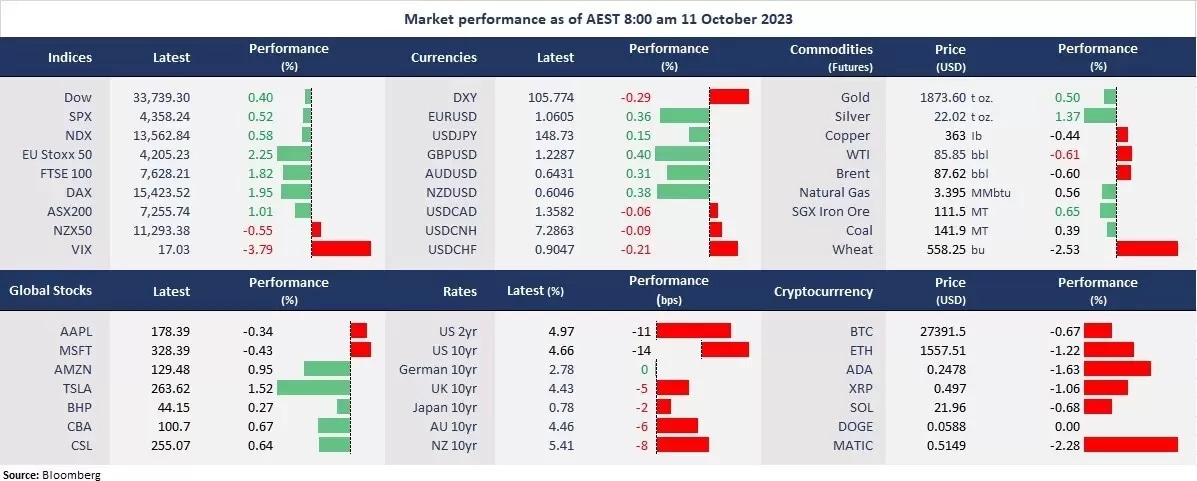

Wall Street continued to rally as the US government bond yields sharply retreated following Fed official’s comments that the interest rates are peaking. The ongoing Hamas-Israel war may have also pushed down bond yields as investors sought haven assets. The US 10-year and 2-year bond yields fell 15 and 12 basis points, respectively, taking pressure off the equity markets as the CME’s Fed Funds Futures are pricing in no more rate hikes by the Fed. The probability of a rate hike pause rose to nearly 90% from 53% a month ago. The upcoming US September CPI data tonight can be critical for further clues of the Fed’s policy path.

Technology stocks saw a swift rebound ahead of the quarter earnings reports in October after a two-month slump amid bond jitters. Consumer sectors outperformed after PepsiCo. reported the third-quarter earnings that topped Wall Street’s expectations.

Crude oil prices slipped after the one-day surge, suggesting traders were re-assessing the Middle East geopolitical risks. Gold futures were higher as the US dollar index continued to retreat from the recent high.

In Asia, the Chinese stock markets are set to jump amid news that the government is considering raising its budget deficit for 2023, weighing on 1 trillion Yuan debt issuance to aid the economy in achieving its growth goal. Futures point to a higher open across Asia. The Nikkei 225 futures were up 0.14%, the ASX 200 futures rose 0.52%, and Hang Seng Index futures were up 1.49%.

- 10 out of 11 sectors in the S&P 500 finished higher, with Utility leading gains, up 1.36%. Consumer Staples, Consumer Discretionary, and Industrials were also strong, all up more than 1%. Energy is the only sector that ended in the red due to a slide in oil prices.

- Birkenstock is set to price IPO at between US$44 and US$49, valuing the company at roughly US9.2 billion. The company is seeking to sell about 32 million shares and raise US1.25 billion.

- PepsiCo’s shares rose 2% due to a beat on earnings expectations. The beverage giant’s earnings per share were US$2.25, beating an estimated US$2.15. Revenue came to US23.45 billion, topping the expected US$23.39 billion. The company raised the full-year guidance to a 13% growth in earnings per share from the previous forecast of 12%.

- Amazon’s shares rose 1% as Prime Big Deal Days kicked off, which is a two-day event when Amazon offers its members new deals every few minutes ahead of the Christmas Holiday. But the July Prime Day is considered the largest sales day in history, with its online sales hitting US$12.7 billion, according to Adobe Analytics.

- Crude oil dipped 0.5% as traders were awaiting further development in the Hamas-Israel war that potentially sparked tightened supply in the Middle East. Iran’s potential involvement in the conflict and the international impact on its production is key to steering the oil market movements.

ASX and NZX announcements/news:

- No major announcement.

Today’s agenda:

- New Zealand Visitor Arrivals for August

- RBA Assist Governor Kent Speaks

- Chinese New Yuan Loans and M2 Money Supply for September

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.