The Reserve Bank of Australia (RBA) will hold the policy meeting at 2:30 pm local time on Tuesday when the RBA is expected to raise the interest rate by 25 basis points and bring the Official Cash Rate (OCR) to 3.85%. Despite the call from consensus, a “hold” on the interest rate is still on the table, considering the current economic playout and what the Reserve Bank has signaled in its March meeting. The recent US and EU bank crisis may also strengthen the odds of a pause in the upcoming meeting tomorrow.

Inflation cools, retail sales levels off, but labor market stays tight

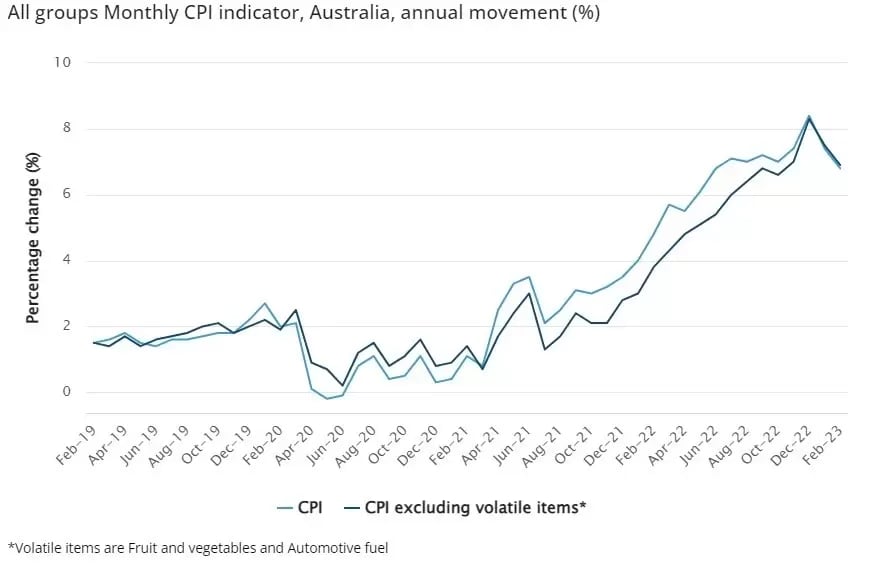

Perhaps the most convincing economic data for a prediction of a “hold” by the RBA is the recent Consumer Price Index (CPI) for February, which printed at 6.8% annually, well below an estimated 7.2%. Inflation shows signs of peaking at 8.4% in December, followed by 7.4% in January. Though the level is still well above the RBA’s target of 2-3%, the CPI trajectory may encourage the Reserve Bank to hold for now to avoid an economic downturn amid the gloomy outlook.

Australia’s monthly CPI (annual movement%)

Source: Australian Bureau of Statistics

The February retail sales rose 0.2% sequentially and 6.4% annually, which is the lowest yearly increase since January 2022, signaling a slowdown in consumer spending due to rising rates and elevated inflation. While food retailing kept rising at a 0.2% monthly pace, the other sectors, such as household goods, clothing, and department stores, all showed a decline in spending, indicating that consumer shifted their spending to staples from other categories.

Australian total retail turnover

Source: Australian Bureau of Statistics

However, one gauge that may complicate RBA’s rate decision is the labor market. The latest employment data shows that the Australian unemployment rate fell back to a near 50-year low of 3.5% in February after a jump to 3.7% in January, while the wage price index rose 0.8% quarterly and 3.3% from a year ago in the December quarter, which is the fastest annual increase in a decade. The combination of the two data may still keep inflation at an elevated level in the near term, but a 3.3% in wage growth is well below the increase in the consumer price of 7.8% during the same period, which tends to rein in consumer spending further.

In light of cooling inflation and the recent bank crisis, some commercial banks, like the Commonwealth Bank and Macquarie already start lowering their deposit rates, reflecting a possible policy turnaround of the RBA. The CBA has cut its six-month deposit term rate by 25 basis points to 3.25%. And Macquarie also reduces the three or four-year term rate to 3.6% from 3.85% and the five-year rate to 3.65% from 3.9%.

What is the possible market reaction to the RBA’s rate decision?

In fact, RBA’s guidance on the further rate hike path may have a more significant influence on the financial markets than the actual decision in the upcoming meeting. Even though the Reserve Bank does raise the cash rate by another 25 basis points this time, it may signal a pause going forward. A dovish RBA will most likely spark “risk-on” sentiment and push the stock markets higher, but the Australian dollar may take a hit. The ASX 200 snapped a 7-week losing streak last week, up 3%, to above 7,200, amid broad optimism toward the central bank’s dovish turn in their policy guidelines. The benchmark index may continue to take the policy tailwind and head off the January high of above 7,500 if the bank meets the market’s expectations.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.