A trader’s guide to scalping

Published on: 19/08/2022 | Modified on: 26/10/2022

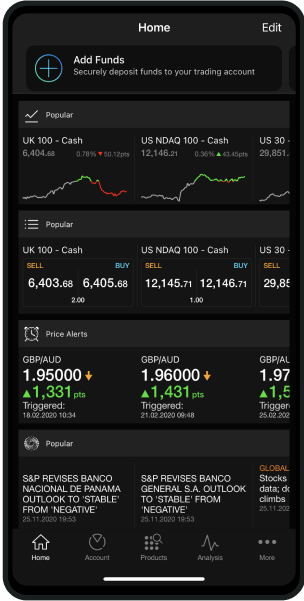

Scalping is a short-term trading strategy where investors attempt to make a profit from small price movements, before and after executing a trade. These sessions can last anywhere between a few seconds to an hour, therefore, scalpers may perform hundreds of transactions on an average trading day in an attempt to make a substantial profit.

KEY POINTS

- Scalpers look to enter and exit positions as quickly as possible, making small but frequent profits from successful trades

- The strategy is based on price action and doesn’t take into account fundamental factors

- Traders tend to prefer volatile markets where price fluctuations are more common

- Popular assets to scalp include stocks and forex, as these markets provide high liquidity

- Technical indicators such as moving averages and Bollinger Bands can help traders to spot price movements on charts