Capitalise on market movements with our powerful analytics and dedicated options tools. Made for the experienced investor.

Why trade options with us?

- Integrated Platform

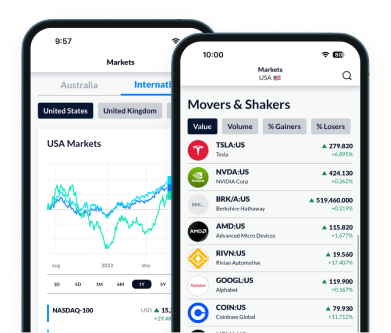

View your whole portfolio in one place and trade options directly from our share trading platform.

View your whole portfolio in one place and trade options directly from our share trading platform. - Competitive FeesFocus more on investments and less on fees with brokerage starting at just $33 per trade.

- Speed

Fast execution means your orders are sent directly to the exchange.

Fast execution means your orders are sent directly to the exchange. - Flexibility

Open positions best suited to your strategy through writing both put and call options.

Open positions best suited to your strategy through writing both put and call options.

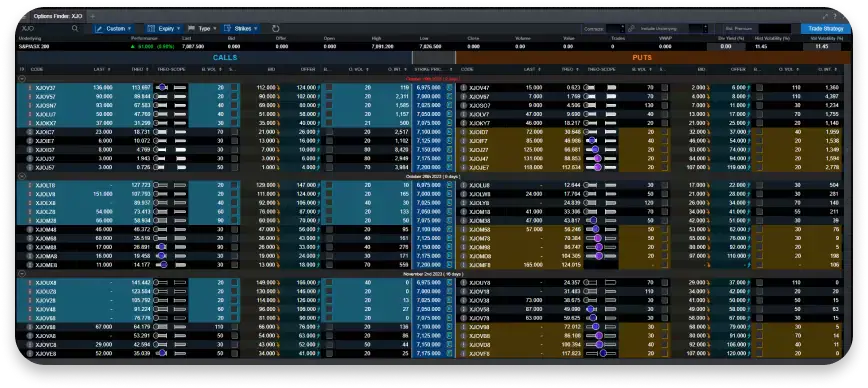

Guide your trading strategy with our powerful options tools. Filter and build out your options order straight in the platform. You’ll even get a margin estimate before placing your order. Plus, place multi leg options orders straight in the platform – giving you full control from placement to execution.

Options can be traded from our standard desktop platform, or you can take it a step further with our Pro platform. Fully customise your trading view and access advanced charting packages. Our in-depth indicators, drawing tools and different chart types will help guide your investment strategies. All for just $49 a month.

Brokerage fees

We've kept our brokerage simple, so you can focus on timing the markets, not navigating pricing tables.

We charge $33 brokerage for trades up to $10,000 and 0.33% for trades over $10,000.

Are options right for you?

Before getting stuck into trading, we recommend taking a look through the following guides and documents.

Complete the options application form to enable options trading on your account.

Options

Frequently asked questions

We send a daily statement that shows your margin movements.

Yes.

Once you have options enabled on your account, you’ll need to complete a quiz to access the different options strategies.

To view or increase your options trading level – once you’re logged into the platform hover over the cogwheel in the top right-hand corner of your screen and select Trading Settings. You don’t need to take the quizzes consecutively and can advance to any level that you’d like.

Learn more about the different trading levels.

Once you have created a CMC Invest account, please complete, scan and send your signed Options Account Application Form (you'll need to sign and date in wet ink) along with valid ID to stockbroking.forms@cmcmarkets.com. ID can include either a driver's license or passport.