What is the spread in trading?

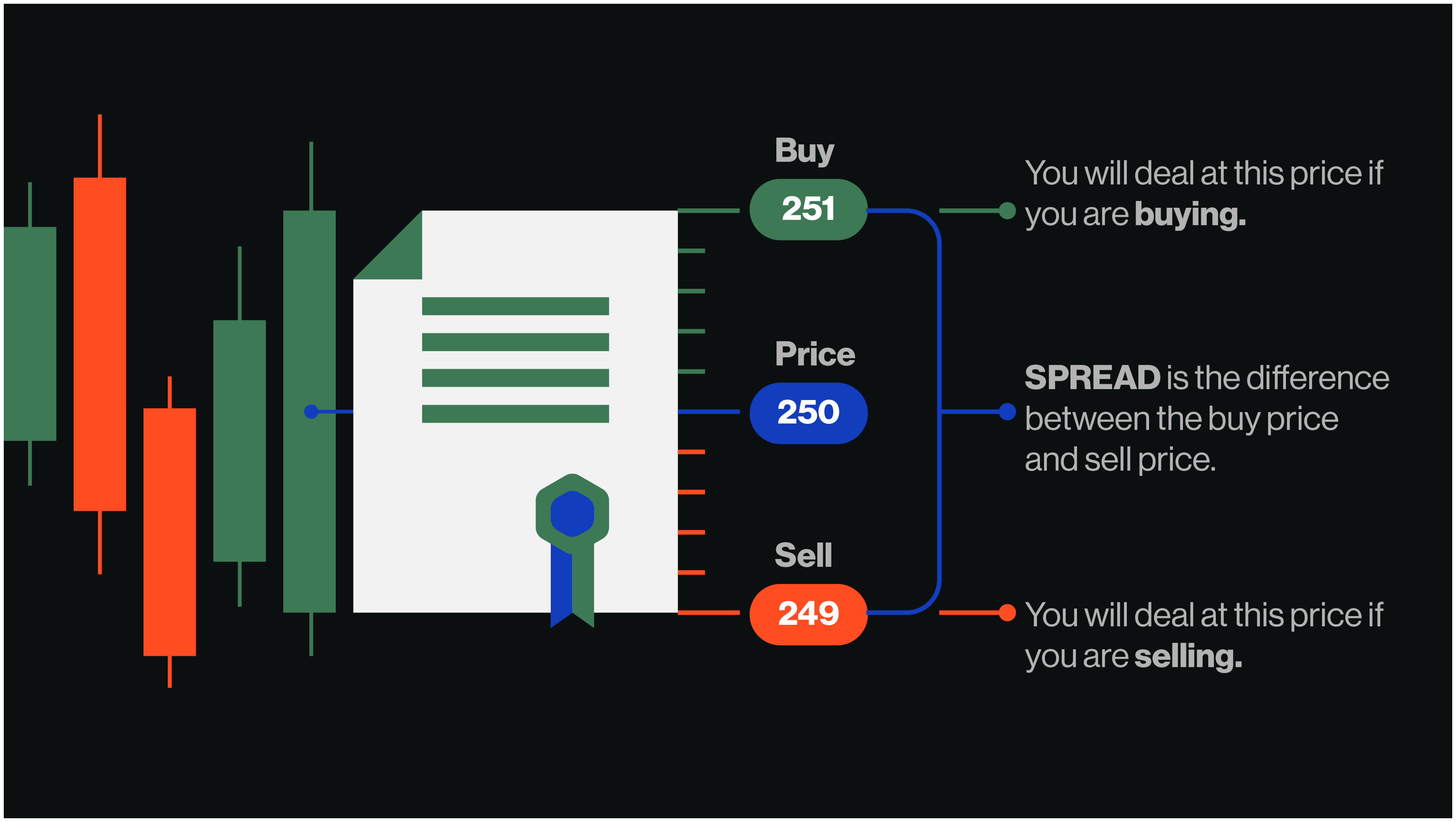

When online trading, whether spread betting or trading CFDs (contracts for difference), the spread represents the difference between the buy and sell price of an asset. The price at which you buy (bid price) is always higher than the price at which you sell (ask price), and the underlying market price will general be in the middle of these two prices.

Trading spreads are implemented by market makers, brokers and other providers to add costs to a trading opportunity, based on supply and demand. Depending on how expensive, volatile and liquid an asset is, the spread will fluctuate along with an assets price and trading volume.