The US non-farm payrolls data for December 2024 is set to be released at 1.30pm (UK time) on Friday 10 January. The CME S&P 500 mini options market is pricing in a move of over 90 points (1.5%), potentially increasing volatility and breaking the index out of its recent triangle pattern.

Strong labour market and high interest rates

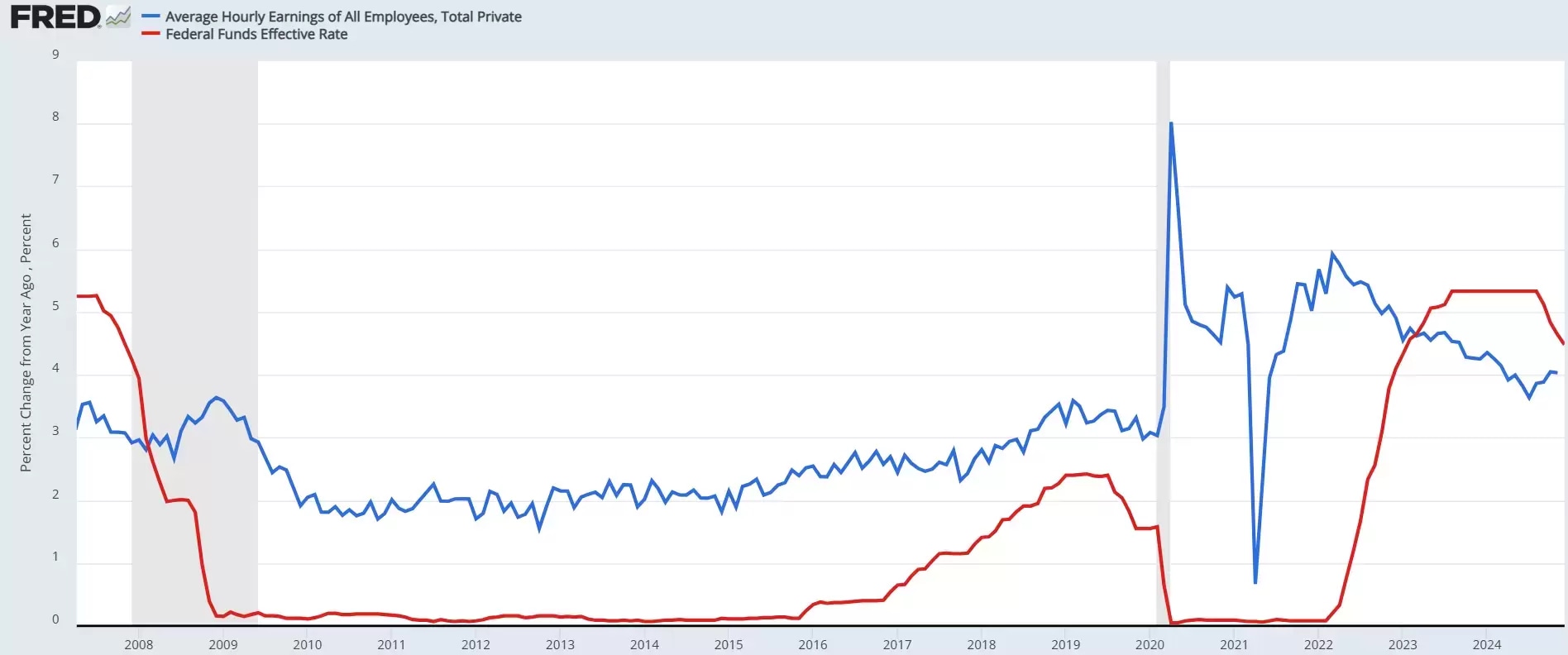

The Thomson Reuters market consensus expects a reading of 160,000 payrolls, down from 227,000 in November, while the unemployment rate is expected to remain steady at 4.2%, and average hourly earnings are expected to continue to rise at an annualised rate of 4%.

If these estimates are correct, tomorrow’s report could indicate a strong labour market: full employment, steady job growth and rising incomes, a combination that could point to potential inflationary pressures.

A paradoxical impact on stock markets

The US economy’s strength (the Atlanta Federal Reserve’s latest GDP Now estimates 2.7% GDP growth in Q4 2024), increasing inflationary pressures (with ISM services at 64.4 in December 2024) and possible Trump policies have prompted the Fed to adopt a stricter monetary policy stance, as reflected in the latest Federal Open Market Committee minutes. This has driven a sharp rise in US interest rates, with 10-year notes reaching 4.70% and T-Bonds around 4.90%, levels not seen in recent months.

High interest rates and a strong US dollar are weighing on stock markets, which are paradoxically reacting negatively to positive economic data. In this context, stronger-than-expected employment data could hurt stocks if rates continue to rise, while weaker data might boost markets if rates ease.

CMC Markets er en ‘execution-only service’ leverandør. Dette materialet (uansett om det uttaler seg om meninger eller ikke) er kun til generell informasjon, og tar ikke hensyn til dine personlige forhold eller mål. Ingenting i dette materialet er (eller bør anses å være) økonomiske, investeringer eller andre råd som avhengighet bør plasseres på. Ingen mening gitt i materialet utgjør en anbefaling fra CMC Markets eller forfatteren om at en bestemt investering, sikkerhet, transaksjon eller investeringsstrategi. Denne informasjonen er ikke utarbeidet i samsvar med regelverket for investeringsanalyser. Selv om vi ikke uttrykkelig er forhindret fra å opptre før vi har gitt dette innholdet, prøver vi ikke å dra nytte av det før det blir formidlet.