Welcome to Michael Kramer’s pick of the top three market events to look out for in the week ahead, and his latest US election update.

Traders’ focus will be on a trio of central bank interest rate decisions: first up is the US Federal Reserve on Wednesday, followed by the Bank of England on Thursday and the Bank of Japan on Friday. As central bankers set the course for monetary policy in the final months of 2024 and look ahead to 2025, traders will be aware that divergent monetary policies could have an impact on markets. The Bank of Japan is mulling a rate rise, while the Fed and the Bank of England are considering rate cuts.

US election update

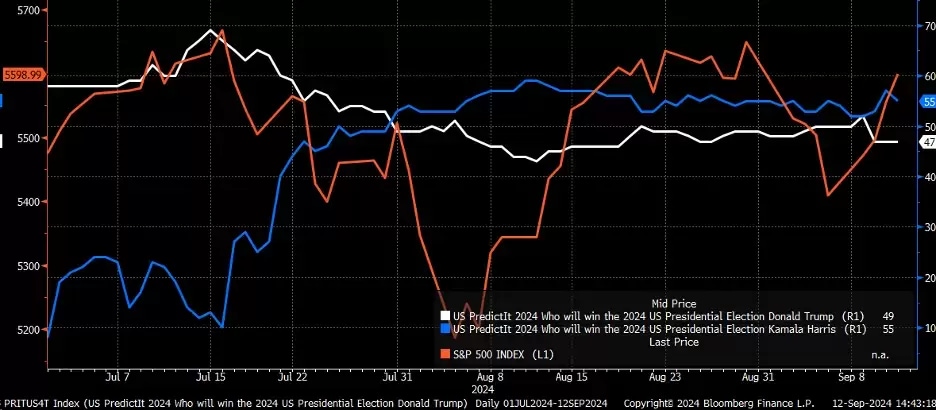

The first – and possibly only – presidential debate between vice-president Kamala Harris and former president Donald Trump came and went on Tuesday. It doesn’t seem to have had a significant impact on the bookmakers’ odds. PredictIt, an online betting market that covers political events, continues to give Harris a 55% chance of winning versus Trump’s 47% chance. Meanwhile, US equity markets seem to be refraining from picking a side, and are instead moving at their own pace. This follows the pattern we've seen throughout this election campaign, with the market seemingly unwilling to "endorse" a candidate.

US election poll tracker, July 2024 - present

US August retail sales

Tuesday 17 September

Analysts estimate that US retail sales declined 0.2% month-on-month in August, down from a 1% gain in July, with the ex-autos index rising 0.3% month-on-month, down from 0.4%. After retail sales for July came in stronger than expected, we saw a sharp rally in the equity market. Given ongoing concerns about the health of the US economy, it’s certainly conceivable that US stock markets could again make a big move in response to the retail sales data.

Data favourable to the US economy's health would likely be bullish for equities, sending stocks higher following the news. Conversely, a downside miss could be seen as further evidence of a slowing US economy, with stocks likely to fall as a result.

First, let’s look at the bullish scenario. The S&P 500, which gained 0.75% on Thursday to close at 5,595.76, still has an upside gap to fill at 5,650. The gap was created following the US Labour Day holiday and could serve as a target for the market in the coming days, potentially acting as a level of resistance.

On the other hand, if the retail sales figures come in weak, a move back down to 5,400 for the S&P 500 cannot be ruled out. That could partly reverse the gains that the index made after Wednesday’s US consumer prices report showed that the annual rate of inflation eased to 2.5% in August, down from 2.9% in July.

S&P 500, 22 July 2024 - present

UK August CPI

Wednesday 18 September

Economists estimate that the UK consumer price index rose 2.2% in the year to August, the same rate as in July, and increased 0.2% on a monthly basis, up from a decline of 0.2% month-on-month in July. Inflation has eased from a peak of 11.1% in October 2022 and appears to be stabilising around the Bank of England’s target rate of 2%.

It would likely take a hotter-than-expected CPI number to impact the market significantly. However, the market will be influenced by more than just inflation data in the coming days, since the Fed and the Bank of England will announce their interest rate decisions on Wednesday and Thursday, respectively. The outcome of those meetings could shape the direction of travel for GBP/USD. The pound looks to have a bullish setup, with an apparent bull flag still present on the charts. A move above $1.314 could see the pound break out of that flag formation and potentially challenge the $1.327 level.

GBP/USD, 15 April 2024 - present

Central bank interest rate decisions

Wednesday 18 September to Friday 20 September

Major central banks are queuing up to make monetary policy announcements in the next few days, with the US Federal Reserve kicking things off on 18 September, followed by the Bank of England on 19 September and concluding with the Bank of Japan on 20 September. The main takeaway from these meetings is likely to revolve around policy divergences. The Fed is expected to cut interest rates, the BoE is likely either to cut or hold rates, and the BoJ is thought to be considering further tightening. Any divergence in the central banks’ policies is likely be a major market driver, especially in forex markets and, in particular, for yen pairs.

This places the yen in the spotlight, with USD/JPY likely to receive the most attention from traders. The pair is at a crucial technical level, ranging from ¥141 to ¥142. A break below this support zone could further strengthen the yen against the dollar, potentially sending USD/JPY down to the ¥137 to ¥138 region. For this to happen, the BoJ would need to adopt a hawkish tone, signalling more rate hikes, while the Fed would need to take a dovish stance, indicating that more rate cuts are on the horizon.

However, if the central banks don’t strike the right balance, the yen could depreciate against the dollar, pushing the pair back towards resistance around ¥147 to ¥148. With the Fed up first, followed by the BoJ two days later, policymakers in Tokyo will likely take the steps necessary to jawbone the yen in line with their objectives.

USD/JPY, May 2023 - present

Key economic and company events

Our rundown of notable economic announcements and US and UK company reports scheduled for the coming week:

Monday 16 September

• Italy: August consumer price index (CPI)

• Results: Wilmington (FY)

Tuesday 17 September

• Canada: August CPI

• Japan: August imports, exports and trade balance

• US: August retail sales

• Results: Ferguson Enterprises (Q4), Kingfisher (HY), THG (HY)

Wednesday 18 September

• Eurozone: August CPI

• New Zealand: Q2 gross domestic product (GDP)

• UK: August CPI, producer price index (PPI) and retail price index (RPI)

• US: Federal Reserve interest rate decision

• Results: General Mills (Q1)

Thursday 19 September

• Australia: August unemployment rate and employment change

• Japan: August CPI

• New Zealand: Q3 Westpac consumer survey

• UK: Bank of England interest rate decision

• US: initial jobless claims to 13 September

• Results: Darden Restaurants (Q1), FactSet (Q4), FedEx (Q1), Next (HY), Ocado (Q3)

Friday 20 September

• China: People’s Bank of China interest rate decision

• Germany: August PPI

• Japan: Bank of Japan interest rate decision

• UK: August retail sales

• Results: Lennar (Q3)

Note: While we check all dates carefully to ensure that they are correct at the time of writing, the above announcements are subject to change.

CMC Markets er en ‘execution-only service’ leverandør. Dette materialet (uansett om det uttaler seg om meninger eller ikke) er kun til generell informasjon, og tar ikke hensyn til dine personlige forhold eller mål. Ingenting i dette materialet er (eller bør anses å være) økonomiske, investeringer eller andre råd som avhengighet bør plasseres på. Ingen mening gitt i materialet utgjør en anbefaling fra CMC Markets eller forfatteren om at en bestemt investering, sikkerhet, transaksjon eller investeringsstrategi. Denne informasjonen er ikke utarbeidet i samsvar med regelverket for investeringsanalyser. Selv om vi ikke uttrykkelig er forhindret fra å opptre før vi har gitt dette innholdet, prøver vi ikke å dra nytte av det før det blir formidlet.