What is shares trading?

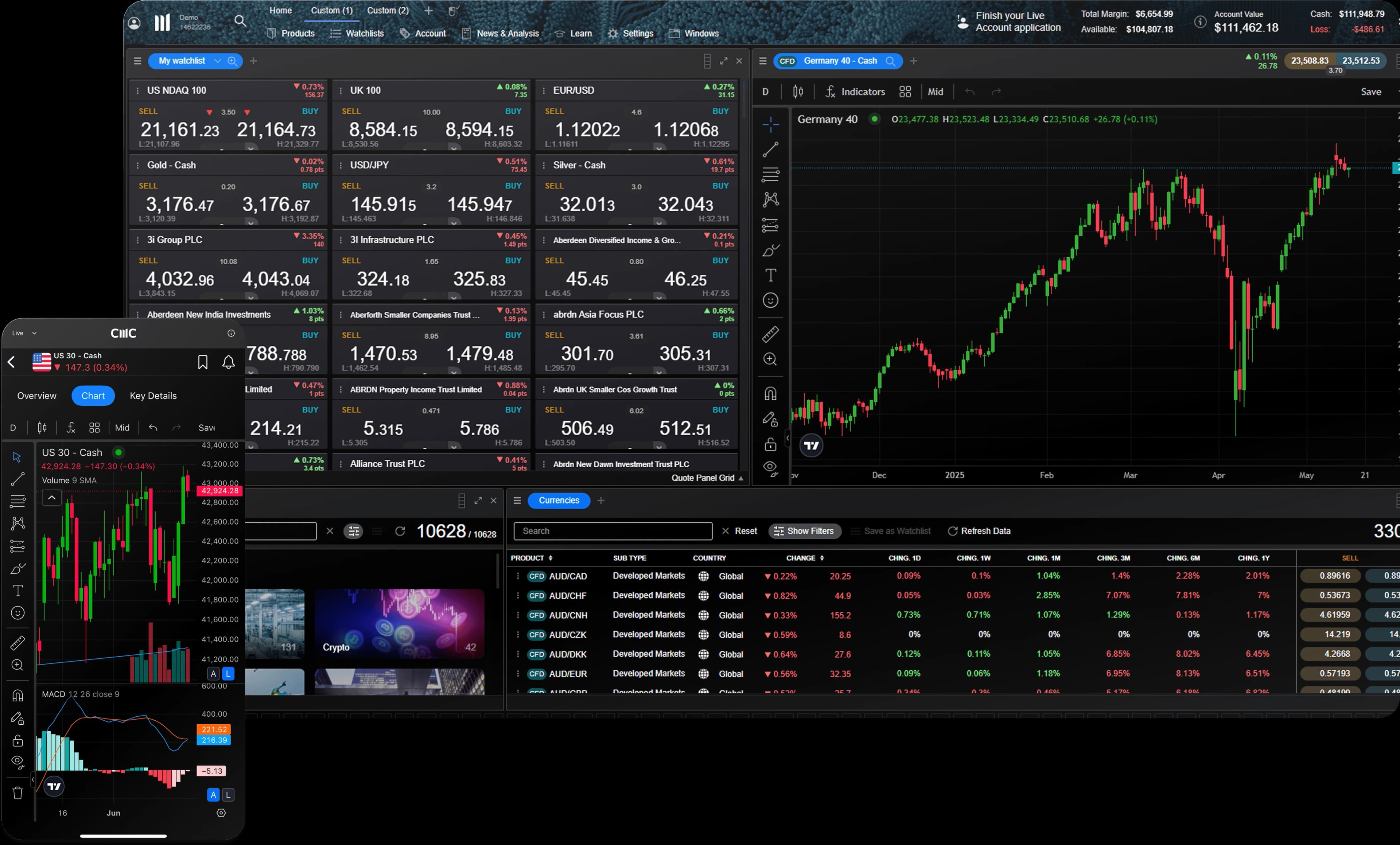

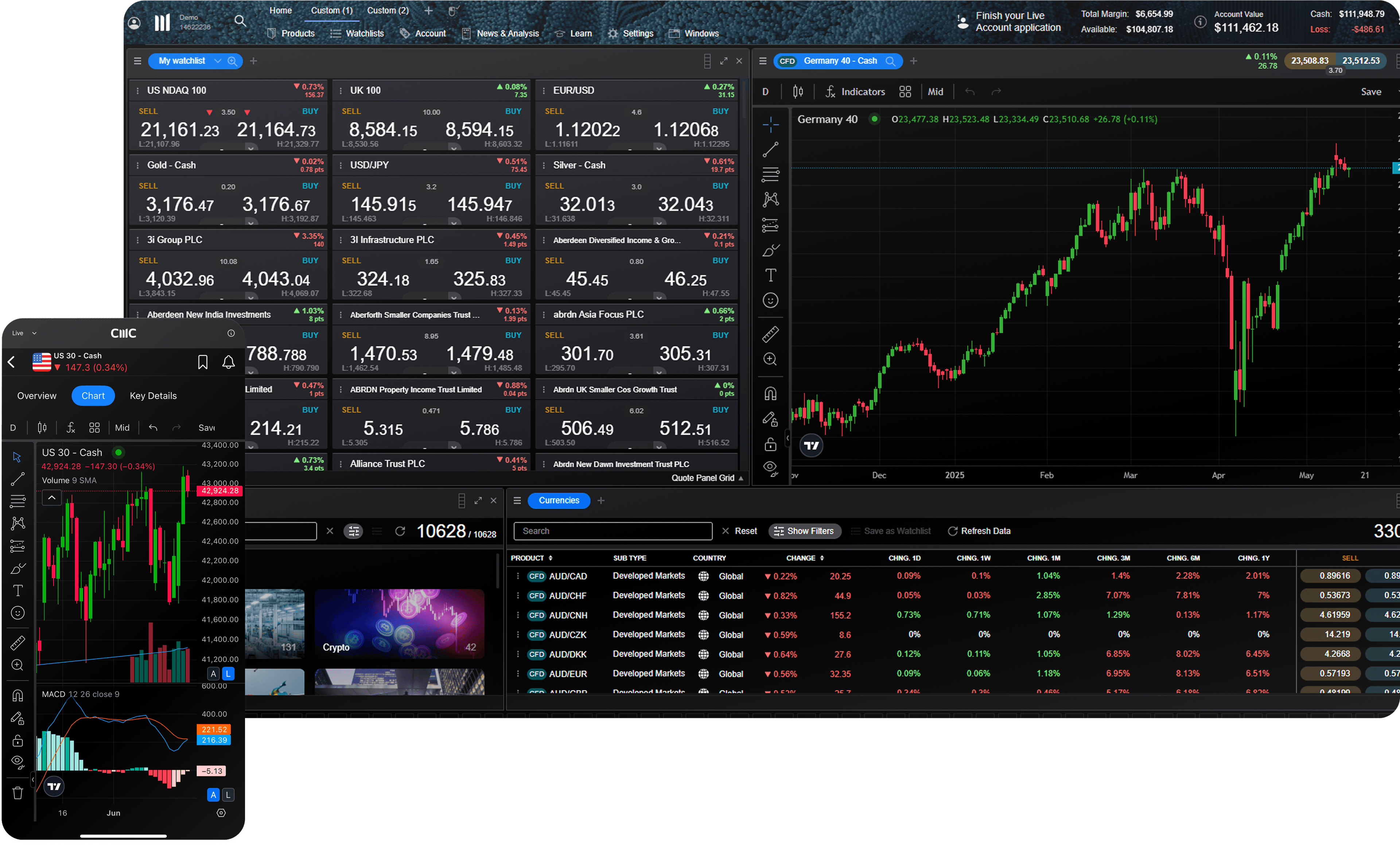

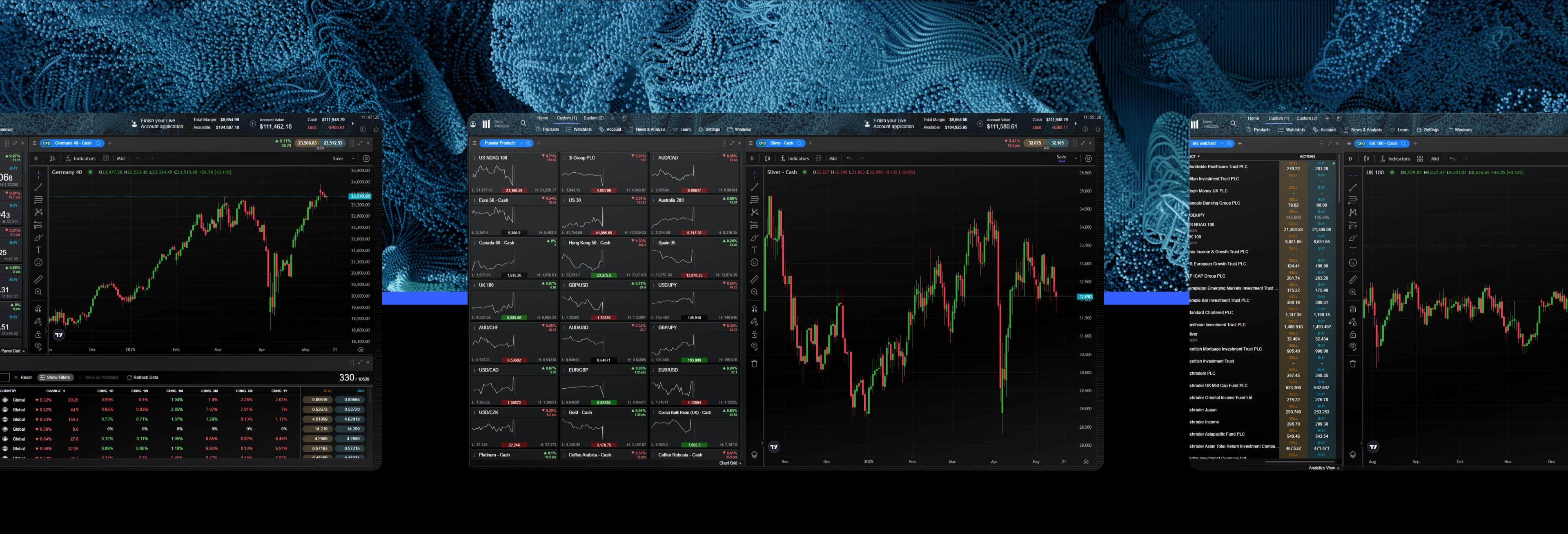

Shares trading, also known as stock trading, is the process of speculating on the price movement of publicly trading companies.

With us, you can trade on shares via CFDs, which allow you to go long if you think a share price will rise, or go short if you think that it'll fall, without taking ownership of the underlying stock.

Dive deeper

Do you have any questions?

Our client services team is here whenever the markets are open.

Email us at clientmanagement@cmcmarkets.ca or call us on 1-866-884-2608.

10.009 seconds CFD median trade execution time on CMC Markets' web and mobile platforms, 1 April 2024-31 March 2025.

2Reuters news ticker is a registered trademark of Thomson Reuters®. Refinitiv® Morningstar is a registered trademark of Morningstar Inc.

3Best Mobile Trading Platform, ADVFN International Financial Awards 2024; No.1 Web Platform, ForexBrokers.com Awards 2023; No.1 Most Currency Pairs, ForexBrokers.com Awards 2023; Best Charting (Germany), Investment Trends Leverage Trading Report 2023; Best Customer Service (Germany), Investment Trends Leverage Trading Report 2023; Best In-House Analysts, Professional Trader Awards 2023; No.1 Platform Technology (UK), ForexBrokers.com Awards 2022; Best CFD Provider (UK), Online Money Awards 2022; Industry Pioneer with "Outstanding" Customer Rating (Germany), Focus Money Test Edition 36/2022, "Very good" Trading Platform (Germany), Deutsches Kundeninstitut (DKI) Survey 2022.

4Based on over 2 million unique user logins across CMC's trading and investing platforms, including partners, as at November 2025.

Loading...

Loading...