Welcome to Michael Kramer’s pick of the top three market events to look out for in the week ahead, plus his reaction to Donald Trump’s election victory.

The coming days give markets a chance to catch their breath after a hectic week. The US presidential election resulted in a resounding win for Donald Trump, after which both the US Federal Reserve and the Bank of England cut interest rates by a quarter of a percentage point. As investors figure out what it all means, they’ll be keeping an eye out for upcoming announcements on US inflation and retail sales, as well as UK GDP.

US election: Trump romps to victory

Despite expectations of a tight race, president-elect Donald Trump comfortably beat vice-president Kamala Harris in the US election. Trump not only captured the required 270 electoral college votes to secure victory, he also became the first Republican candidate to win the popular vote since George W. Bush in 2004.

Wall Street reacted favourably to the election result, with US stock markets such as the S&P 500 and the Dow Jones driven higher by investor optimism about potential deregulation and economic growth under Trump. Bond yields also surged on inflation fears amid expectations that government borrowing will rise sharply to fund Trump’s proposed tax cuts. The US dollar strengthened against other major currencies as an expected pro-growth fiscal package could reduce the likelihood of sharp interest rate cuts from the Fed. The possibility of rates staying higher for longer makes dollar deposits more attractive. Recent US economic data has been strong, October’s hurricane-affected non-farm payrolls print aside, further supporting the case for fewer rate cuts, higher yields, and a stronger dollar.

However, it remains to be seen whether the equity market response to Trump’s win was a show of confidence in him or simply a volatility reset of the sort we typically see after major events. If the Fed delivers fewer rate cuts, the dollar strengthens, and government bond yields rise, financial conditions could tighten, which may be a negative for US stocks. Rates and the dollar seem likely to be the key drivers that could determine where equity markets go in the weeks and months ahead.

US October inflation

Wednesday 13 November (CPI), Thursday 14 November (PPI)

Analysts estimate that the US consumer price index (CPI) increased 2.6% in the year to October, up from 2.4% in September. On a monthly basis, CPI is expected to be up 0.2%, flat compared to September. Core CPI, which excludes volatile food and energy prices, is projected to have risen 3.3% year-on-year and 0.3% month-on-month, both unchanged from September.

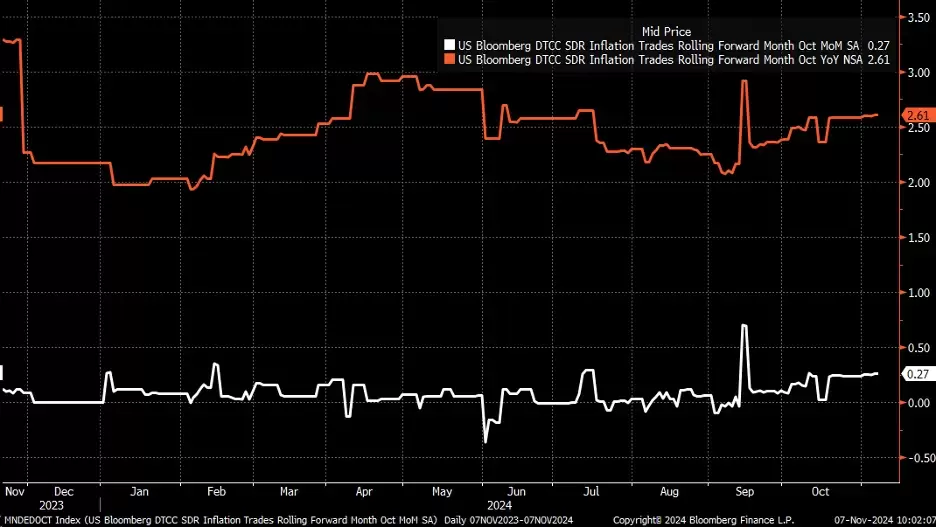

However, inflation swaps indicate the potential for a higher-than-expected monthly CPI reading of 0.3%, as shown on the chart below.

US inflation swaps, November 2023 - present

Following Wednesday’s CPI release, Thursday’s producer price index (PPI) data is expected to show a 0.2% month-on-month increase, with core PPI rising by 0.3% month-on-month, both in line with September's data.

If inflation exceeds expectations, the Fed may decelerate the pace of interest rate cuts, which could bolster the dollar, particularly against the euro. The EUR/USD pair is currently near the $1.06 support level, and a breach below this threshold could lead to a decline towards $1.04.

EUR/USD, January 2022 - present

UK Q3 GDP

Friday 15 November

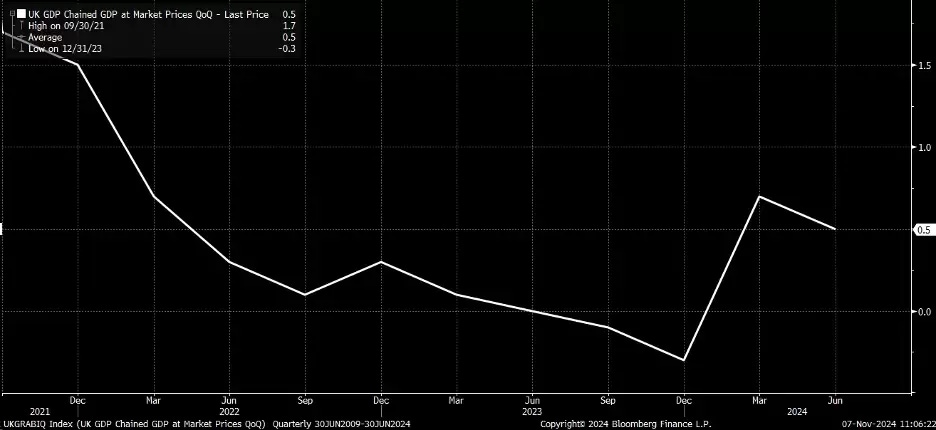

Investors are likely to approach the UK’s third-quarter gross domestic product data with caution. Economic growth in the UK was miniscule in 2022 and ground to a halt in 2023, but in the first half of 2024 the green shoots of recovery became visible, with growth of 0.7% in Q1 and 0.5% in Q2. If the UK economy really has returned to growth after the recession that marked the second half of 2023, then the new government’s spending plans – announced in the Budget on 30 October – could help spark a rally in UK stocks. However, the potential gains may be driven more by Keynesian “animal spirits” – or emotions – than fundamental value, since the government’s investment drive will inevitably take time to deliver tangible results.

UK GDP, December 2021 - present

The FTSE 100, up 4.5% year-to-date, has been treading water since May, trading in a range between 8,000 and 8,400. However, the index could benefit if a feeling of growth can be revived in the British economy. Although the footsie's momentum has weakened lately, based on the relative strength index (RSI), a decent GDP reading could help the share index move off support and rise towards resistance at 8,400. That said, a weak GDP figure could open up further downside, potentially sending the FTSE 100 towards 7,900.

UK 100, September 2023 - present

US October retail sales

Friday 15 November

Retail sales in the US are expected to have increased 0.3% month-on-month in October, down from 0.4% in September. Retail sales might play a role in where the dollar goes next, since a robust reading – alongside the inflation data earlier in the week – could mean that the Fed delays further interest rate cuts.

The dollar index, which measures the US dollar against a basket of six major currencies, may have reached overbought levels, based on its RSI and Bollinger Bands, suggesting that it could consolidate in the near term. However, a convincing move above 104.70 could propel the index to around 107.

US dollar index, May 2023 - present

Key economic and company events

Our rundown of notable economic announcements and US and UK company reports scheduled for the coming week:

Monday 11 November

• Australia: November Westpac consumer confidence

• New Zealand: Q4 inflation expectations

• US: Q3 loan officer survey

• Results: Live Nation Entertainment (Q3)

Tuesday 12 November

• Germany: October harmonised consumer price index (CPI)

• UK: September average earnings, September unemployment rate, October jobless benefit claimant count

• Results: AstraZeneca (Q3), Flutter Entertainment (Q3), Home Depot (Q3), Rocket Companies (Q3), Sea Limited (Q3), Shopify (Q3), Spotify (Q3), Tencent Music Entertainment (Q3), Tyson Foods (Q4), Vodafone (HY)

Wednesday 13 November

• Australia: Q3 wage price index

• Eurozone: September industrial production

• UK: Bank of England monetary policy report hearings

• US: October CPI

• Results: Cisco Systems (Q1), Nu (Q3), Occidental Petroleum (Q3), Smiths (Q1)

Thursday 14 November

• Australia: October unemployment rate, November consumer inflation expectations

• Eurozone: Q3 gross domestic product (GDP), Q3 employment change

• Japan: Q3 GDP

• US: October producer price index (PPI), initial jobless claims to 8 November

• Results: Applied Materials (Q4), Aviva (Q3), JD.Com (Q3), NetEase (Q3), Walt Disney (Q4), WH Smith (FY)

Friday 15 November

• China: October retail sales, October industrial production

• France: October CPI

• UK: Q3 GDP

• US: October retail sales, October industrial production

• Results: Alibaba (Q3), Land Securities (HY)

Note: While we check all dates carefully to ensure that they are correct at the time of writing, the above announcements are subject to change.

CMC Markets er en ‘execution-only service’ leverandør. Dette materialet (uansett om det uttaler seg om meninger eller ikke) er kun til generell informasjon, og tar ikke hensyn til dine personlige forhold eller mål. Ingenting i dette materialet er (eller bør anses å være) økonomiske, investeringer eller andre råd som avhengighet bør plasseres på. Ingen mening gitt i materialet utgjør en anbefaling fra CMC Markets eller forfatteren om at en bestemt investering, sikkerhet, transaksjon eller investeringsstrategi. Denne informasjonen er ikke utarbeidet i samsvar med regelverket for investeringsanalyser. Selv om vi ikke uttrykkelig er forhindret fra å opptre før vi har gitt dette innholdet, prøver vi ikke å dra nytte av det før det blir formidlet.