Welcome to Michael Kramer’s pick of the top three market events to look out for in the week ahead.

The market is about to enter what should be one of its quietest weeks of the year ahead of the US Labor Day weekend. Trading volumes across the S&P 500 futures have been light since the 5 August low, which could be a factor in the rapid equity market rebound.

US election update

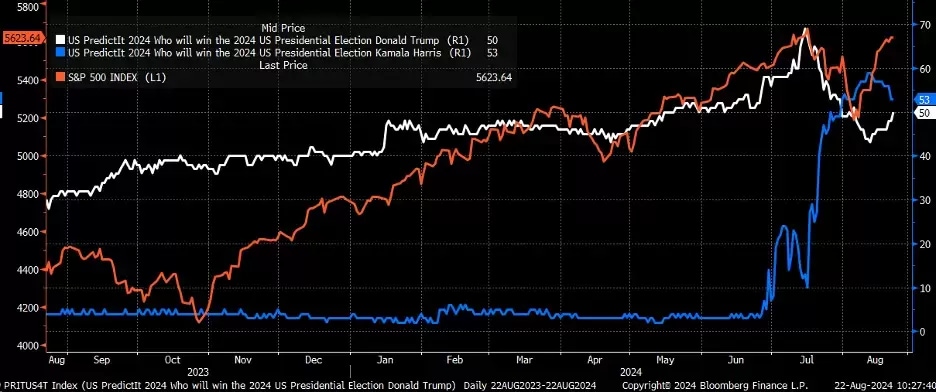

This past week, former president Donald Trump’s odds rose in the betting markets, closing the gap with vice-president Kamala Harris. At one point, markets seemed to rise in anticipation of a Trump victory, but that correlation has decoupled since the beginning of August. Given the recent gains in the stock market compared to the polls, it is now unclear whether the market is even focused on the election; that may change in September.

US election poll tracker, August 2023 - present

Nvidia Q2 earnings

Wednesday 28 August

Nvidia is expected to report that earnings and revenue more than doubled in the fiscal second quarter of 2025 to $0.64 a share and $28.7bn, respectively. Adjusted gross margins are anticipated to have risen to 75.5% for the quarter. Investors will closely watch the guidance for Q3, with revenue expected to reach $31.7bn, adjusted gross margins at 75%, and earnings of $0.71 per share. The options market is pricing in a 9% post-earnings move in the company's share price.

Implied volatility levels are very high for options expiring on 30 August, with call demand outweighing put demand. This potentially sets up a bearish catalyst for the stock if the results do not meet investors' high expectations.

Nvidia shares have climbed back to the 78.6% Fibonacci retracement level of the decline between 20 July and 5 August, which has acted as resistance for a few days. A push above resistance at $130 could propel the Nasdaq-listed stock to new highs, as there is little resistance from an options perspective or a technical standpoint. However, given the high expectations set by the massive beats over the past year, anything less than stellar could lead to a rapid decline in the share price, potentially returning it to those 5 August lows.

Nvidia share price, April 2024 - present

Germany August CPI

Thursday 29 August

Germany's preliminary August consumer price index (CPI) report will be followed by the eurozone CPI report on Friday, and is expected to show a continued disinflation trend, bringing the country’s inflation back to around 2%, following last month’s 2.3% year-on-year reading and an EU-harmonised reading of 2.6%. If the report comes with no surprises, it probably means that the eurozone report the next day shouldn’t offer many surprises.

EUR/USD has broken above crucial resistance around $1.11 and is now overbought, trading above the upper Bollinger Band with a relative strength index (RSI) above 70. The pair is now consolidating around $1.11, which is now support; a break of this level could lead to a decline towards $1.09.

EUR/USD, January 2023 - present

US July PCE price index

Friday 30 August

The July personal consumption expenditures (PCE) price index reading is expected to show an increase of 0.2% month-on-month, up from 0.1% in June, and a year-on-year rise of 2.6%, up from 2.5%. Meanwhile, core PCE is anticipated to have risen by 0.2% month-on-month in July, consistent with the previous month’s increase, though the year-on-year figure is expected to decrease slightly from 2.7% to 2.6%. With the market pricing in rate cuts from the US Federal Reserve between now and December, any weaker-than-expected data could result in another rate cut being priced in for early 2025.

This could benefit GBP/USD even further, as the Bank of England is expected to cut rates just once more in 2024. Although cable is currently overbought, a consolidation ahead of the PCE report could lead to another move higher, especially since GBP/USD is testing resistance around $1.32. A breakout could send it towards $1.34.

GBP/USD, July 2021 - present

Key economic and company events

Here’s our rundown of notable economic announcements and company reports scheduled for the coming week:

Monday

• Results: PDD Holdings (Q2)

Tuesday

• Germany: Q2 gross domestic product (GDP)

• US: August consumer confidence index

Wednesday

• Australia: July consumer price index (CPI)

• Results: CrowdStrike (Q2), Faron Pharmaceuticals (HY), HP (Q3), Naked Wines (FY), Nvidia (Q2), PensionBee (HY), Salesforce (Q2)

Thursday

• Eurozone: August consumer confidence index

• Germany: August CPI

• Japan: August Tokyo CPI

• US: Q2 GDP, initial jobless claims to 23 August

• Results: Autodesk (Q2), Dell (Q2), Lululemon (Q2), Marvell Technology (Q2)

Friday

• Eurozone: August CPI

• Germany: July retail sales

• US: July personal consumption expenditures (PCE) price index

Note: While we check all dates carefully to ensure that they are correct at the time of writing, the above announcements are subject to change.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.