We've partnered with Sharesight for portfolio tracking and performance analysis, giving you a clearer view of your returns and overall investment performance.

Sharesight helps you track your holdings, and evaluate the performance of your shares.

Once synced, your trades will automatically flow into Sharesight, giving you an easy way to access portfolio reporting.

You'll be able to track up to 10 holdings on a complimentary free plan, with the option to upgrade to a more comprehensive paid plan.*

Sharesight can track the performance of your overall portfolio and individual holdings, all in one place. Capital gains, dividends, and currency movements are all shown in dollars and annualised percentages.*

Get all the information you need for comprehensive performance analysis in one integrated view.

How to integrate

To link Sharesight with your Invest account, simply log into the web platform and go to ‘Account’ > ‘Tax Portfolio & Reporting.

*Note

Features and functionality may be updated by Sharesight.

Some advanced function such as tax report may incur charges. Please refer to Sharesight’s pricing page for details.

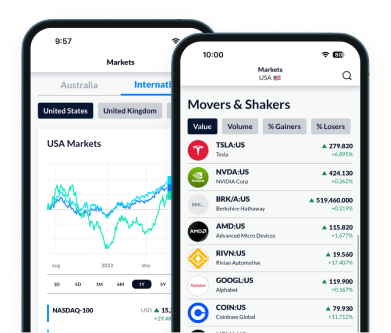

The latest market news, curated for you

- BudgetingInvest BudgetingLearn More

Budgeting isn't just about knowing where your money is going and coming from. No matter what your skill level is, budgeting can be a very helpful way to build your portfolio, and it can even lay the groundwork for a long and fruitful investing career.

- Goal SettingDefining GoalsLearn More

Everyone wants their investment journey to be successful. Defining your goals can be a helpful way to understand what your approach could be.

- FundamentalsAnalysing Investment PerformanceLearn More

When you’re working towards a goal, it's always important to stop and assess your progress. Analysing the performance of your investments is crucial in order to ensure you're on the right track to reach your goals.