What are CFDs?

CFDs, short for contracts for difference, are financial derivative products that allow traders to speculate on price movements, usually in the short term. They are contracts between an investor and an investment bank. At the end of the contract, the parties exchange the difference between the opening and closing prices of a specified financial instrument, which can include forex, shares and commodities. Trading CFDs means that you can either make a profit or a loss, depending on which direction your chosen asset moves.

CFDs vs stocks

CFDs and stocks differ fundamentally in their structure and purpose. When you buy a stock, you own a share of the company, giving you rights such as dividends and voting power. By contrast, CFDs are derivative instruments that let you speculate on price movements without owning the underlying asset.

Moreover, CFDs offer leverage, which means you can control a larger position with a smaller capital outlay, unlike stocks, where you need to pay the full value upfront. CFDs are also bidirectional, which means traders can profit from both rising and falling prices, whereas stock investors traditionally benefit only when prices rise.

The costs and fees also vary when considering CFDs vs stocks: stock trading tends to incur brokerage fees and potential dividend taxes, while CFDs can involve spreads, overnight financing and commission. Finally, CFDs can often be traded outside regular market hours, which offers greater flexibility than just trading stocks during periods when the exchange markets are open.

Advantages of CFD trading

One of the benefits of CFD trading is that you can use margin trading, which lets you open larger positions with a smaller capital outlay. Having this leverage can amplify your market exposure but also requires careful risk management to avoid bigger losses.

CFD trading is also bidirectional, meaning you can profit from both rising and falling markets. If you anticipate a price increase, you can go long (buy), and if you expect a decline, then you can go short (sell). It’s this type of flexibility that presents new opportunities in all market conditions.

Another advantage of CFDs is being able to hedge an existing portfolio. If, for example, you own stocks and expect their value to drop temporarily, you can use CFDs to offset potential losses. CFDs also cover a wide range of markets, including indices, forex, commodities and cryptocurrencies, which are all accessible from a single trading account.

CFDs also provide flexibility in trading timeframes, especially when compared to stocks. Traders can adopt long-term positions or employ day trading strategies, depending on their goals and market outlook.

Learn more about the benefits and risks of CFD trading with our CFD advantages and risks guide.

How does CFD trading work?

When you trade CFDs, you don’t buy or sell the underlying asset (e.g. a physical share, currency pair or commodity). We offer CFDs on thousands of global markets, and you can buy or sell a number of units for a particular product or instrument depending on whether you think prices will go up or down. Our wide range of products includes shares, currency pairs, commodities and stock indices.

Wondering how CFDs work? For every point the price of the instrument moves in your favour, you gain multiples of the number of units you have bought or sold. For every point the price moves against you, you will make a loss. Please remember that for retail clients, you could lose up to the amount of your deposit.

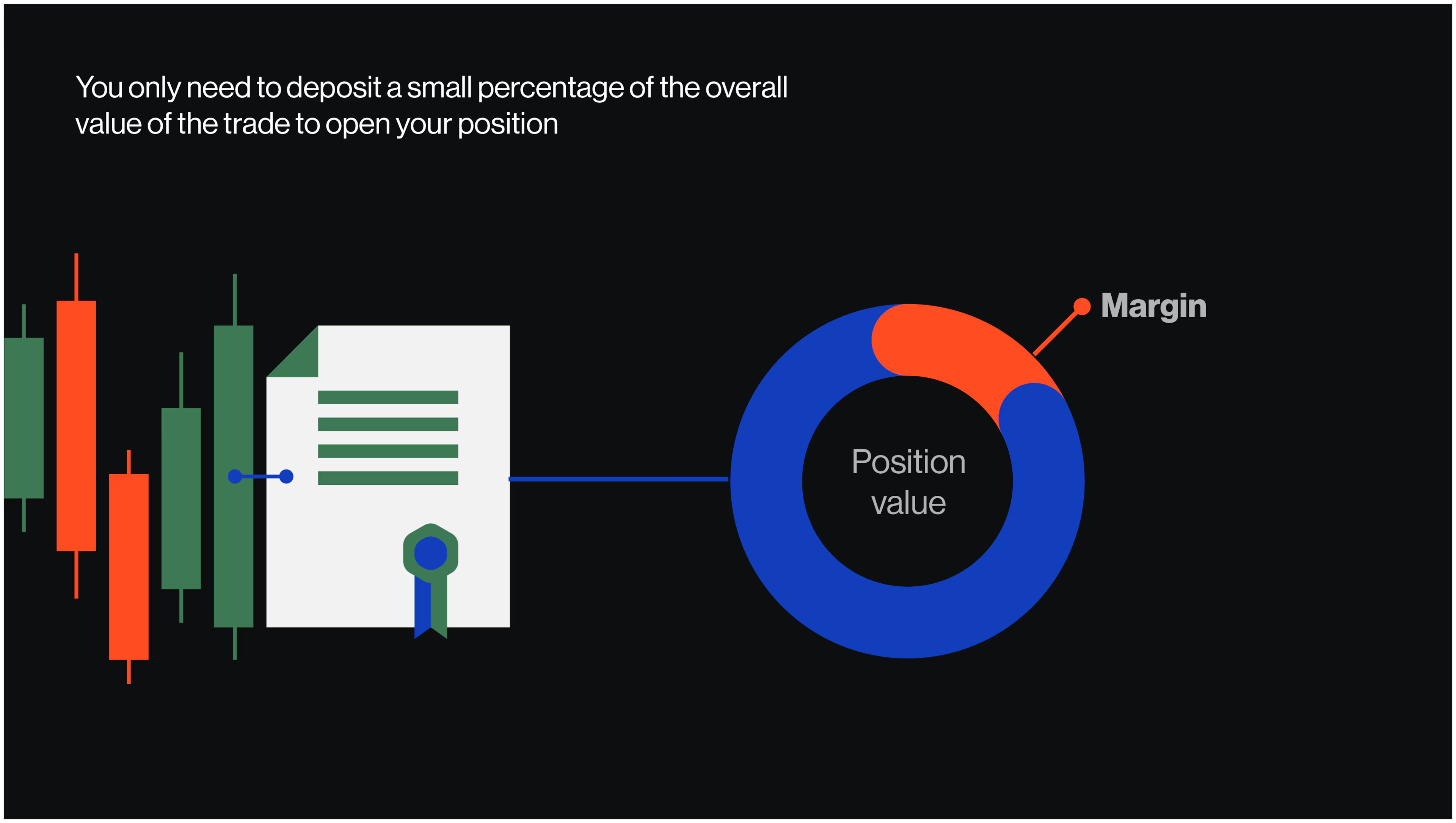

Margin and leverage

Contracts for difference (CFDs) is a leveraged product, which means that you only need to deposit a small percentage of the full value of the trade in order to open a position. This is called ‘trading on margin’ (or margin requirement). While trading on margin allows you to magnify your returns, your losses will also be magnified as they are based on the full value of the position. This means that you could lose all of your capital, but as the account has negative balance protection, you can't lose more than your account value.

Learn more about CFD margins and how to calculate CFD margins.