US

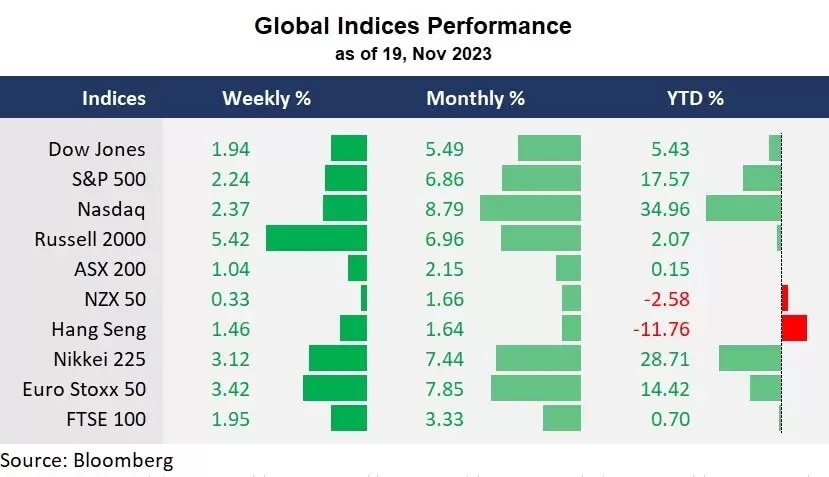

In the past week, Wall Street extended the third straight weekly gains after the US reported lighter-than-expected CPI data, which reignited hopes for a sooner end of the Fed’s rate hiking cycle. The CME Fed Watch Tool indicates that the Fed may start cutting rates as soon as March 2024, slashing the US dollar and buoying bond prices. The AI-powered tech rally continued to fuel the upside moment in the stock markets, with Microsoft refreshing its all-time high levels. The prevailing trend could direct Wall Street into a Santa rally.

This week, we will focus on the top tech performer, Nvidia’s third-quarter earnings report, which will provide insights into how rapid AI development has been shaping the market trend. Here is the earnings preview for your advanced view of the chipmaker’s potential. The macro playout should also be on investors’ radar, as the FOMC meeting minutes are due for release on Wednesday. Its statement is set to provide crucial clues for the central bank’s policy path.

China

China’s major event will be the People’s Bank of China’s decision on its 1-year and 5-year Loan Prime Rate decisions this week. The bank cut the 1-year rate two times and the 5-year rate once this year, but it is not expected to lower these key mortgage rates further as the recent economic data shows signs of improvement. China’s economic trajectory remains a focus of the global markets as the country’s economy stumbled throughout the year. Beijing stepped up stimulus measures to shore up the sluggish economy with a 1.45 trillion yuan injection through its medium-term lending facility last week.

On the earnings front, Chinese multinational tech company Baidu is set to report its third-quarter earnings on 21 November. Its result will be seen as a key bellwether for China’s AI development and business sentiment. The Chinese tech giants, including Tencent and JD.com, all beat expectations recently, which buoyed the Hong Kong stock markets last week.

Australia

Recently, the Australian stock markets continued its November bull run as big miners’ stocks were boosted by risk-on sentiment, riding the bullish wave on Wall Street. Weakened USD lifted minerals’ prices, with the SGX Iron Ore Dec23 futures rising to the highest level since May 2022. The Australian dollar may be set for a bottom reversal trend against the US dollar amid the king dollar’s weakness.

The RBA will release its November meeting minutes this week after it did a dovish rate hike early in the month. The reserve bank expressed concerns about global economic uncertainty, despite the ongoing tight labour market and wage-price spiral risk. Economists do not expect the RBA to raise the interest rate in its meeting on 5 December. Also, Webjet will release its first-half earnings for fiscal year 2024, gauging the industrial sentiment.

What are we watching?

- Gold rebounded: Gold rebounded sharply as the US dollar softened following the US lighter-than-expected inflation. Spot gold found key support at about 1,930, and may head off the 2,000 mark again if the momentum continues.

- Crude oil may have been oversold: Crude oil prices sank further due to record-high US oil production and softened demand outlooks. The WTI futures deepened losses below the 50-day moving average. However, oil markets may have been oversold from a technical perspective.

- Tesla’s stocks soared: Tesla’s shares were up about 20% this month. The EV maker updated the term in its Cybertruck order agreement, saying buyers can not sell the vehicle within one year without its permission. Cybertruck is seen as a key element that drives Tesla’s further growth.

- Bitcoin tested key support: Bitcoin retreated from above 37,000 and tested key support of about 35,000. The spot ETF optimism abated, but it may still be in a new bullish cycle.

Economic Calendar (20 Nov – 26 Nov )

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.