One of the many questions we faced at the start of this year was whether the equity market gains that we saw in European stocks, from the lows in October, was simply part of a bear market rally, or whether it was the beginning of a move towards new record highs.

Others included how many more rate hikes could we expect to see, and when would rates start to come down again, with markets pricing in rate cuts in the second part of 2023.

While this was never really a realistic proposition, for anyone who's been around in the markets longer than 20 years, the fact that rates have been close to zero for so long had lulled many people into a false sense of security, along with the comfort blanket that central banks would ride to the rescue as soon as the going got tough.

The events of March soon put paid to that idea, with the US Federal Reserve hiking rates again despite the turmoil of the US regional banking crisis. At times its easy to forget how long rates have been as low as they have, and this recency bias has shaped a lot of the narrative in terms of what comes next.

Now with rates back at more normalised levels, we can expect to see further shocks start to play out as the effects of higher rates become more apparent in the coming months, as more and more people come off fixed low mortgage rates, and have to face the reality of more normal rates of interest.

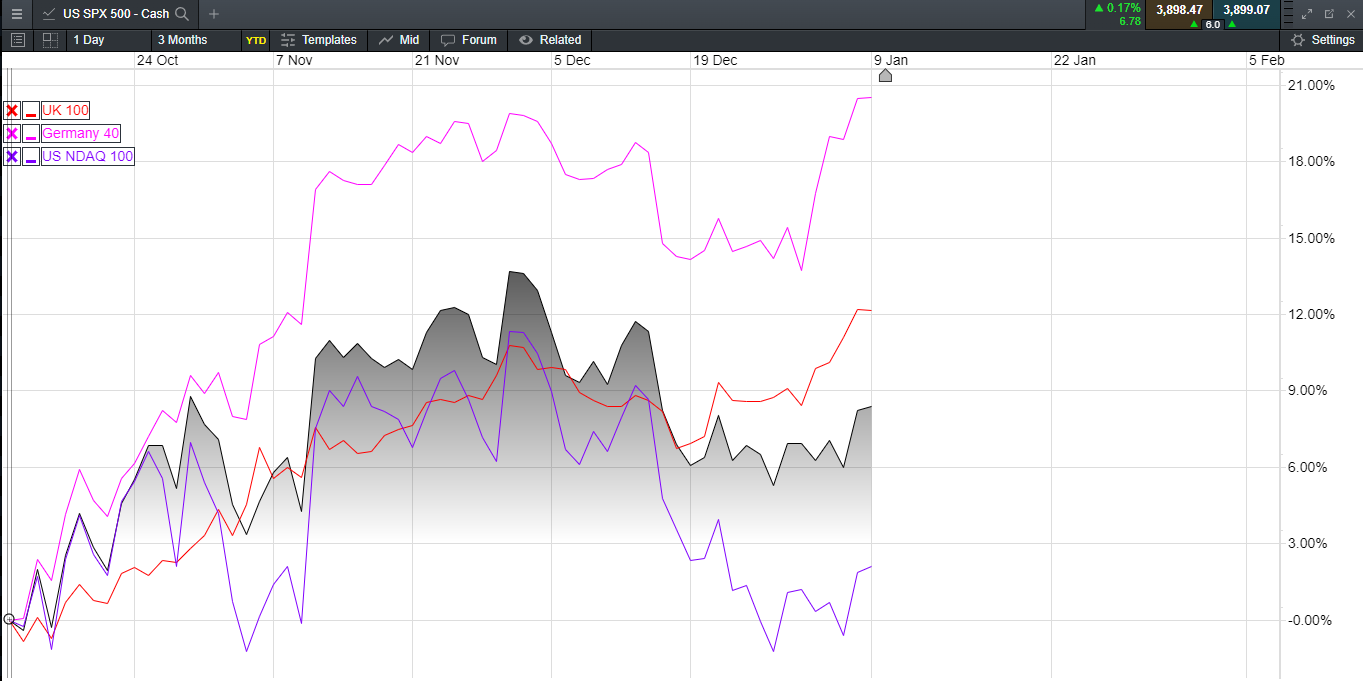

The early days of 2023 saw European markets get off to a flier, with sharply slowing headline inflation in the US, as well sharply slowing PPI inflation fuelling optimism that central bank rate hikes would soon be coming to an end. What was particularly notable was how the rebound off the October lows was led by markets in Europe, with the DAX leading the gainers, while the markets in the US struggled, as illustrated in the chart below.

Equity market performance since October lows to 9 January

Source: CMC Markets

This was expected to continue in 2023 largely due to the calculation that there was more value in European markets than in the US where valuations are, and still much higher. This was based on the premise that having outperformed European markets so much over the last decade with the Nasdaq 100 up over 300%, compared to the DAX which has doubled in value, that now was the time for that gap to start to close. Not unreasonably this reasoning was based on a move from a TINA (There Is No Alternative) world, to a world where money now has a value, with many tech stocks expected to be held to a higher benchmark when it comes to their growth potential.

The expectation was that we would get a situation where the FTSE100 and DAX continue to make new highs, while the S&P500 and Nasdaq 100 continue to struggle with the prospect that we might see a revisit of their October lows in the process, now that there is an alternative in this higher interest rate and inflation environment. As we now know, it hasn’t quite worked out the way we thought, even though we have seen markets in Europe reach new record highs, with the FTSE 100 reaching a new record high above 8,000 in mid-February, the DAX new record highs in May and June and the CAC 40 in April.

While European markets have done well in the first half of this year, the performance of US markets has been even more remarkable, if you look past the performance with the Dow, which has seen little in the way of gains, while the more US focussed Russell 2000 is up by about 3%.

Looking at the performance of the Nasdaq 100 and S&P 500 we see a completely different story, with the Nasdaq 100 up by more than 30%, and the S&P 500 up by over 10%. This is an extraordinary performance for two indices which are geared to the economic cycle, and where the global outlook for growth is slowing.

If you look more closely at what has driven this surge in both the S&P 500 and the Nasdaq 100 the picture is all the more worrying given that the rebound has been driven by a very small cohort of companies which means a failure to deliver on investor expectations could see things turn ugly very quickly.

This is no better illustrated by the graphic below, with strong gains for the likes of Nvidia, Advanced Micro Devices, Meta Platforms and Tesla as investors pile into bets on AI, which has become the latest market darling du jour, following in the footsteps of cryptocurrency and the metaverse.

Nasdaq 100 key movers (2023 year-to-date)

Source: Bloomberg

If we exclude the likes of these big cap movers, which also include Microsoft, Apple, Amazon and Alphabet then we have a classic case of tech bloat when it comes to US markets.

That of course doesn’t mean we can’t go higher given how the current price action looks but it does mean that any change in sentiment could see a sharp correction. The outperformance of US markets has been even more remarkable given that we had to navigate a regional banking crisis during March which caused a sharp pullback.

Looking at the Nasdaq 100 the trend remains clearly higher, as illustrated in the chart below, which broke out of its downtrend in late January (red trendline) and then broke above 12,850, at the end of March, which was the September 2022 and February highs, as well as 38.2% Fibonacci retracement of the entire down move from the record highs in November 2021 to the October lows.

Nasdaq 100 daily chart

Source: CMC Markets

Since the lows in January, we’ve been in a solid uptrend with the 50-day SMA also acting as decent support, so until we break this cycle of higher highs and higher lows, trying to call the top is quite tricky. The same applies to the S&P 500.

If we compare the performance of these two US markets, European markets have stalled in the last few months, despite the new record highs we saw earlier this year. Since April the DAX has traded sideways with solid support around the 15,650 area, and resistance at the recent highs at 16,300.

DAX year to date

Source: CMC Markets

While the DAX has performed reasonably well year to date the FTSE 100 performance has been less so, with a solid Q1 followed by a weak Q2, with the fall in natural gas and crude oil prices prompting weakness in the energy component of the index. The weak nature of the post Covid-19 Chinese economic recovery has also weighed on the basic resource sector as all of the early year optimism about a strong China rebound has given way to worries about deflation and weak consumer confidence.

FTSE 100 year to date

Source: CMC Markets

As we can see from the chart above the FTSE 100 appears to have decent support at the 7,375 area, however the series of lower peaks since the record highs in February does speak to increased uncertainty about the global outlook, and especially demand for commodities.

Looking ahead to the second half of 2023, and the outlook for equity markets more broadly, the same risks that we were concerned about at the start of the year remain as prevalent as ever, with the situation in Eastern Europe continuing to evolve. Recent events in Russia have added a new twist as the invasion of Ukraine continues to generate problems for President Vladimir Putin inviting questions as to whether he can survive, and what sort of Russia might we see if he were to be replaced.

We also have the small matter of the Chinese economy and whether officials there can engineer an increase in demand at a time when parts of Europe are already in recession, with the likelihood that the UK could follow.

Core inflation continues to remain stubbornly high, even as central bankers commit to more rate hikes despite evidence that inflation is coming down sharply already. This commitment to drive down inflation has seen markets finally price out the prospect of rate cuts this year, driving short term rates back towards the highs of the year.

Global markets year to date

Source: CMC Markets

While central bankers around the world have committed to raising rates further to combat sticky core inflation, one central bank has stood apart, namely the Bank of Japan despite core inflation rising to a new 40-year high of 4.3%.

Its policy rate is still negative and yield curve control remains intact. This has helped to drive the Nikkei 225 to its highest levels in 40 years, however at some point we may find that new Bank of Japan governor Kazuo Ueda may have to bow to the inevitable and tweak policy settings by year end. Having said that, given the direction of producer prices in recent months there is a chance that in doing nothing the BoJ may find themselves vindicated if headline inflation continues to fall at the pace that it has been over the last 12 months.

In conclusion, the progress of European markets has stalled in recent months on concern over the number of additional rate hikes, at a time when recession signals in the bond market are flashing red, and inflation is slowing sharply. A break of key support levels as illustrated above could be the catalyst for further weakness, but until then, the outlook for European stocks and stock markets more broadly remains positive.

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.