Wall Street retreated from a five consecutive month rally last week as spiking bond yields sent jitters to stock markets following Fitch’s US credit downgrade. At the same time, Friday’s job data shows that the US labor market slowed, securing another rate hike pause in September. On the earnings front, Apple and Amazon’s quarterly results wrapped up the US mega-cap earnings with a mixed picture, with Apple registering the third straight quarterly revenue decline, while Amazon blew away expectations with its strong performance. This week, Disney and Alibaba’s earnings will be the major companies investors should focus on gauging leading industrial players’ growth trajectories. While recent resilient economic data points to a soft-landing scenario of the US economy, the US July CPI data can be critical to steer market trends as it will provide clues for the Fed’s future policy path. Consensus calls for an acceleration in the US inflation after 12 consecutive declines.

In Asia, China will be the center this week as the country is set to report a slew of influential economic data, including its trade balance, CPI, PPI, and New Yuan Loans. Chinese stock markets rebounded sharply in July amid the government’s pledge to boost its economy. Risk-on sentiment may lift the regional stocks higher if these data come as positive.

The Australian stock markets were also hit by the bond rout and closed in the red, with all 11 sectors finishing lower last week. The ASX will continue to navigate its trajectory with earnings season rolling on. The largest Australian bank, CBA, will report its full-year earnings, shedding light on the banking sector’s health.

What are we watching?

- Long-dated Bond yields surge: Global bond yields jump following Fitch’s US credit downgrade, with the US 10-year Treasury yield surging to the highest since November 2022. The unexpected ratings cut sparked risk-off trades and sank equity markets too. Bond jitters could continue to rattle global markets.

- The USD strengthens against AUD and NZD: The dollar index climbed amid a surge in the US long-term bond yield, pressing on riskier currencies, such as the Australian dollar and the New Zealand dollar. Both Australia and New Zealand face economic challenges amid sticky inflation and China’s weakened demands.

- Energy stocks outperform: At a sector level, Energy stocks in both S&P 500 and the ASX 200 outperformed broad markets due to a jump in oil prices. However, the re-ramped oil prices may complicate the global inflation outlook again.

- Crude oil extends gains: Crude prices rose for the sixth consecutive week, approaching near-term resistance of their April highs. OPEC+’s output cuts, China’s stimulus measures, and an improved US economic outlook are the bullish element that supports crude prices.

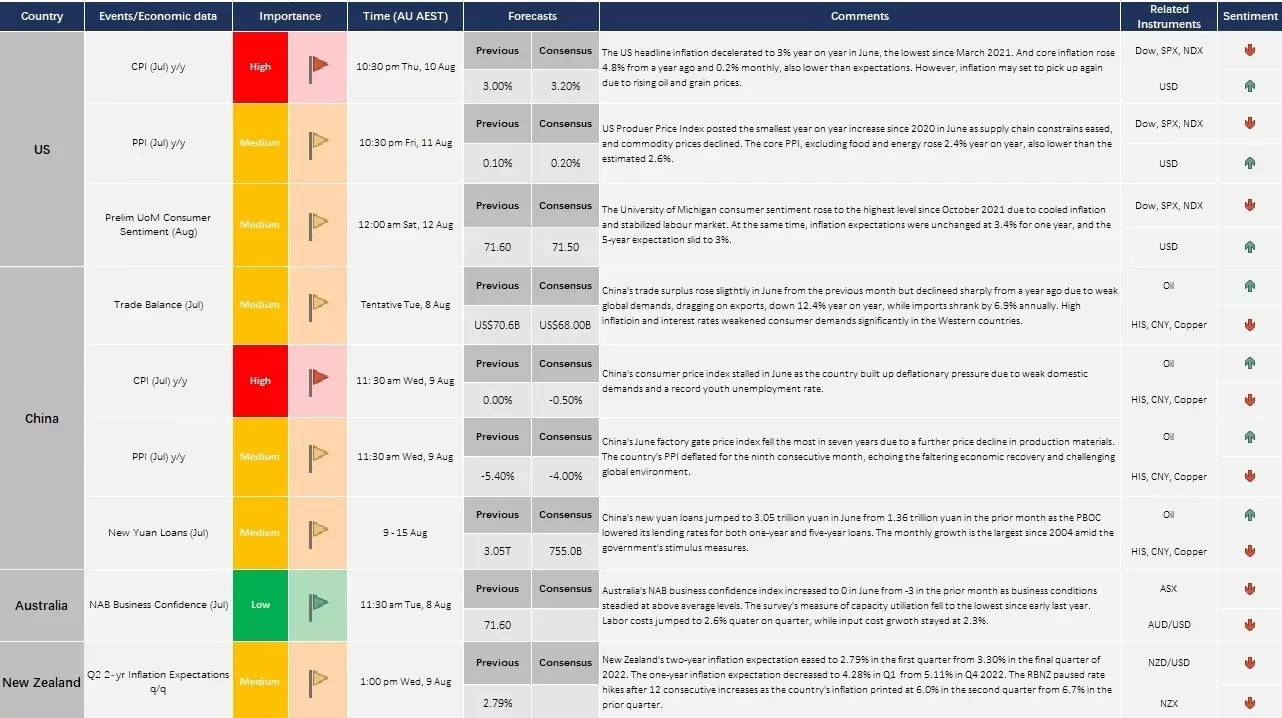

Economic Calendar (7 Aug – 11 Aug)

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.