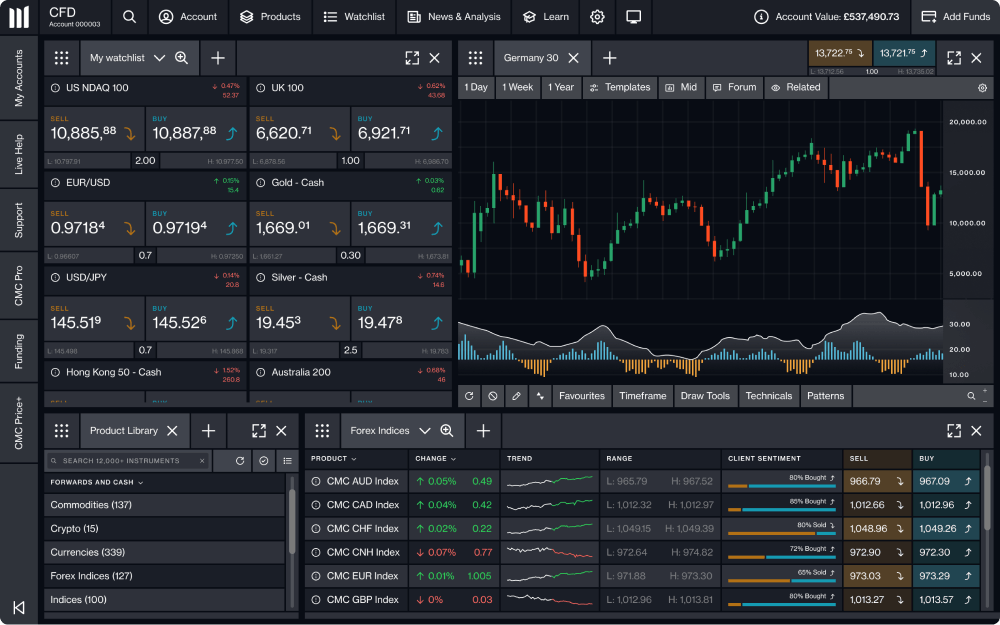

Trade on over 1,000 exchange-traded funds with leverage, on our award-winning Next Generation CFD platform.

More than just an ETF trading platform

- Your favourites in one placeOver 1,000 ETFs to trade, including the most popular themes from Australia, the US and Europe.

- Professional researchFree access to quantitative equity analysis from Morningstar.

- Minimal slippageWith fully automated, lightning-fast execution in 0.040 seconds*

- 24/5 supportOur support team is available 24 hours, Monday – Saturday (in line with global market hours).

- Competitive pricingEnjoy competitive pricing across our full range of ETF instruments.

*0.040 seconds CFD median trade execution time on CMC Markets' web and mobile platforms, 1 April 2023-31 March 2024.

Our themes to watch

Since their establishment three decades ago, exchange-traded funds (ETFs) have evolved from a relatively obscure investment fund to a type of investment vehicle that has attracted trillions of dollars worth of assets. But with thousands of available instruments and multiple types and focuses, how do you know where to start? Our in-house trading team have identified three themes with high growth potential and the instruments well placed to benefit from their performance.

Most popular instruments

Pricing is indicative. Past performance is not a reliable indicator of future results. Client sentiment is provided by CMC Markets for general information only, is historical in nature and is not intended to provide any form of trading or investment advice - it must not form the basis of your trading or investment decisions. Number of instruments available on MT4 may vary.

Other popular instruments

Product |

|---|

- |

- |

- |

- |

- |

- |

- |

- |

Min spread | Buy | Day | Week | Trend |

|---|---|---|---|---|

- | - | -% | -% | |

- | - | -% | -% | |

- | - | -% | -% | |

- | - | -% | -% | |

- | - | -% | -% | |

- | - | -% | -% | |

- | - | -% | -% | |

- | - | -% | -% |

See our competitive trading costs

Whatever you trade, costs matter. That’s why we’re committed to bringing competitive pricing and transparency across all of our markets, whether you trade on ETFs, indices or commodities.

Product |

|---|

- |

- |

- |

- |

- |

- |

- |

- |

Min spread | Holding cost (buy) | Holding cost (sell) | Margin rate |

|---|---|---|---|

- | -% | -% | -% |

- | -% | -% | -% |

- | -% | -% | -% |

- | -% | -% | -% |

- | -% | -% | -% |

- | -% | -% | -% |

- | -% | -% | -% |

- | -% | -% | -% |

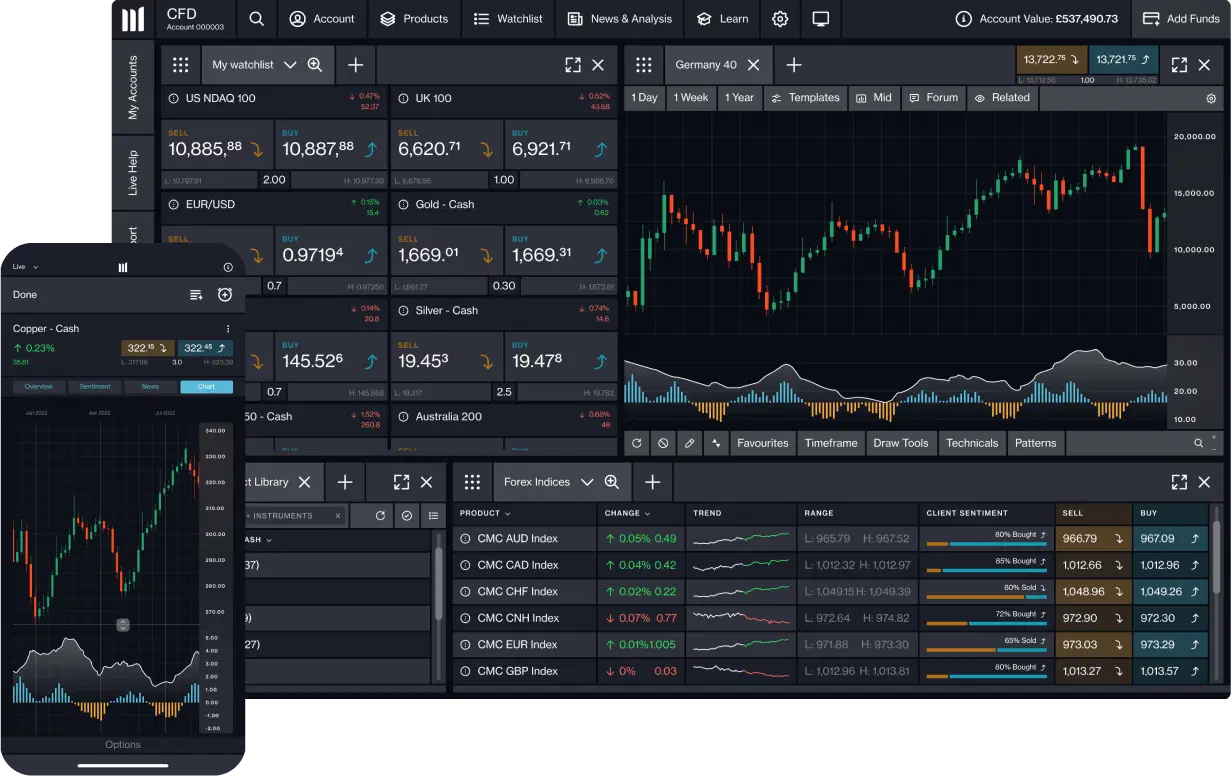

Our charting package ranked highest for charting in the 2019 Investment Trends survey. Choose from over 115 technical indicators and drawing tools, more than 70 patterns and 12 in-built chart types.

We automatically scan over 120 of our most popular instruments every 15 minutes for emerging and completed chart patterns, such as wedges, channels and head & shoulders formations to give you a head start on the market.

Join over 1 million global traders and investors

Winner 2023

#1 web platform

ForexBrokers

Winner 2024

Best Mobile Trading Platform

ADVFN International Financial Awards 2024

Winner 2025

Most Currency Pairs

ForexBrokers

Winner 2025

#1 Commissions & Fees

ForexBrokers

New to ETF trading?

Frequently asked questions

When you trade CFDs on ETFs on our platform, you don’t buy or sell the underlying ETF. Instead, you’re taking a position on whether you think the ETF price will go up or down.

With CFD trading, you buy or sell a number of units for a particular instrument. For every point or unit that the price moves in your favour, you gain multiples of your stake, and vice versa.

There are a number of costs to consider when trading on ETFs, including holding costs (for trades held overnight) and guaranteed stop-loss order charges (if you use this risk-management tool).

See our trading costs