Crypto Trading

Cryptocurrencies are digital currencies that operate independently of traditional banks and governments—offering 24/7 trading opportunities driven by global demand and technological innovation. Trade the volatility of major cryptocurrencies like Bitcoin and Ethereum, plus altcoins like TRON, with competitive spreads from just 1.9 points.

Why Trade cryptocurrencies with CMC Markets

Your Favourites in One Place

Get exposure to volatility on favourites like Bitcoin and Ethereum as well as alt coins like TRON.

Precise Pricing

We combine multiple feeds from tier-one banks, to get you the most accurate bid/ask price.

Minimal Slippage

With fully automated, lightning-fast execution in 0.0040 seconds.

Professional Research

Free access to quantitative equity analysis from Morningstar.

Dedicated Customer Service

Our experienced team is here whenever the markets are open to support you on your trading journey.

No Partial Fills

No dealer intervention - we don't reject or partially fill trades based on size.

Trade Crypto With Spreads From as Low as 1.9 Points

Trade Bitcoin, Ethereum, and 20+ altcoins including TRON — all with competitive spreads and flexible leverage.

*Rebate amount is in USD and per million in turnover

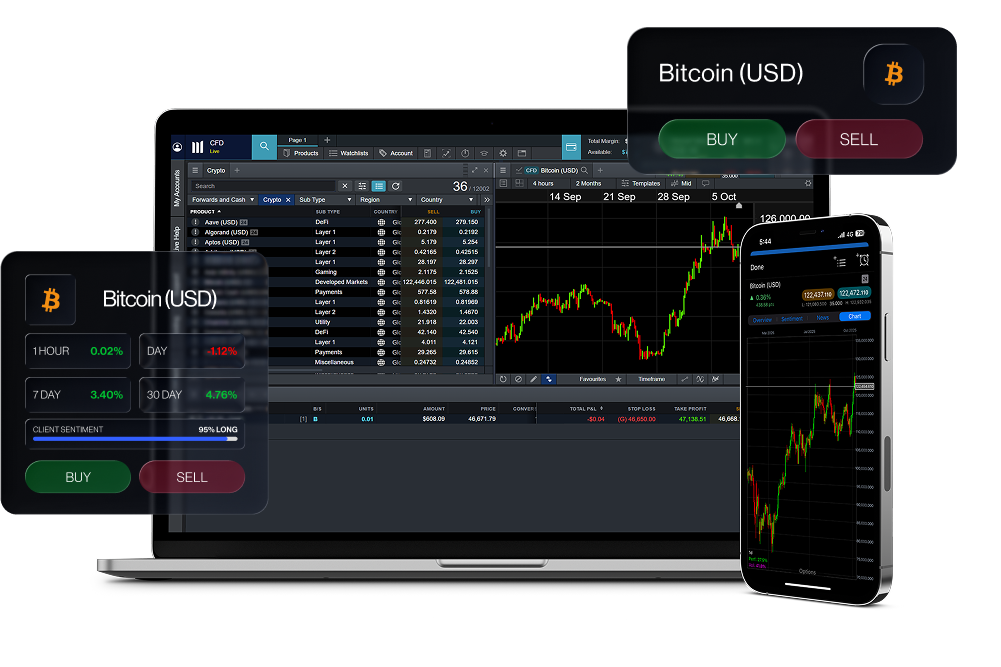

Choose Your Platform

Whether you choose our award-winning platform or the renowned MetaTrader 4, you'll find tight spreads and no hidden fees.

Our award-winning proprietary trading platform combines institutional-grade features and security, with lightning-fast execution and best-in-class insight and analysis.

Trade CFDs on popular indices, forex pairs, commodities and cryptocurrencies with the world's favourite trading platform, backed by our exceptional service.