- Invest Knowledge Hub

- Platform guides

- Volume-Weighted Average Price algorithmic instructions

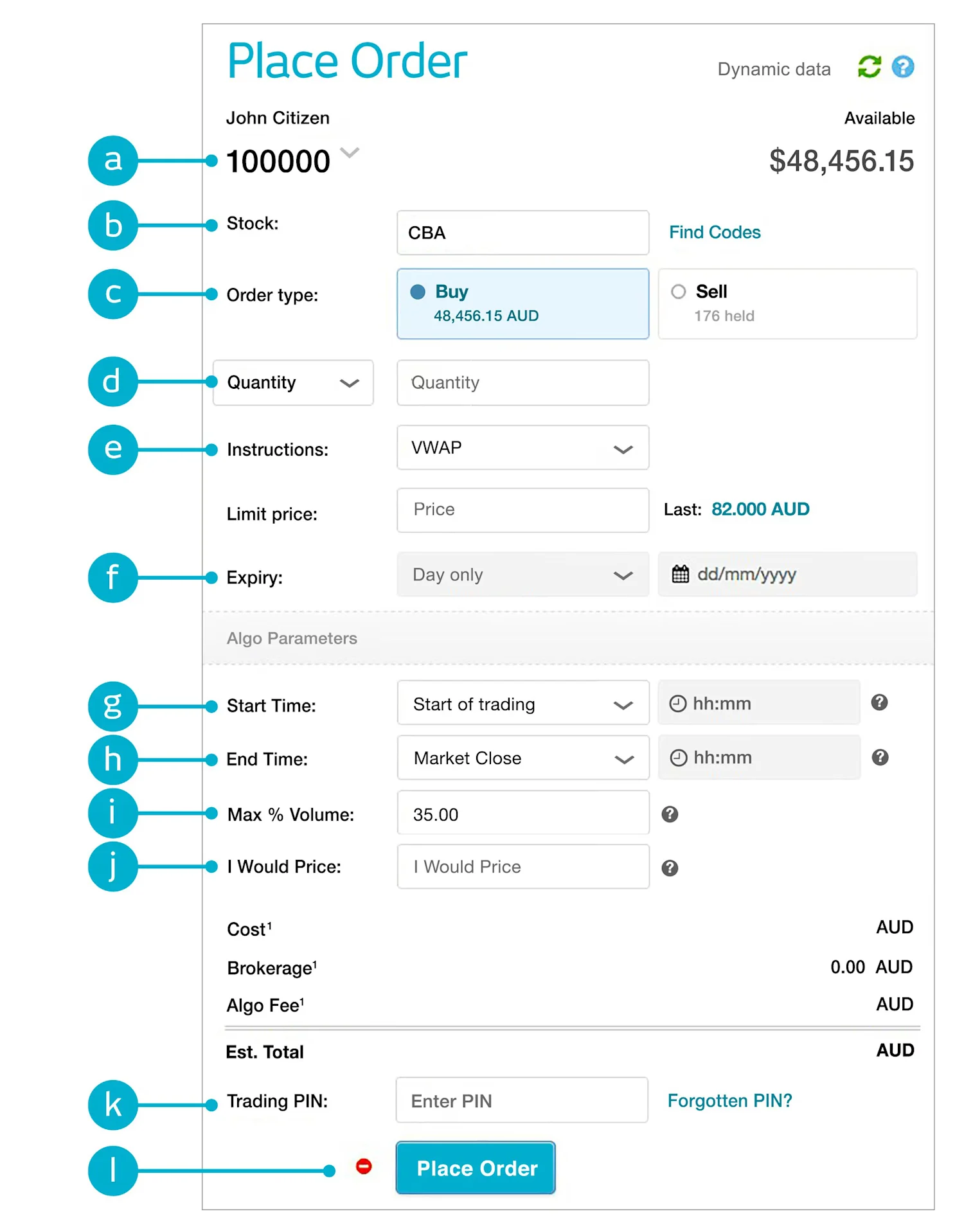

Volume-Weighted Average Price algorithmic instructions

Volume-Weighted Average Price (VWAP) is a popular algorithmic trading strategy, which has traditionally been used for the execution of larger orders. Using projected volume curves, the order is executed proportionally throughout a specified time period – this will reduce the market impact on the market price and will likely result in a better execution outcome.

a) Select your trading account from the top of the order ticket.

b) Enter your stock code (or you can find codes by clicking on the Find Codes link)

c) Select your order type; Buy or Sell

d) Choose your quantity

e) Set instruction to VWAP (under Algo Orders)

f) Expiry is Day only

g) Select the start time, this is the time you specify for the algorithmic order to start trading in the market

h) Select the end time, this is the time you specify for the algorithmic order to stop trading in the market

i) Set your max volume (optional), this is the maximum percentage that your order can trade as a proportion of total market volumes

j) Enter your I would price (optional), this is the price at which your algorithmic order will exit the VWAP strategy and attempt to complete the order

k) Enter your trading PIN

l) Click Place Order to submit this to market