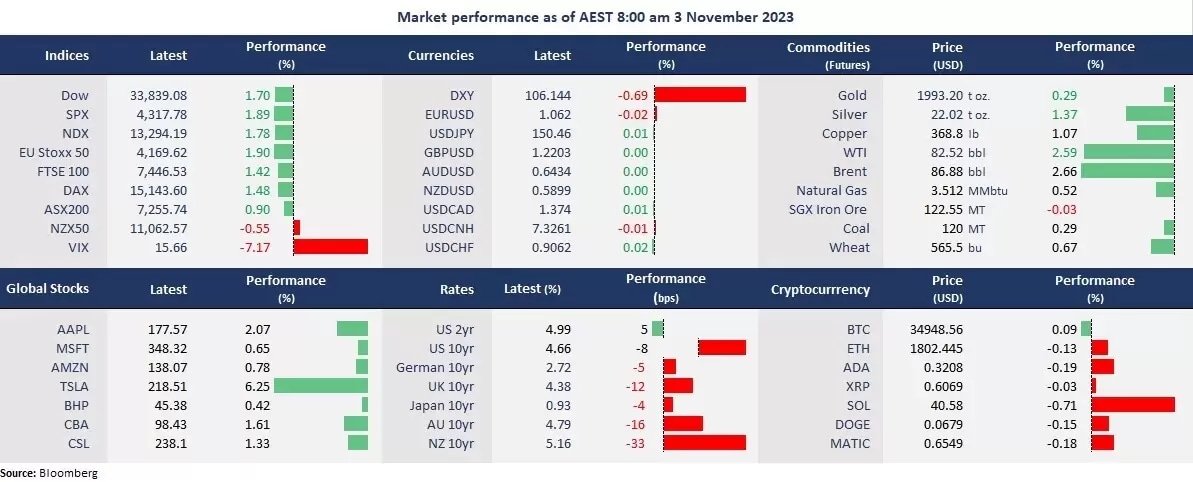

Peak rate hike bets continued to fuel the relief rally in global stock markets as the Bank of England followed suit, pausing rate hikes for the second consecutive time. Wall Street accelerated gains for the second straight trading day, with the S&P 500 posting the best trading day since May, following the Fed’s dovish hint. The US 10-year Treasury yield slid 12 basis points to 4.67%, the lowest since 16 October.

Sliding bond yields sent the US dollar lower, in turn lifting all the other G-10 currencies and commodity prices. The worst-beaten currency, the New Zealand dollar, strengthened the most, thanks to the risk-on sentiment. Crude oil prices took the macro tailwind and rebounded more than 2%.

On the earnings front, Apple’s shares dipped in after-hours trading due to the fourth straight quarterly revenue decline despite an earnings beat. The tech giant’s revenue fell 1% year on year due to tepid iPhone sales in Great China, while service revenue again topped market expectations.

The US non-farm payroll that is due for release tonight will be the focus steering market movements on the last day of the week.

Asian markets are set to open higher. ASX 200 futures were up 1.2%, Hang Seng Index futures rose 1.14%, and Nikkei 225 futures climbed 1.20%.

Price Movers:

- All 11 sectors in the S&P 500 finished higher, with Energy and Real Estate leading gains, both up 3%. Real Estate saw a sharp rebound as the sector benefited from falling bond yields. Communication Services was the laggard but was still up 0.91%, dragged by Meta Platforms, whose shares were down 0.31%.

- Apple’s shares fell about 3% in after-hours trading due to weak guidance. The company’s overall revenue posted the fourth consecutive year-on-year decline due to weakened demands in China. CFO provided disappointing guidance of further decline in its December revenue.

- Tesla jumped 6% amid possible dip-buys after a 20% slump since it reported a narrowed profit margin last month. The recent pivotal support was found at around US$200 per share as the EV maker’s stocks rebounded about 13% in the last three trading days.

- WTI futures rebounded 2%, snapping a three-day losing streak after finding key support at about US$80 per barrel. A softened US dollar and technical trade may have been the cause of the sharp rebound in crude prices.

Today’s agenda:

- China’s Caixin Services PMI for October

- The US Non-farm Payroll for October

- US ISM Services PMI for October