Open a spread betting demo account

Spread bet on the financial markets, including indices, forex, commodities, shares and treasuries, at home or on the go on the UK's best spread betting platform1.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets, CFDs, OTC options or any of our other products work and whether you can afford to take the high risk of losing your money.

Spread bet on the financial markets, including indices, forex, commodities, shares and treasuries, at home or on the go on the UK's best spread betting platform1.

Just enter your email address and a password to create your free spread betting demo account.

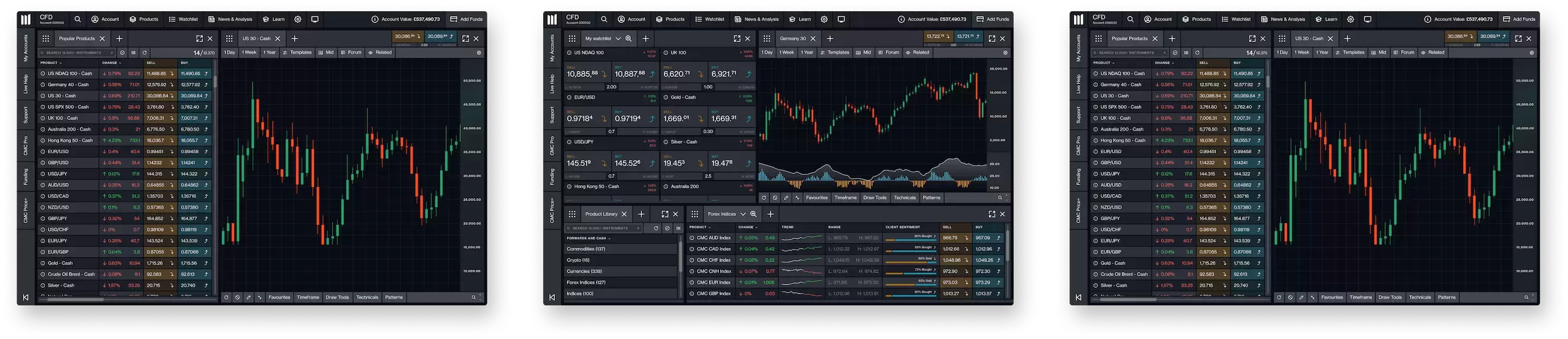

Get to know the platform by exploring the product library, charts, watchlists, order tickets, analyst insights and more.

Learn how to spread bet with £10,000 of virtual funds and conduct analysis on free live charts.

Spread betting is a tax-efficient way4 of speculating on the price movement of thousands of global financial markets (or instruments). When you spread bet, you take a ‘buy’ or ‘sell’ position based on whether you think the price of an instrument will rise or fall, and make a profit or loss depending on which direction the market moves. The difference between the buy price and sell price is referred to as the spread.

Pay no capital gains tax (CGT) or stamp duty on profits.

Spread bet on some indices 24 hours a day, five days a week.

Deposit from just 3.3% of the full value of your position to open a trade.

Our award-winning customer service team1 is online 24/5, whenever you need us.

Trade using multiple screens with access to our entire range of features.

Automate trades with trading robots and access a suite of add-ons.

Access to more pairs than anywhere else on the world's largest, most liquid market.1

More on forexTrade on favourites like Gold, Silver, Brent & West Texas Crude Oil.

More on commoditiesSpeculate on the performance of the world's largest companies, from Apple to Walmart.

More on sharesGain exposure to a range of instruments in a single transaction with our range of more than 1,000 ETFs.

More on ETFsTake a position on over 50 interest rates and government debt obligations.

More on treasuriesTrade the next big trend. Take your pick from our exclusive, low-cost thematic portfolios.

More on share baskets35 years of industry experience.

1 million+ global traders and investors2.

Is it free to open an account?

There's no cost when opening a live spread betting, CFD or FX Active account. You can also view prices and use tools such as charts, Reuters news or Morningstar quantitative equity reports, free of charge. However, you will need to deposit funds in your account to place a trade. Find out more about the costs of placing a trade .

Is CMC Markets regulated by the FCA?

Yes, CMC Markets UK plc (registration number 173730) and CMC Spreadbet plc (registration number 170627) are fully authorised and regulated by the Financial Conduct Authority (FCA) in the UK. Retail client money is held in segregated client bank accounts and money held on behalf of clients is distributed across a range of major banks, which are regularly assessed against our risk criteria.

Is CMC Markets covered by the FSCS?

Yes, your eligible deposits with CMC Markets are protected up to a total of £85,000 by the Financial Services Compensations Scheme (FSCS), the UK's deposit guarantee scheme. If CMC Markets ever went into liquidation, retail clients would have their share of segregated money returned, minus the administrator's costs in handling and distributing these funds. Any shortfall of funds up to £85,000 may be compensated under the FSCS.

How does CMC Markets segregate client money?

Under the FCA's Client Money rules, we're required to segregate client money (unless you agree with us otherwise) from CMC's own funds. The funds held in segregated bank accounts do not belong to CMC and will be held in a way that enables it to be identified as client money. Learn more about client money regulations

How does CMC Markets make money?

Our income primarily comes from our spreads, while other fees, such as overnight holding costs, make a minor contribution to our overall revenue.

We never aim to profit from our clients' losses. Our aim is to build long-term relationships by providing the best possible trading experience through our technology and customer service.

What can I trade on with CMC?

You can trade on over 12,000 financial instruments when you spread bet or trade CFDs with us. See a list of all our popular markets and instruments .

How do I open a demo account?

All you need to do is provide a valid email address, your full name, phone number and password. Once you have opened a demo account, you will need to click on the verification link sent to your registered email address to activate it. Learn more about documentation to provide.

How long does a demo account last?

You can keep your account open for as long as you like. Please note that shares on a demo spread betting account are available for a limited period due to exchange restrictions. Most shares, including US shares, are available for 30 days once activated. For UK and Italy shares, demo subscriptions are available for the current calendar month only. When you select to activate shares from these countries, you will see a message confirming this, enabling you to either activate straightaway, or wait for the beginning of the following month. This gives you the opportunity to trade on UK and Italy shares for a whole month. Learn more about the share market.

How can I switch to a live account?

Just click on the ‘Live Account’ button on the login page to go to the online application form. Use your spread betting demo account login details to get started and then follow the step-by-step instructions to apply for your live account.

How will a demo account prepare me for live trading?

Our demo account is a risk-free simulation of our platform. You can get a taste for the features and you can use it to test strategies, even after you've opened a live account. You can add more virtual funds at any time via the 'Payments' menu. Learn about our Next Generation platform features.

Ready to start spread betting?

Try a demo with £10,000 of virtual funds or open a live account.Do you have any questions?