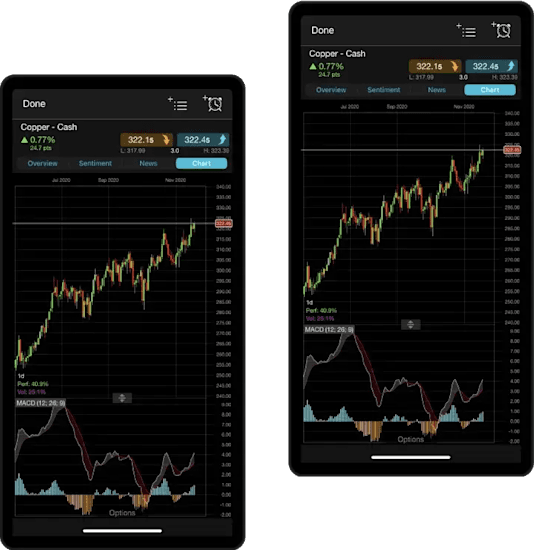

Explore our bond trading platform

You can start spread betting or trading CFDs on more than bonds, interest rates, debt obligations, and treasury notes offered on our Next Generation platform. Some of our most popular instruments trade up to 23 hours a day, giving you a wider exposure to the markets.

As well as ‘cash’ instruments, you can also take a position on forwards (based on the underlying futures price), which are an agreement between a buyer and seller to exchange a treasury at a set price at a future date. Learn how futures work.

All financial trading involves risk, including treasuries. Gilts, however, are considered by some investors to be relatively safer, as they have lower interest rates than corporate bonds and are generally tax-free, similar to municipal bonds. Learn about government bonds.