Wall Street finished higher, with Nasdaq posting back-to-back gains as tech stocks gained momentum amid the earnings optimism. Coca-Cola’s shares rose 3% as the third-quarter earnings beat both the top and bottom lines. Microsoft’s stocks jumped 4%, while Alphabet’s stocks dropped 6.5% in after-hours trading following the respect earnings results. Microsoft’s cloud-computing segment, Azure’s growth accelerated, while Alphabet’s Google Cloud reported lower-than-expected revenue. The US earnings season is painting a mixed picture so far, but investors’ focus remains on AI development, which is usually tech companies’ bottom line. Meta Platform and Amazon will be due for earnings release tomorrow and Friday.

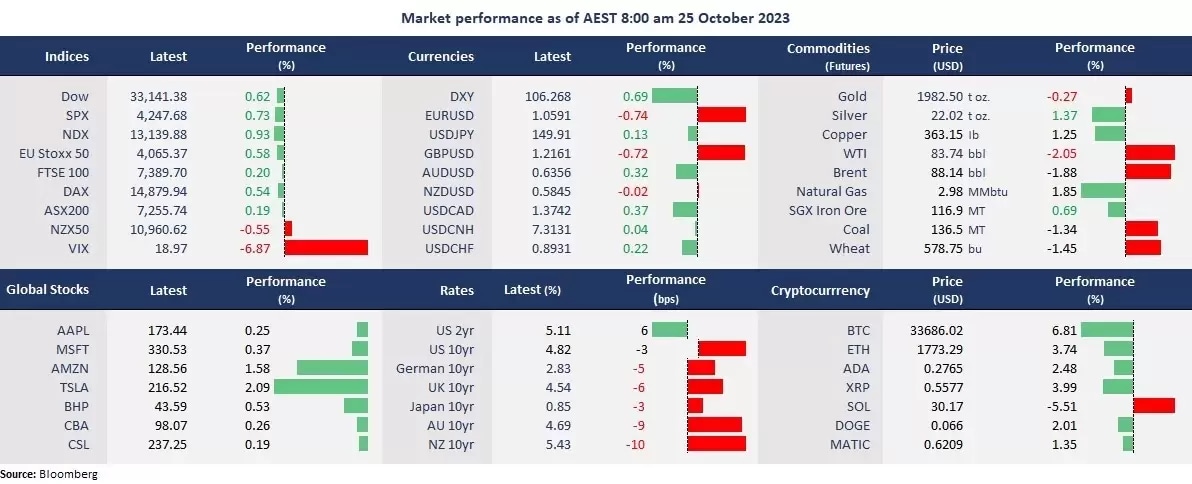

The US bond yields stabilized, and the VIX retreated, lifting risk-on sentiment. The US dollar index was higher due to a sharp decline in the Eurodollar following disappointing Eurozone PMI data, highlighting recessionary risks for the region. By contrast, the US Flash Manufacturing and Services PMI returned to expansion, buoying the king dollar. Gold was slightly lower, while crude fell for the second straight trading day.

China issues additional sovereign debt to aid the stumbling economy in the wake of its property woes. The Chinese stock markets jumped on the news, with the Hang Seng index futures jumping 2.8%, pointing to a higher open today. ASX 200 futures were up 0.29%, and Nikkei 200 futures rose 0.64%. Australia’s third-quarter CPI will be in the spotlight on moving the ASX and the Australian dollar. Markets expect the data to rise slightly from the second quarter, which may prompt the RBA to keep the OCR at a high level for longer.

Price movers:

- 10 out of 11 sectors in the S&P 500 finished higher, with Utility, leading losses, up 2.57%. Energy was the only sector that finished in the green, down 1.42%, due to a slump in oil prices.

- Coca-Cola’s shares jumped 3% following stronger-than-expected earnings results. The soft-drink beverage giant beat expectations on both the top and bottom lines in the third quarter as sales ramped up despite price hikes. The company raised its full-year guidance for the adjusted EPS to between 7% and 8% year-on-year growth.

- Micorosft’s shares jumped 4% in the after-hours trading as its cloud segment Azure’s growth strongly beat earnings expectations, lifting the company’s net income to rise 27% year on year. The company’s revenue came to US$56.52 billion, up 13% from a year ago, the highest since Q3 FY22.

- Alphabet’s shares dropped 6.5% in the after-hours trading due to disappointing Google Cloud’s revenue, which was up 22% year on year, a sharp slowdown from 28% in the second quarter, and 38% in the same quarter last year.

- Crude oil fell for the second straight trading day, with Brent futures falling below US$90 per barrel as war-led fears receded. Increasing US shale oil production and economic uncertainties again became the bearish factor.

- Bitcoin topped 34,000 before pulling back to about 33,500, buoyed by a court ruling, which potentially cleared the final hurdle in an application of BlackRock’s spot ETF.Coinbase’s shares jumped 6%.

Today’s agenda:

- Australia’s Q3 CPI

- BOC Rate Decision

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.