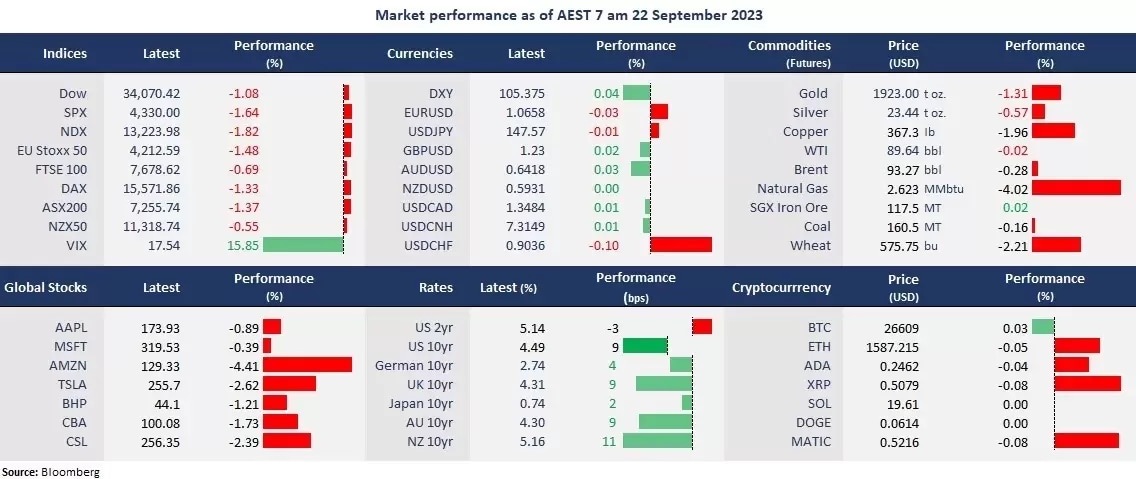

The global stock markets were hit by the Fed’s hawkish stance as government bond yields surged, pressing on equity valuations. Wall Street tumbled amid risk-off sentiment, while the US 10-year Treasury yield soared 14 basis points to 4.5%, the highest since 2007. The selloff was particularly in growth stocks, with the tech-heavy index, Nasdaq, shedding 1.8%, closing below the 100-day moving average for the first time since 13 March. From a technical perspective, the index emerges a potential head-and-shoulder top pattern, indicating increasing selling pressure could be ahead. And the VIX jumped 16% to 17.5 due to prevailing risk-off trades.

In FX, the US dollar index pulled back from a day-high level as the dollar weakened sharply against the Japanese Yen ahead of the BOJ’s policy meeting later today. Markets are awaiting if the bank will further tweak its policy stance on the bond yield curve control. On the other hand, both BOE and SNB kept their policy rates unchanged on economic concerns. Despite sticky inflation in the UK, recession risks overweighed the cost-of-living crisis. The decisions put further pressure on both the British Pound and the Swiss Franc, while the Eurodollar bounced back from a session low.

Asian markets also finished in a sea of red as bond market turmoil spilled over to the APAC region. And futures point to a lower open in Asia, the Nikkei 225 futures fell 1.07%, the ASX 200 futures slid 1.25%, and the Hang Seng Index futures were down 0.48%.

Price movers:

- All 11 sectors in the S&P 500 finished lower, with Real Estate and Consumer Discretionary leading losses, down 3.48% and 2.88%, respectively. All big techs finished lower, with Amazon slumping 4.4%, Nvidia down 2.9%, and Tesla slipping 2.6%. FedEx was the only stock that finished in the red following positive earnings results, up 5% but pulled back from a session high.

- Cisco slipped 4% after the company announced its acquisition of cybersecurity company Splunk Inc. in a deal of about US$28 billion, at US$157 per share, all in cash. The size of the acquisition roughly represents 13% of Cisco’s market value, and is expected to close the deal by the end of the third quarter. Splunk’s shares soared more than 20% amid the news.

- Microsoft’s shares held up despite the broad selloff as the tech giant unveiled its new Surface computers and a new version of Windows 11 embedded Copilot AI assistant. It starts offering Microsoft 365 Copilot tools to enterprise customers on 1 November.

- USD/JPY slipped to below 148 ahead of the BOJ meeting later today. The drop may suggest that traders increased their bets on the central bank to give more hawkish tweaks to its monetary policy. The bank is not expected to change the policy rate but may lift the cap further on the 10-year government bond yield, which has already reached 0.74, the highest since December 2013.

- Crude oil bounced off a session low after Russia banned diesel export, which included gasoline. The action reversed a downside movement in crude markets following the hawkish Fed decision on Thursday. However, mounting fears of a recession in the Eurozone could continue pressuring oil prices.

ASX and NZX announcements/news:

- No major announcement.

Today’s agenda:

- New Zealand Trade Balance for August

- Australian Flash Manufacturing and Services PMIs for September

- Japan’s Core CPI for August

- BOJ Policy Meeting

Maximize your potential gains! Take immediate action and seize the investment opportunities that await you. Login to the platform now!

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.