Both US CPI and PPI cooled for the tenth consecutive month, but both are still above the central bank’s target level of 2%. The data may be enough to convince the Fed to pause rate hikes in its June meeting, but it is not likely for the bank to start a rate cut cycle just yet.

The recent banking crisis added worries that a potential credit crunch might lead the US economy into an economic downturn, as rising rates, high inflation, and weakened growth are pointing to stagflation economic dynamics. In such a cycle, the best investment destination that we could be looking at is those assets that may have a better chance to hold value, or what we can call “defensive assets”.

Gold and gold ETFs

Gold can be considered one of the typical safe-haven assets that defend against an economic downturn or a recession. Unlike stocks, gold’s valuation does not depend on a company’s growth prospect. It has an intrinsic worth that makes it desirable in times of financial or political instability. Gold also remains relatively stable over longer periods of time when compared with currencies, as this makes it an attractive hedge against inflation and currency devaluation. Additionally, a drop in the USD can increase the price of gold, as this makes it cheaper to buy gold in other currencies. Gold has been historically used as a store of wealth and remains one of the most popular assets for investors to hold. The below chart illustrates that gold prices went up while the S&P 500 crashed during an economic recession in 2000, 2008, and 2020.

In addition, gold Exchange Traded Funds (ETFs) could be good choices for investors as they usually trace the price of gold on the markets. A gold ETF invests in physical gold, meaning that the investor owns actual gold held by the fund. Gold ETFs can be attractive investments because they provide a low-cost way to buy physical gold and have no storage costs associated with them since the fund holds all of the gold in its portfolio. The most popular gold ETFs include SPDR Gold Trust (GLD), iShares COMEX Gold Trust (IAU), and Aberdeen Standard Physical Swiss Gold Shares ETF (SGOL), which are traded on major stock exchanges, like the NYSE or NASDAQ, and can be bought and sold just like any other stock.

Mega-cap tech stocks and defensive sectors

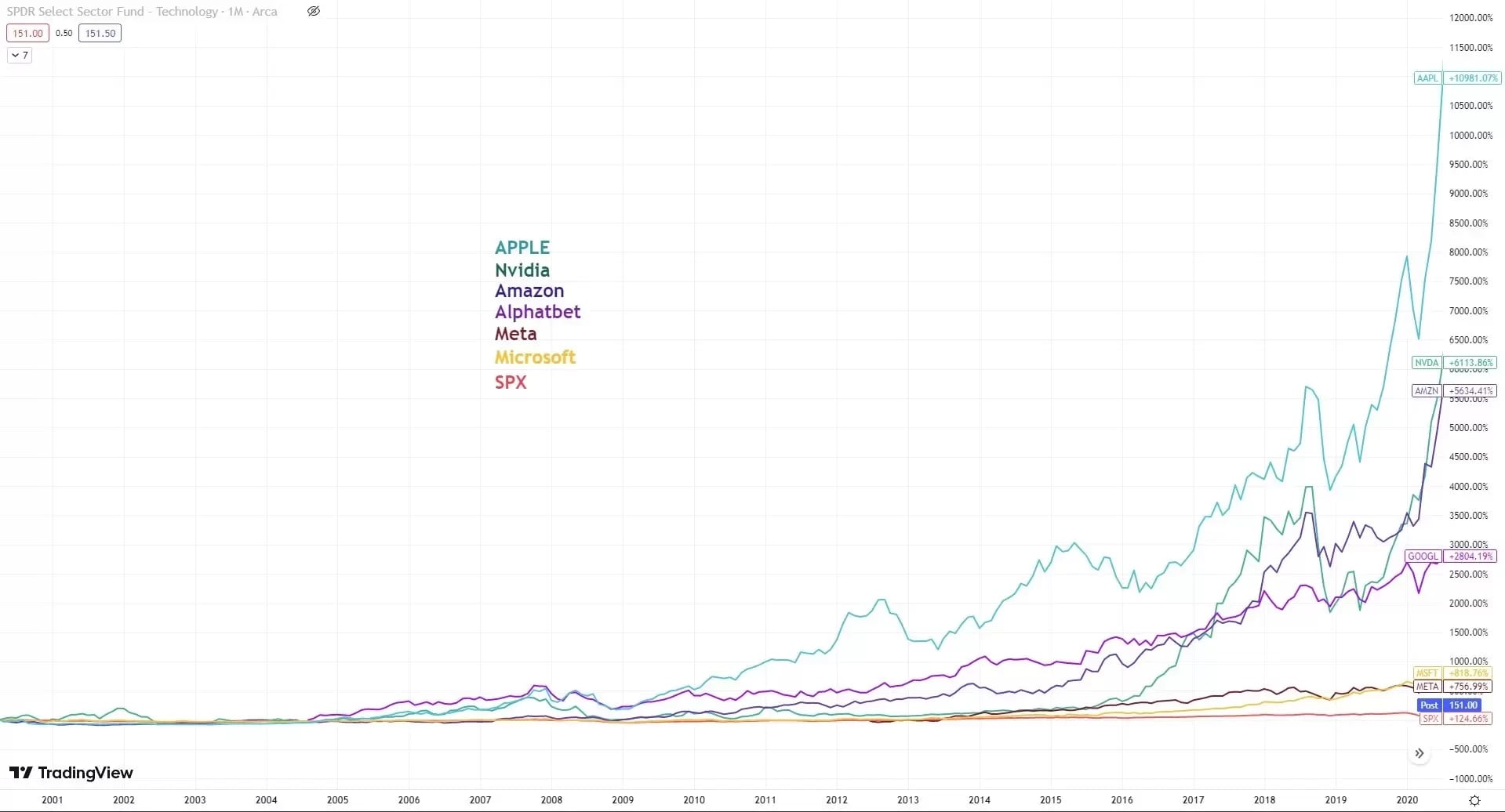

I know it may be tricky, but US mega-cap tech stocks, such as Apple, Amazon, and Microsoft, have been seen as recession-proof investments due to their strong balance sheet and healthy cash flow. They tend to be able to weather economic downturns better than debt-burdened companies.

In addition, mega-cap techs have advanced technology, a large consumer base, and high pricing power, which makes them less vulnerable to economic woes. They are usually able to continue dividend payout even when other sectors suffer from weakened demands. These tech giants experienced only a 1.4% loss in stock prices during the Great Recession of 2008-09, compared to a 26.7% average loss for stocks from other sectors.

The below chart shows that mega-cap tech stocks have been long outperforming the S&P 500 since the 2000 internet bubble crisis, with Apple’s share up more than 10,000%. Hence, mega tech shares can also be considered inflation-bearing investments.

Apart from big tech stocks, the defensive stock sectors, such as utilities, consumer staples, and healthcare, are often considered more stable and resilient during an economic downturn. These stocks usually pay out higher dividends and have a consistent demand so that they can act as a hedge against market downturns. Investors should also look for companies with strong balance sheets and good cash flow to ensure that the company is able to remain profitable during difficult times. Or you may consider the ETFs that concentrate on defensive stocks, such as Utilities Select Sector SPRD Funds ETFs (XLU), Consumer Staples Select Sector SPDR ETFs (XLP), and Health Care Select Sector SPRD ETFs (XLV). In the past 5 years, the three sectors were among the top performers in the S&P 500, as indicated in the below chart.

Japanese Yen

Japanese Yen has long been long regarded as a haven currency due to the exchange rate stability during an economic downturn. Its low volatility also makes it a popular choice for currency hedging strategies.

Two main reasons that make Yen a safe destination. Firstly, the Bank of Japan has been maintaining low-interest rates for many years, which makes it very attractive for borrowers to fund their investments. During an economic downturn, investors tend to sell risky assets and buy back the Japanese Yen, which drives up its value. Secondly, the Japanese government’s current account is in surplus most of the time. This is largely due to Japanese exports often exceeding their imports, which causes the Japanese Yen to be in high demand.

The below chart indicates that Yen apricated against the USD during a stock market downturn or crisis time, with these trends illustrating during the 2008 GFC, the Chinese stock crash in 2015, the US-China trade war in 2018, and the pandemic in 2020.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.