Have you ever wondered what it would be like to retire in your 50s? Or even your 40s? The idea of being retired for more than half your life might sound like a pipe dream, but for some advocates of the FIRE (Financially Independent, Retire Early) movement, they’ve turned that dream into reality. Here, we discover the formula for FIRE and discover why it’s far less complicated than you might think.

What is the FIRE movement?

Originating in the US, the FIRE movement’s core principles are often traced back to the 1992 book Your Money or Your Life by Vicki Robin and Joe Dominguez. Dominguez was a Wall Street analyst who retired at the age of 31 and shared his FIRE formula for success.

In a nutshell, FIRE is about keeping your outgoings as low as possible and investing or saving as much as you can, thereby generating capital that works to generate more money. Once the money this capital generates exceeds your expenditure, you have achieved Financial Independence (FI) and could, if you wished, retire early (RE).

The promise of early retirement is an eye-catching headline that increased the FIRE movement’s appeal. However, many advocates of FI don’t just view early retirement as the end goal; rather, it’s about freedom from financial stress and the ability to choose when and how you work.

The FIRE formula

When it comes to achieving financial independence (FI), the goal is to accumulate enough savings so that the returns on your investments can cover your annual expenses indefinitely.

Using the widely known 4% rule, the assumption is that a portfolio can consistently generate 4% annual returns. This means you can safely withdraw 4% of your total savings each year in retirement without running out of money over a 30-year period. For example, if you have $1 million saved, you could withdraw $40,000 in the first year.

This is directly tied to the "25 times rule" because multiplying your annual expenses by 25 ensures your total savings can provide 4% of that amount each year. In simple terms, if you plan to spend $1 annually in retirement, multiplying it by 25 ($1 x 25) gives the amount you need saved to safely withdraw 4% each year. For instance, if you plan to spend $40,000 annually, you'd need $40,000 × 25 = $1 million saved.

Example Calculations:

If your annual spending is $20,000, you would need $500,000 saved to achieve FI.

For $40,000 per year, you would need $1 million.

Those who can live on $10,000 annually would need just $250,000 saved.

Savings required based on annual spending:

Annual Spend | Savings Required for FI |

$10,000 | $250,000 |

$20,000 | $500,000 |

$30,000 | $750,000 |

$40,000 | $1,000,000 |

$50,000 | $1,250,000 |

$75,000 | $1,875,000 |

At these savings levels, retirees can theoretically live entirely off the returns their portfolios generate, without dipping into their principal savings. This means their funds could last indefinitely, regardless of how early they choose to retire.

Could I really retire at 40 with the FIRE movement?

The longer answer requires discipline, but achieving financial independence is certainly possible.

Let’s assume you start full-time employment at 21 years old, earning an average Australian income throughout your career. As of May 2024, by some measures the average annual income in Australia is approximately $100,000. Using the ATO tax calculator, this translates to an annual take-home salary of about $75,000 after taxes.

The ASFA Retirement Standard, as outlined by the Association of Superannuation Funds of Australia (ASFA), suggests that the annual spend required for a “Modest” retirement lifestyle (which covers all basic needs, with a little left over for leisure) is about $31,785 per year for a single person as of May 2023. If you assume you’ll spend the same amount both before and after retirement, you can save approximately $43,215 per year and will need to accumulate around $794,625 ($31,785 x by 25) to achieve financial independence (FI) using the 4% rule.

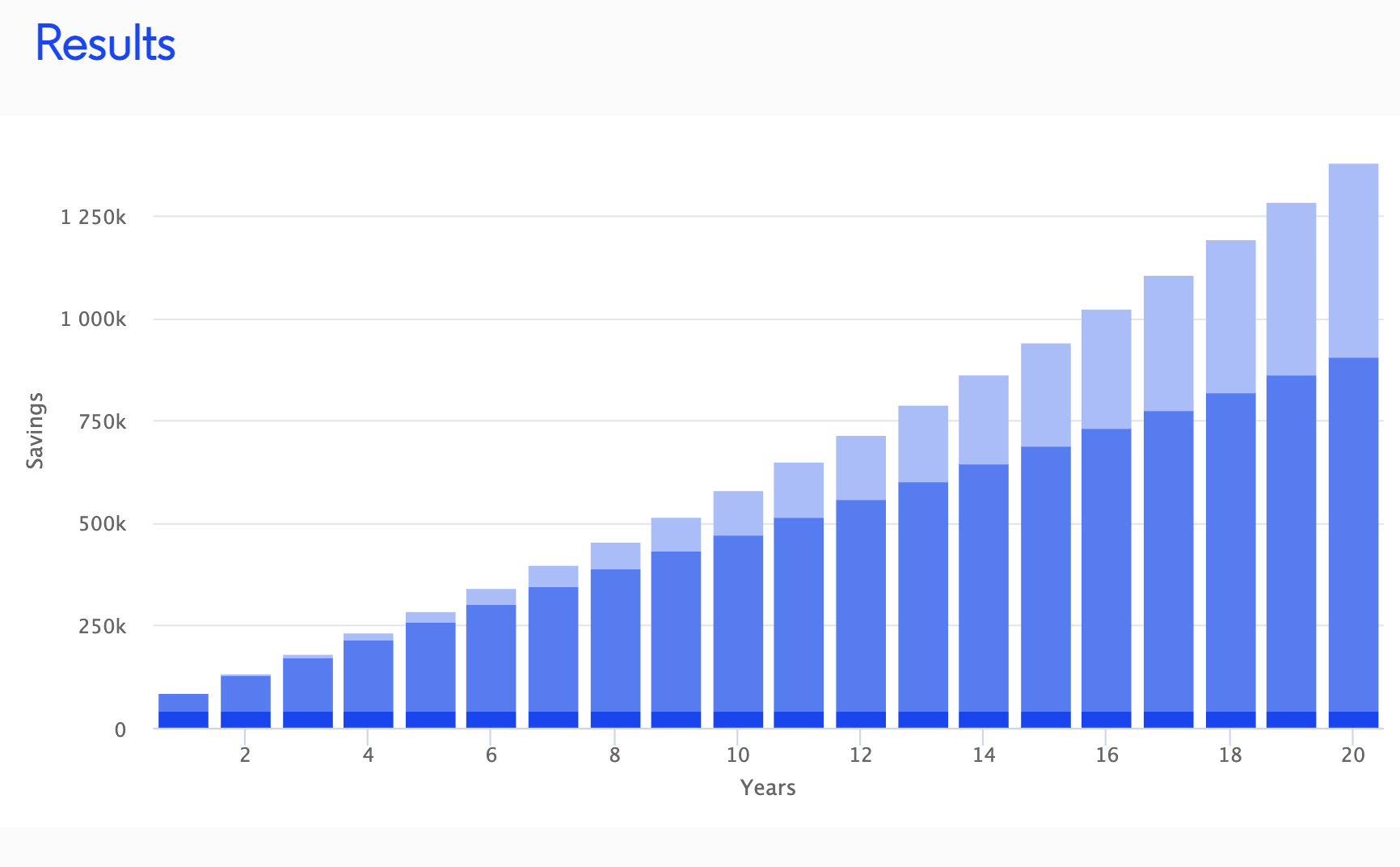

So, if you initially invested $43,215 and added to that investment $43,215 annually at a 4% interest rate for 20 years, your total investments would be worth approximately $1,381,549, according to the MoneySmart compound interest calculator. If you start saving $43,215 per year at age 21, compound interest could help you cross the minimum FI (Financial Independence) threshold of $794,625 by your 14th year, or by the time you’re 35.