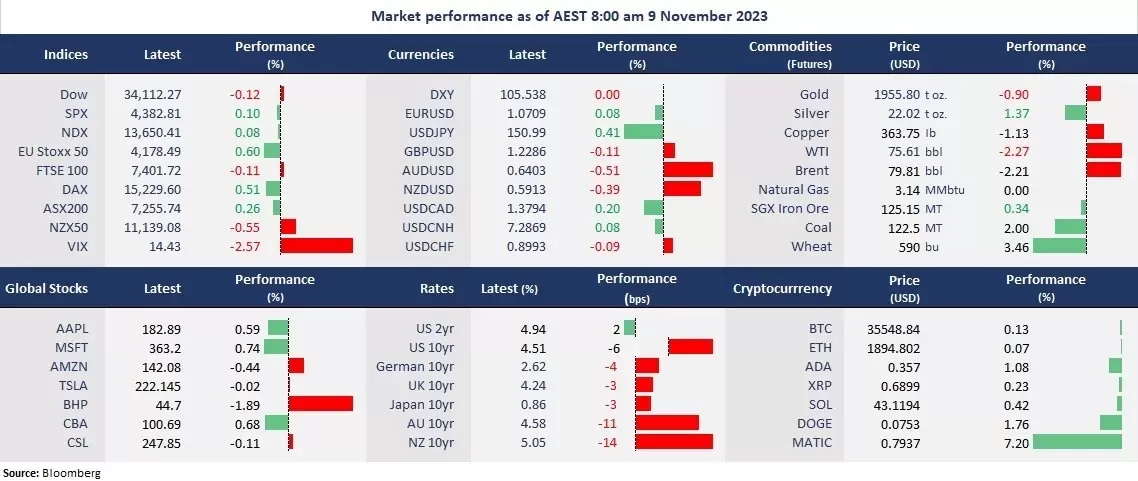

The Wall Street rally lost steam as the tech-led rebound slowed, with the energy sector continuing to lag. Here are the headlines:

- The Wall Street rally lost steam as the tech-led rebound slowed, and energy continued lagging

- Long-dated US bond yields fell after a US$40bn auction, with the 30-year Treasury yield slumping to a month-low

- The US dollar was slightly higher, while Asian currencies weakened amid ongoing China’s property woes

- USD/JPY reclaimed 151, which may spark intervention bets again

- Crude oil deepened losses on economic concerns. WTI and Brent futures fell off the 200-day moving averages at a fresh three-month low

- Gold extended a three-day losing streak, testing key support as haven demands abated

- Asian stock markets are set to open slightly higher. ASX 200 futures were up 0.38%, and Hang Seng Index futures rose 0.19%

Chart of the day

Gold, daily

Company news

- Disney (NYSE: DIS) rose 2% in after-hours trading following Q3 earnings result. The entertainment giant beat EPS expectations but missed revenue estimates. Disney+ subscribers saw higher than expected growth of 150.2 million...

- Robinhood (NDX: HOOD) tumbled 15% due to a miss on earnings expectations. Its third-quarter revenue fell short of market’s prediction due to reduced trading volume.

- Rivian (NDX: RIVN) cut early gains and finished flat following an earnings beat. The EV maker upgraded its full-year guidance to 54,000 vehicles from 52,000 vehicles.

- Roblox (NYSE: RBLX) soared 12% following the strong quarterly earnings report. The gaming platform’s third-quarter bookings and revenue far exceeded expectations.

ASX corporate actions

- VEA is set to launch the Investor Day.

- XRO is due to report S1 2024 earnings.

- WBC is on Dividend Ex. US$0.72. Pay Date: 19/12/23

Today’s agenda

- Japanese Current Account for September

- China’s PPI and CPI for October

- US Unemployment Claims

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.