How to accurately value your options

Learn about the factors that can impact the pricing of options, and find out how options are priced.

Understanding options valuation

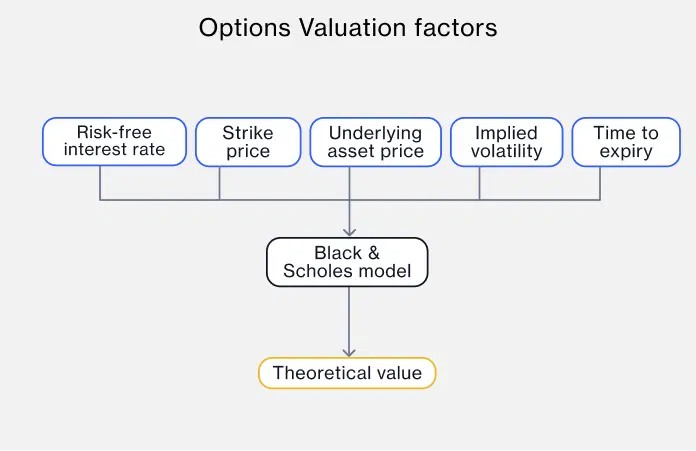

The value of an option is determined by several factors:

The underlying asset price

The strike price

Time left until the expiration of the contract

Implied volatility

The interest rate

Various calculation methods use this data to work out the premium – the price a trader pays for an option. The most used calculation in options pricing is the Black-Scholes model (BSM). It uses the five variables mentioned above to derive the theoretical value of an option.

There are many BSM calculators available online, where you can enter the variables to get your calculation.

Factors affecting options value

The following factors have an impact on the value of an option:

Underlying asset price: changes in the asset price will increase or decrease an option price – but have opposite effects for calls and puts. When the price of an asset rises, a call option value will generally rise, but a put option value would decrease. If the price of an asset falls, the opposite happens.

Strike price: this influences the price of an option by determining whether it has intrinsic value. In essence, how much an option would be worth if it was exercised right now (see below).

Time to expiration: the further away the expiry date, the more time you have for the contract to potentially move ‘in-the-money’ (in profit), which therefore means a higher premium. The less time there is for the trade to turn profitable, the cheaper the option’s price will be (but the risk of the contract expiring worthless increases).

Implied volatility: when implied volatility (IV) increases, so does the probability of the option being in-the-money at expiration – which pushes options prices up.

Interest rates: when interest rates go up, call option premiums generally rise, and put option premium generally decrease.

Intrinsic value vs extrinsic value

An option premium is set by two sets of values – intrinsic value, which reflects the value of the strike price compared to the asset price, and extrinsic value, which factors in the time until expiry, implied volatility, dividends and interest-rate risks.

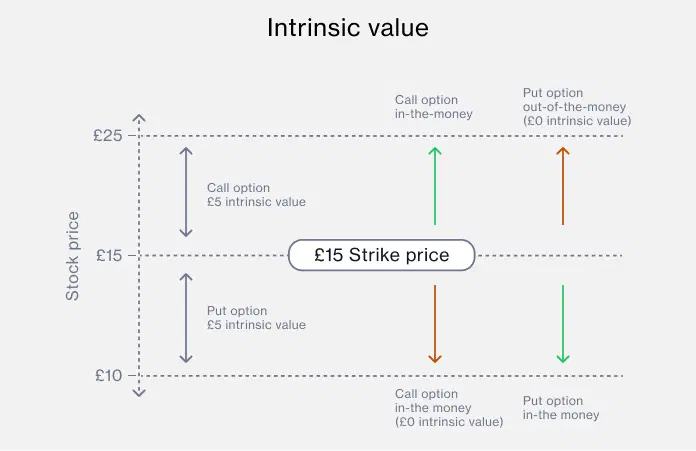

How to calculate the intrinsic value of an option

The intrinsic value is the value of an option if it were exercised now. An option only has intrinsic value if it’s in-the-money, meaning the option holder would benefit from exercising the contract. This occurs if the strike price of a call option is below the underlying asset price, or the strike price of a put option is above the underlying asset price.

The intrinsic value is calculated by taking the strike price and underlying asset price and subtracting one from the other – and which way around depends on whether it’s a call or a put:

Intrinsic value (call options) = underlying price - strike price

Intrinsic value (put options) = strike price - underlying price

For example, if a call option has a strike price of £10 and the asset price is £15, the option is in-the-money and immediately has an intrinsic value of £5. This means the holder of the call option could exercise the option and buy the asset for £5 less than its market price.

But, if the strike price is at-the-money (the asset price and the strike price are both £10) or is out-of-the-money (the asset price drops to £5), there is no profitability in exercising the option and therefore it has no intrinsic value.

How to calculate the extrinsic value of an option

The ‘extrinsic value’ is the value of an option that exceeds its intrinsic value. In essence, it’s a number that reflects the potential for an option to become more valuable before it expires.

If the implied volatility of an option increases, the probability of the contract ending up in the money when the contract expires increases, and therefore raises its extrinsic value. All this is framed by the duration of the contract, and, for this reason, extrinsic value is sometimes known as “time value”.

The extrinsic value is calculated by subtracting the intrinsic value from the option price. For example, if the option has an intrinsic value of £5 and the call option has a premium of £7, the extrinsic value is £2.

Extrinsic value tends to diminish over the duration of the contract. This is because as time till expiry decreases, the likelihood of the option ending in-the-money also decreases.

Theoretical options pricing versus market value

As with any trade, the prices of options do not always reflect their true market value. If there is an obvious disparity between the option price and the theoretical value, this could suggest that the option is overpriced or underpriced.

Options pricing provides an estimate of what an option should be worth assuming efficient markets and no transaction costs. Traders use options pricing to assess whether an option is overvalued or undervalued relative to its theoretical value.

Market value in options trading refers to the actual price at which an option is currently trading in the market. Market value is determined by supply and demand dynamics, investor sentiment, news, and other market factors. It can differ from an option’s theoretical value due to various factors, like changes in market conditions, sudden shifts in volatility, changes in interest rates, and changes in the underlying asset's price. Market value reflects real-world conditions and the perceptions of market participants.

In summary, options pricing is a calculated estimate of an option's value based on mathematical models and assumptions, while market value is the actual price at which options are currently trading in the market, influenced by real-time supply and demand dynamics. Traders often compare options' theoretical values to their market values, to identify potential trading opportunities based on discrepancies between the two.

Practical tips for valuing options

A fair price for an option essentially reflects the probability of it expiring in-the-money, combined with the potential profit. It’s important to remember that trading options is high risk, and that you could also make a loss.

To use options valuations for potential trading ideas, you may find the following guidelines useful:

1. Establish what you want out of the trade – is this a speculative trade or are you using it to hedge an existing asset? This will influence your option and how much you want to pay for it.

2. Make time to understand the conditions and individual factors that influence an option’s price. Check economic and company financial event calendars for any events which could influence volatility during the contract’s duration.

3. Determine the ratio of risk to reward.

4. Use a pricing tool such as the BSM (described above) to value the option.

5. Set trading parameters.

Any questions?

Email us atWe're available whenever the markets are open, from Sunday night through to Friday night.