Meta Platforms medium-term technical analysis chart

The recent rally of 18% seen in the share price of Meta Platforms (META), the parent company of Facebook, from its 28 July 2022 low post-Q2 earnings announcement has reached a potential roadblock at a 186.20 key medium-term resistance.

(18 August 2022, 2:40pm SGT)

Source: CMC Markets & TradingView

Integrated technical analysis (graphical, momentum, Elliot Wave/fractals) suggests that META now faces the risk of a drop to retest its 23 June 2022 low and even the possibility of shaping a lower low after that.

Key levels (1-3 months/META)

Pivot (key resistance): 186.20

Supports: 153.10 & 137.10/132.55

Next resistance: 236.80/248.00

Directional bas (1-3 months/META)

Bearish bias below 186.20 key medium-term pivotal resistance for a potential drop to retest the 23 June 2022 swing low areaof 153.10, and a break below it may see a further slide towards a key major support area of 137.10/132.55.

On the flip side, a clearance with a daily close above 186.20 invalidates the bearish tone for a significant corrective rebound towards the next resistance zone of 236.80/248.00 (also the 200-day moving average & the 38.2% Fibonacci retracement of the major downtrend from 1 September 2021 all-time high to 23 June 2022 low).

Key elements (META)

- Since 5 April 2022, the price actions of META have started to oscillate within a three-month plus bullish reversal “Descending Wedge” configuration. Elliot Wave/fractal analysis suggests that META has potential room to shape a residual down move sequence towards 137.10/132.55 (also the lower boundary of the “Descending Wedge”) before a more significant corrective rebound takes shape in terms of magnitude and duration.

- The daily RSI oscillator has again staged a retreat from a corresponding key resistance at the 59% level, suggesting that medium-term downside momentum has resurfaced.

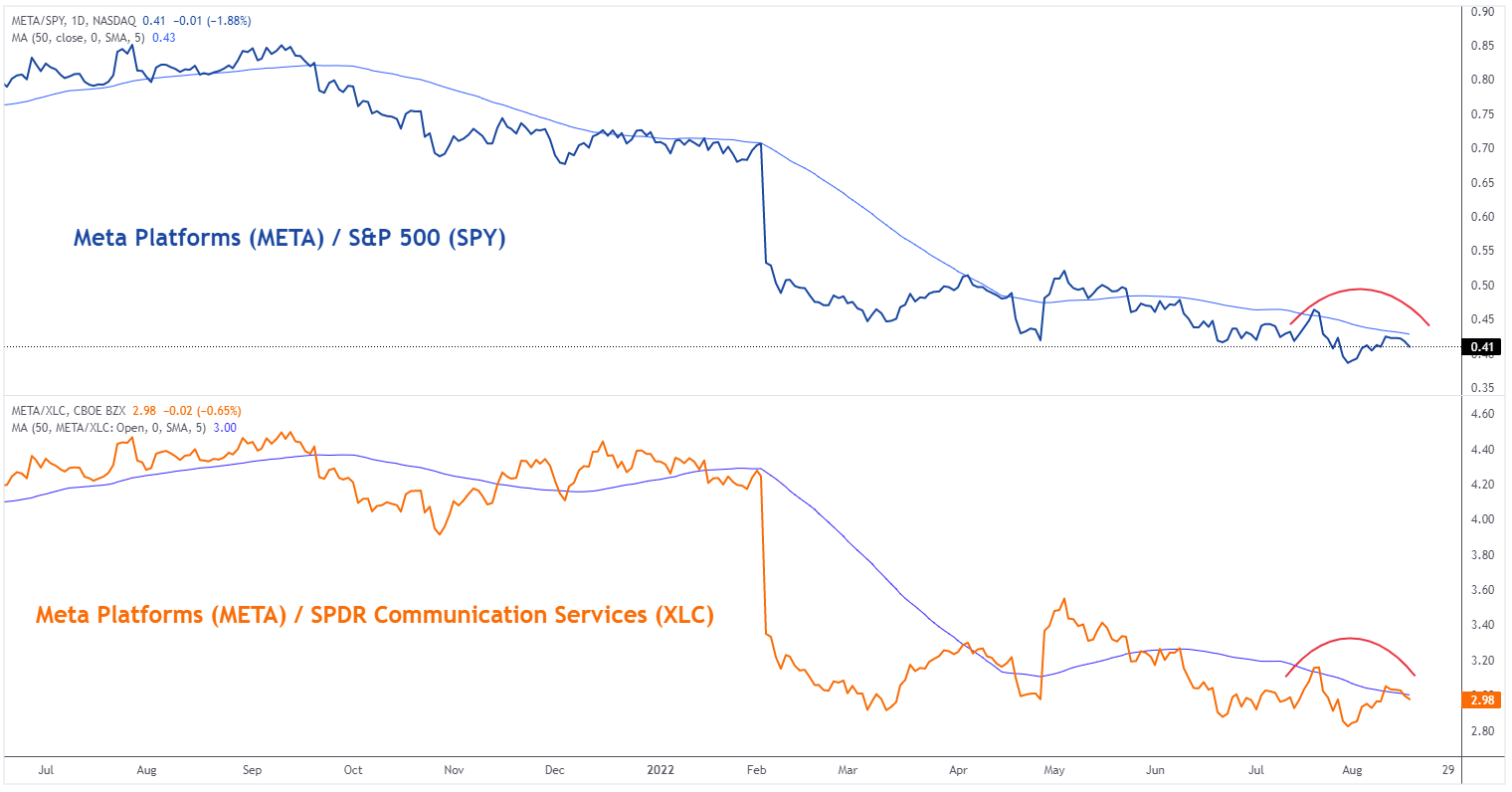

- Relative strength analysis of META against the benchmark S&P 500 and its Communication Services sector shows potential underperformance of META.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.