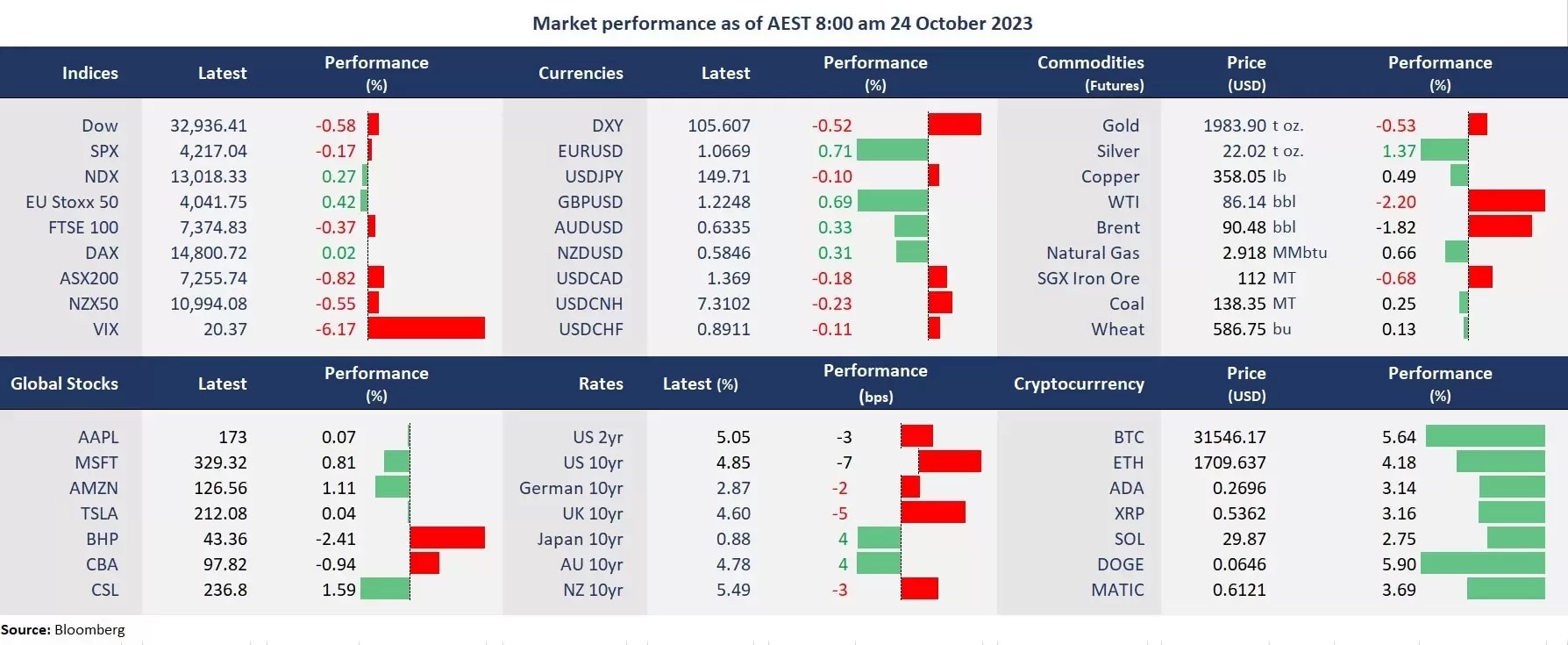

Wall Street finished mixed to kick off the week as the US Treasury yields retreated, lifting tech stocks ahead of major earnings, including Alphabet, Microsoft, Meta Platforms, and Amazon later this week. The tech-heavy index Nasdaq closed higher after a four-day losing streak amid a recovery in risk sentiment. By contrast, oil prices slid, thanks to efforts made to ease the geopolitical tensions in the Middle East. The VIX fell 6% but stayed above 20, suggesting volatility may still be ahead.

At a company level, Chevron’s stocks slumped on a US$53 merger announcement with Hess, while Nvidia’s shares jumped 3.8% after it said to make an Arm-based PC chip. The latter’s stocks surged 5.6% on the news. It appears investors may rotate back to tech stocks after the war-led selloff in risk assets.

Chinese property woes continued to press on its stock markets as the Credit Derivatives Determinations Committees were questioned about credit risks following Country Garden’s default on its coupon payment last month. Futures point to a higher open in Asia. The Nikkei 225 futures rose 0.20%, the ASX 200 futures slumped 0.24%, and Hang Seng Index futures were down 0.12%.

Price movers:

- 8 out of 11 sectors in the S&P 500 finished lower, with Energy and Materials, leading losses, down 1.62% and 1.07%, respectively. By contrast, the growth sectors all closed higher on tech’s comeback, with Consumer Discretionary up 0.21%, Technology rising 0.42%, and Communication Services climbing 0.71%.

- Arm’s stocks jumped more than 5%, and Nvidia’s shares rose 3.9%, following the news that Nvidia was planning to make Arm-based chips for Windows PC. The plan was also involved with Microsoft’s plan to compete with Apple’s MAC, which released its Aim-based chips about three years ago. The announcement challenged the CPU maker, Intel, whose shares fell 3%.

- Chevron’s shares fell 3.7% as the energy firm agreed to buy the oil and gas explorer and producer, Hess for US$53 billion in an all-stock deal, which is the second-largest merger following Exxon Mobil’s US$60 billion acquisition of Pioneer Natural Resources recently. The two oilfield mergers suggest fossil fuel producers sought lucrative markets in the wake of surging oil prices on geopolitical tensions.

- Crude oil futures retreated, given no signs of an escalation in the Hamas-Israel war. Both WTI and Brent futures fell more than 2% and closed just above the 50-day moving average. A breakdown below this level may take oil prices to their October lows.

- Bitcoin topped 31,000 for the first time since July amid optimism toward a potential approval of spot ETF filed by BlackRock. The USD's retreat and recovered risk appetite may have also added to its momentum.

Today’s agenda:

- Australia’s Flash Manufacturing and Services PMIs for October

- BOJ CPI for September

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.