Welcome to Michael Kramer’s pick of the top three market events to look out for in the week ahead.

US markets will return to trading after Thanksgiving with plenty of economic data to push prices around, including the US jobs report and a pair of US purchasing managers’ index (PMI) prints. Prices are expected to be particularly volatile ahead of the next Federal Reserve meeting, about two weeks away, with markets split on whether another rate cut is coming in December. Currently, the overnight swaps market is pricing in about a 60% chance of a 25-bps cut rate in December.

ISM manufacturing and services report

Monday 2 December (manufacturing) and Wednesday 4 December (services)

The US Institute of Supply Management (ISM) is set to release two key PMI readings this week, with manufacturing data on Monday morning, and services data on Wednesday. ISM manufacturing data has been in contraction territory for some time but is expected to rise closer to the 50 mark which signals expansion, by climbing to 48 from 46.5 during November. Meanwhile, services reached its strongest reading since August 2022 in October at 56, but is forecast to slip to 55.4 in November.

Robust figures could start tipping the scales towards no rate cut in December, which could push interest rates up and strengthen the US dollar. EUR/USD has been the weakest link, and is currently trying to find some support, with a potential double bottom on the relative strength index (RSI), but it is struggling to surpass the 10-day exponential moving average (EMA). If the pair can exceed the 10-day EMA, it could target $1.068, but the momentum appears to favour further downside potential, with a possible revisit of 22 November lows.

EUR/USD, March 2023 - present

Salesforce Q3 earnings

Tuesday 3 December

Salesforce’s earnings are forecast to rise by 15.7% year-on-year to $2.44 per share in Q3, with revenue growing 7.2% to $9.3bn. For Q4, analysts expect the company to guide sales to $10bn, a growth rate of 8.3% year-on-year, with earnings climbing 15.7% to $2.65 per share. The options-based implied move is for the stock to rise or fall by 7.2%.

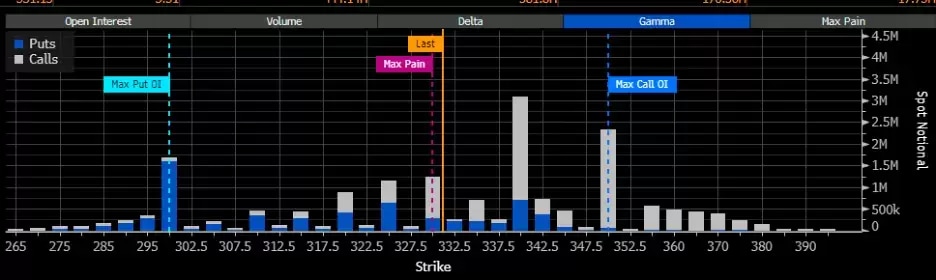

The options positioning suggests bullish sentiment, with traders betting on the upside. This is evidenced by a significant level of call gamma at $340 and $350, which may act as resistance. Meanwhile, support does not appear until $300, where the put wall is located.

Salesforce options positions chart

The technical chart concurs, indicating that resistance hovers around $350. This suggests that inline results from the company may not be sufficient to propel the shares higher, while the 10-day EMA has been serving as support. The stock is currently testing that support, and a definitive break below this level heading into the results could lead to the stock filling a gap at $300, as potentially dissatisfied call option holders unwind their positions.

Salesforce, July 2024 - present

US jobs report

Friday 6 December

Analysts estimate that the US economy added 200,000 non-farm payroll jobs in November, up from just 12,000 in October, while the unemployment rate is anticipated to rise to 4.2% versus last month’s 4.1%. Wage growth is expected to slip to 0.3% month-on-month from 0.4%, and to 3.9% year-on-year from 4.0%.

This report could tip the scale for or against a December rate cut, with the following week’s consumer price index (CPI) report being a potential deciding factor. A strong report would be bullish for the dollar against most currencies apart from USD/JPY. This is because the Bank of Japan may raise rates in December, which could supersede any US economic data, especially if the odds for a rate hike increase from the current 60%.

Nerves are already heightened as USD/JPY has already broken an uptrend, and the RSI shows a significant shift in momentum has taken place. A breach of support at ¥151 could set up a return towards ¥148.50.

USD/JPY, July 2024 - present

Key economic and company events

The coming week’s major economic announcements and scheduled US and UK company reports include:

Monday 2 December

• Australia: October retail sales data

• China: November Caixin manufacturing PMI

• Eurozone: Manufacturing PMI

• UK: November Nationwide house prices, manufacturing PMI

• US: November ISM manufacturing PMI

• Results: Zscaler (Q1)

Tuesday 3 December

• UK: November UK retail sales

• Results: Marvell (Q3), Salesforce (Q3), SSP Group (Q4)

Wednesday 4 December

• Australia: Q3 gross domestic product (GDP)

• China: November Caixin services PMI

• Eurozone: Speech from European Central Bank president Christine Lagarde

• UK: Services PMI, Speech from Bank of England governor Andrew Bailey

• US: November ISM services PMI, Fed Beige Book

• Results: Ixico (FY), Marston’s (FY), Paragon Banking Group (FY), Synopsys (Q4)

Thursday 5 December

• Eurozone: October retail sales data

• US: October trade balance

• Results: AJ Bell (FY), American Outdoor Brands (Q2), Brown-Forman Corp (Q2), DocuSign (Q3), Dollar General Corp (Q3), DS Smith (HY), Frasers Group (HY), Hewlett Packard, Enterprise (Q4), Kroger (Q3), Lululemon (Q3), Tillys (Q3), Ulta Beauty (Q3)

Friday 6 December

• Eurozone: Q3 GDP

• US: November non-farm payrolls, unemployment rate

• Results: Berkeley Group (HY), Schroder European Real Estate Investment Trust (FY)

Note: While we check all dates carefully to ensure that they are correct at the time of writing, the above announcements are subject to change.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.