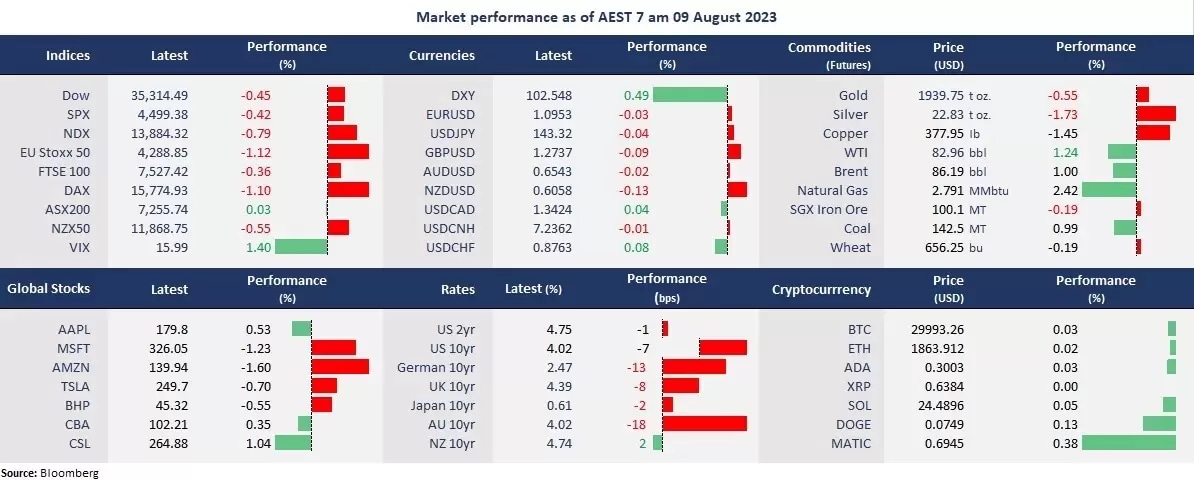

US stocks fell after Moody’s Investors Service cut its ratings for 10 small and midsize banks and put other major lenders under review for a potential downgrade. Coincidentally, European stock markets sank following a surprising 40% windfall tax on Italian banks. The banking sector woes weighed on sentiment and led to a negative close in both the US and EU markets. The selloff may extend the market’s downtrend following Fitch’s US credit downgrade last week. Moody said higher funding costs, potential regulatory capital weaknesses, and risks tied to commercial real estate mount.

Risk-off prevailed in the broader markets as bonds rose on sliding yields, and the US dollar strengthened ahead of the US CPI data on Thursday. In commodities, crude prices continued to rise on supply concerns, but gold fell due to a strong USD.

In Asia, China’s disappointing trade balance data pressured the regional stock markets on Tuesday. The country’s CPI and PPI data will be on close watch today. New Zealand will report its second-quarter inflation expectations, providing clues to the RBNZ’s policy path. Australia’s largest bank, CBA’s full-year net profits, meet expectations with a narrowed margin, which may weigh on the ASX open.

Futures point to a lower open across the APAC region, with Nikkei 225 futures flat, the ASX 200 futures down 0.07%, and the Hang Seng Index futures down 0.29%.

Price movers:

- 8 out of 11 sectors finished lower in the S&P 500, with Materials leading losses, down 1.05%. The growth sectors, including Technology, Communication Services, and Consumer Discretionary, all ended in the red. At the same time, the defensive sectors, such as Healthcare and Utilities, outperformed, up 0.78% and 0.49%, respectively. Energy stocks also finished higher due to rising oil prices.

- Amazon will hold a second Prime Day sale in October, aiming to boost spending ahead of Christmas and New Year holidays. Its July Prime Day pumped sales up by 6.1% to US$12.7 billion. Amazon’s shares jumped 10% following a strong second-quarter earnings report last week.

- Novo Nordisk A/S and Eli Lily’s shares soared 17% and 15%, respectively, amid the weight loss drug’s success. Eli Lilly’s shares hit a record high after the company reported a surge in sales of its diabetes drug Mounjaro. And the Danish drugmaker, Novo Nordisk’s stocks also hit a record high after a clinical trial showed that its obesity drug Wegovy reduced the risk of heart attacks or strokes by 20%.

- Bitcoin posted the best one-day rally in three weeks following Moody’s downgrade on the US banks, as Cryptocurrencies are seen as hedging assets to Fiat’s risks. The largest digital coin rose about 2.8% in the last 24 hours to just under 30,000, the highest in two weeks. Bitcoin held above near-term support of the 50-day moving average of about 29,000 and may approach its year-high of 31,500 from a technical perspective.

ASX and NZX announcements/news:

- Commonwealth Bank of Australia (ASX: CBA) reported the 2023 full-year result. Its net profit rose 5% year on year to A$10.19 billion but down 5% from 1H 2023, while its profit margin narrowed to 2.07%, up 17 basis points annually but down 5 basis points from 1H 2023. The profit growth was supported by net interest income, offsetting higher loan impairment expenses and operating costs. Household deposits were seen a drop below the system level. The bank also announced its full-year dividend of A$4.5, fully franked, up 17% from FY22.

- Suncorp Group Ltd. (ASX: SUN)’s FY23 net profit rose 68.6% to A$1.15 billion, with cash earnings up 86.3% to A$1.25 billion. The insurer declared a dividend of fully franked A$0.27 or 60% of the payout ratio for FY23.

- Briscoe Group Ltd. (NZX/ASX: BGP) announces unaudited sales for the half-year to July 2023 of NZ$369.2 million, up 0.35% from a year ago.

Today’s agenda:

- China’s CPI & PPI for July.

- New Zealand’s Q2 inflation expectations.

Maximize your potential gains! Take immediate action and seize the investment opportunities that await you. Login to the platform now!

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.