When novice traders enter the financial markets, they may aim to make a lot of money in a very short time. The understandable temptation of making ‘easy money’ can quickly take over normal thinking processes, as emotions replace logic and dominate our behaviour.

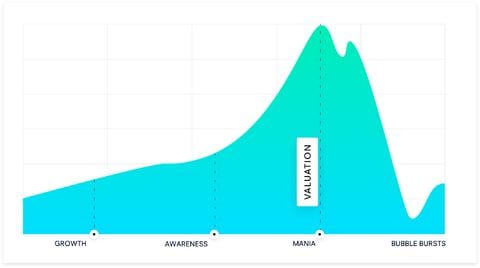

The result is seldom positive and can give rise to the kind of market bubbles seen as far back as the 1630s with the Dutch tulip mania. At one point, a single tulip was fetching more than three times the average yearly salary of the day.

Data retrieved from multiple online sources

Learn from history

Plenty of us will remember the dotcom bubble, where the US tech market soared and then sold off just as sharply. It left thousands of self-proclaimed ‘savvy investors’, who had previously celebrated massive paper profits, with no actual money and lots of regrets.

The most recent rush has been around bitcoin and other cryptocurrencies, where more and more people bought into the unprecedented upward movement of what many believed to be the new future currency. Those who had money in cryptos gained expert status so long as prices were going up. They spread the word, ensuring other, often less experienced investors, climbed aboard this latest ‘can’t lose’ opportunity. By the end of 2017, the bubble popped and bitcoin’s value plunged almost 70%. Cryptos have so far failed to recover their previous high valuations.

The difference between tulip mania and the bitcoin frenzy, is that the latter occurred at a time when people are more connected than ever before via social and other media, meaning the message reached the masses much more quickly. As did the eventual scepticism about its continuing rise, which you can see in the chart below.

Looking back at these major market events, you can see the potential risk of allowing emotions to dominate investing and trading decisions.

But it’s not just these big events that can encourage people to make unwise investing decisions. As traders, it’s easy to become attracted to opportunities that are reportedly ‘interesting’ and which on the face of it could result in potentially significant returns. A typical example is initial public offerings (IPOs) in ‘hot’ sectors.

When a privately-owned company floats on a stock exchange as a publicly traded stock, there is no way to predict exactly how the new stock will be received by the market. An IPO can offer potential rewards for investors and traders, but can also be extremely risky. (Read mor on risk management)

The biggest engagement from the public in an IPO tends to be seen when a household name is floated on to the stock market. One classic example was Facebook, which floated in 2012. Given the millions using Facebook, public interest in and take-up on the stock was high, as evidenced in the chart below.

There are some safeguards for the public when it comes to investing in IPOs – in most countries, there is some regulation around who can and can’t trade on or invest in pre-IPO stocks, given their potential volatility. Investors usually need to show they have a degree of sophistication, have a stipulated net worth, cash flow and record of trading experience.

Be wary of ‘hot’ sectors

Another example of an area where a trader or investor may potentially be at risk is in emerging economies, such as the BRICS countries: Brazil, Russia, India, China and South Africa. This is due to these economies being much more volatile than established economies. Their volatility is driven by political upheaval, volatile currencies and trade dependency on external factors. The new economies offer potential upside rewards, but the downside risks must be factored in.

The question for traders is whether or not to create space for these new economies, IPOs and fast-rising investments, which could turn into burst bubbles, into their trading portfolio.

Or should traders stick with tried and tested approaches? As with many things, there is no ‘one size fits all’ answer. It largely comes down to a trader’s personal risk profile.

But it’s worth keeping in mind that, if the masses have already piled in to an investment, it may be a mistake to follow suit. Some people made a significant amount of money in a very short space of time. Conversely, when the major correction came, many investors suffered huge losses. But experienced technical traders were still able to make consistent returns off the rallies and pullbacks that bitcoin has experienced.

So, be wary of media hype and social media excitement about the ‘next big thing’. As is often remarked, if it seems too good to be true, it probably is. But if you have the risk profile, nerve and skill to trade in a fast-moving market place, there is the potential to make a profit.

Disclaimer

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.