Bitcoin (BTC) halving is occurring on 11 May 2020. When bitcoin has halved in the past, price fluctuations usually follow. We look at what bitcoin halving is and how it can impact your cryptocurrency portfolio. We'll analyse BTC halving from a technical and fundamental perspective to give insight into what could happen and how to trade it.

- CFD Knowledge Hub

- Trading strategies

- Bitcoin halving

Bitcoin halving

- 1.What is bitcoin halving?

- 2.Bitcoin halving 2020

- 3.Historical bitcoin-halving dates

- 4.Bitcoin halving: technical analysis

- 5.Bitcoin halving: fundamental analysis

- 6.How to trade on 2020’s bitcoin halving

- 7.Bitcoin halving: your questions answered

- 8.Summary

What is bitcoin halving?

Bitcoin halving is an event where the block reward for mining new bitcoin is halved, meaning that bitcoin miners will receive 50% less bitcoin for every transaction they verify. BTC halving occurs every 210,000 blocks, which equates to a halving occurring approximately every 4 years.

Although this can sound confusing with concepts such as ‘block reward’ and ‘verifying transactions’, bitcoin halving is a relatively simple process.

When a block of bitcoin is successfully mined, the bitcoin miner receives a block reward – essentially a BTC payment. However, the bitcoin halving process follows cryptocurrency economic theory. As bitcoin has a finite amount and its supply is reduced over time, the price of bitcoin can be kept ‘stable’ and deflationary by reducing the overall supply – this is why bitcoin halving exists.

Bitcoin halving 2020

The next bitcoin-halving event is expected to occur the week commencing 11 May 2020. However, please note that this date can vary, as the time taken to generate new blocks can also vary. However, it's certain that bitcoin halving will occur when block 630,000 is mined.

Currently, 12.5 bitcoins are rewarded to miners per block. However, this will decrease to 6.25 BTC per block after the bitcoin halving event in 2020.

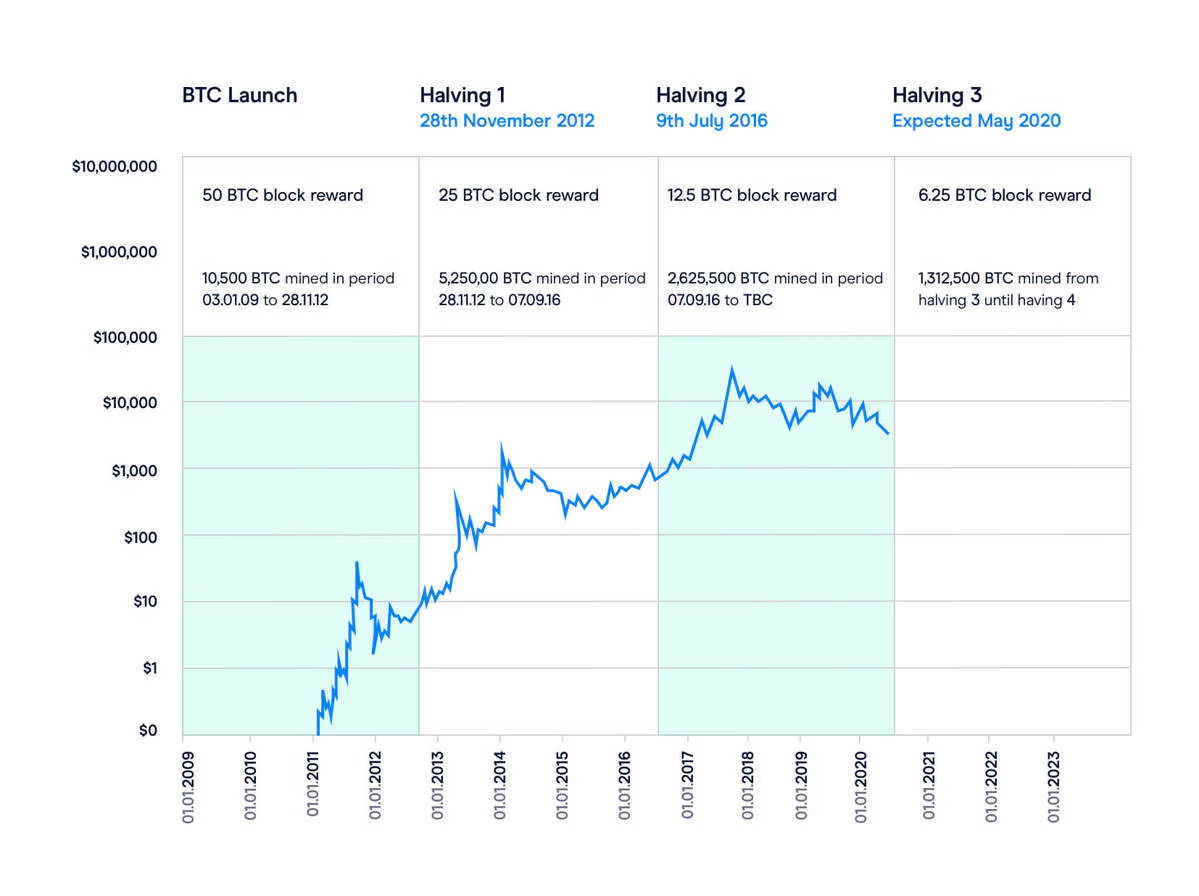

Historical bitcoin-halving dates

Bitcoin halving has occurred twice before. First in 2012, where the reward per block dropped from 50 to 25 bitcoins. Following this, another halving occurred in 2016, where the reward per block dropped from 25 to 12.5 bitcoins. See below for a more detailed explanation into the history of bitcoin halving and predictions for the future.

Halving | Date | Block | Block reward | Mined in period | % mined |

|---|---|---|---|---|---|

BTC launch | 3 January 2009 | 0 | 50 | 10,500,00 | 50 |

Halving 1 | 28 November 2012 | 210,000 | 25 | 5,250,000 | 75 |

Halving 2 | 9 July 2016 | 420,000 | 12.5 | 2,625,000 | 87.5 |

Halving 3 | 11 May 2020 | 630,000 | 6.25 | 1,312,500 | 93.75 |

Halving 4 | Expected 2024 | 840,000 | 3.125 | 656,250 | 96.875 |

Halving 5 | Expected 2028 | 1,050,000 | 1.5625 | 328,125 | 98.4375 |

Halving 6 | Expected 2032 | 1,260,000 | 0.78125 | 164,062.5 | 99.21875 |

As you can see from the above table, the amount of bitcoin mined and the block reward drops by half at every halving event. By 2032, over 99% of bitcoin will have been mined and it is estimated to take up until 2140 until 100% of the total bitcoin is mined.

Bitcoin halving: technical analysis

Technical analysts can use an array of tools to forecast price movements in the bitcoin market before and after the next bitcoin halving. You can use our pattern recognition scanner to identify trading patterns that bitcoin traders often look for, such as ascending triangles, head and shoulders and Fibonacci retracements.

History of bitcoin-halving chart

Bitcoin halving: fundamental analysis

Bitcoin halving is a trading indicator for fundamental analysts, as it’s a direct force that will impact the supply and demand of bitcoin. The halving process reduces the future supply of bitcoin by 50% for the next 210,000 blocks, when this process will repeat again. If demand stays constant, and this factor is not already priced into the market value of bitcoin, the value of bitcoin would rise. However, it's increasingly difficult to determine the intrinsic value of bitcoin due to its complexity.

How to trade on 2020’s bitcoin halving

Open a CMC trading account. You can trade bitcoin with a demo account to practise new trading strategies with virtual funds. Or, you can open a live account if you are ready to trade with real money.

Research the bitcoin market. Determine whether you speculate that bitcoin’s price will rise or fall. Make use of our platform features such as our pattern recognition scanner, which can search the bitcoin market for trading chart patterns.

Create a bitcoin deal ticket. Choose to ‘buy’ or ‘sell’ bitcoin based on your research. Enter a position size then add stop-loss and take-profit orders in order to mitigate any additional risk based on your trading plan.

Place the bitcoin trade. You can deposit just a percentage of the full trade value to open a position and control a larger sum. Please note that your profits and losses are magnified in line with your leverage ratio.

Close your position. Any profits from CFD trades can be offset against losses for tax purposes.

Bitcoin halving: your questions answered

When is the next bitcoin halving?

The next bitcoin halving is estimated to occur on 11 May 2020. Bitcoin halving occurs when the 630,000th block is mined. This bitcoin halving will see the mining reward drop from 12.5 bitcoins per block to 6.25 bitcoins.

What happened last time bitcoin halving happened?

The last time bitcoin halving happened on 9 July 2016, block 420,000 was mined. This saw the mining reward drop from 25 bitcoins per block to 6.25 bitcoins per block. Bitcoin also experienced some price fluctuations before, during and following its 2016 halving. The price of bitcoin rose from around $450 in April 2016 to around $650 at the time of the halving. Following this, volatility ensued in the market but bitcoin’s price continued to steam ahead over the next year, hitting highs of nearly $20,000 before dropping down to around $10,000 at the start of 2018.

How will bitcoin’s price change following the next bitcoin halving?

It’s impossible to predict future bitcoin price changes during the next halving period, just as it is impossible to attribute bitcoin halving to previous price changes. However, we can analyse the previous highs from bitcoin halving 1 and 2, where major price increases were evident:

Bitcoin launch to first halving: Price increases from $31.50 to $1,178 (3,700% increase)

First halving to second halving: Price increases from $1,178 to $19,800 (1,600% increase)

Second halving to third halving: TBC

While the above data is far from producing any meaningful projections or insights into the bitcoin’s price action, it simply showcases what has happened in the past.

Summary

Bitcoin halving is a fundamental event that changes how much bitcoin is supplied from mining. Although it should not be used in solitary as a trading indicator, it can be used alongside other fundamental or technical analysis factors to help determine bitcoin’s future price action.

Find out more about how to trade bitcoin.