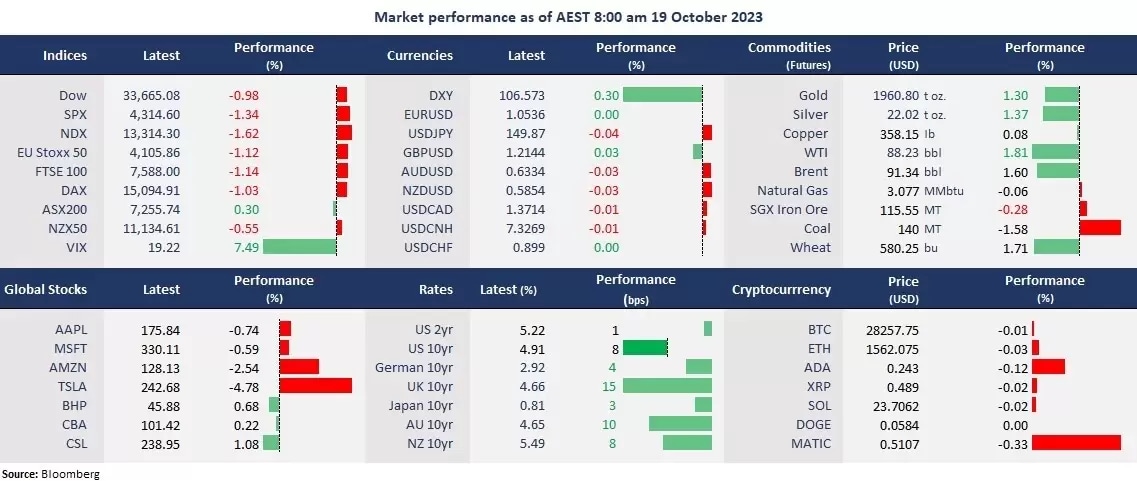

Both the US and EU stock markets fell amid intensifying geopolitical tensions in the Middle East after a deadly hospital blast in Gaza. President Joe Biden said Israel was not behind the attack during his visit. Fears of an escalation of the war lifted haven assets, including gold and the US dollar, pressuring equities and commodity currencies. Crude oil also rose on concerns that Iran’s potential involvement in the war may lead to renewed sanctions on its oil exports. Risk-off dominated the broad sentiment as the VIX jumped 10% to just under 20.

The US 10-year bond yield climbed further, and the US dollar firmed amid risk-aversion sentiment, sending all the other G-10 currencies down. Markets will be awaiting the critical speech by Fed Chair Jerome Powell at the Economic Club of New York later today when the central bank’s boss is expected to tone down on rate hikes.

On the earnings front, Netflix’s third-quarter earnings blew away expectations, thanks to the ad-supported tier’s success, while Tesla missed market estimates due to a sharp decline in its profit margin. Netflix’s shares surged 11%, and Tesla was slightly higher in after-hours trading.

In Asia, China’s third-quarter GDP is stronger than expected, but its property turmoil showed little signs of recovery, with the Hang Seng Index running off a session higher on Wednesday. Asian markets are set to slip amid the war-intensified geopolitical tension. The Nikkei 225 futures fell 1.35%, the ASX 200 futures slumped 1.20%, and Hang Seng Index futures were down 1.1%.

Price movers:

- 9 out of 11 sectors in the S&P 500 finished lower, with Materials and Industrials, leading losses, down 2.58% and 2.43%, respectively. Consumer Staple and Energy were the only sectors that closed in the green, up 0.39% and 0.93, respectively.

- Netflix’s shares soared 11% in after-hours trading on a blown-away earnings beat, primarily due to its ad-supported tier’s success. The streamer added 8.76 million subscribers in the third quarter, well above an estimated 6.2 million. The earnings per share were US$3.73 vs. US$3.49 expected.

- Tesla’s shares were slightly higher in extended trading hours despite a miss on earnings expectations. The EV maker’s gross margin declined to 17.9% from 25% a year ago. The earnings per share were US$0.66, well below an estimated US$0.74. But on a positive note, the production of Cybertruck is on track to be delivered at the end of this year.

- The Australian miner, Whitehaven Coal (ASX: WHC)’s shares soared 12% on the news that BHP agreed to sell two Australian coking mines to the company for US$4.1 billion. The deal is considered to benefit both parties as it will make WHC more cost-effective while helping BHP with its decarbonization mission.

- Gold surged on risk-off sentiment as investors sought safety. Spot gold jumped US$25 per ounce to a two-month high of 1,948, heading off further potential resistance of about 1,970.

- Crude oil rose more than 2% before cutting gains amid escalating Hamas-Israel war. The US inventory data showed stockpiles fell 4.5 million by the week ended 13 October, more than an expected build of 500,000.

Today’s agenda:

- Japan’s trade balance for September

- Australian employment change for September

- Fed Chair Powell’s speech

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.