Welcome to Michael Kramer’s pick of the top three market events to look out for in the week ahead, plus his latest US election update.

After a packed week of central bank rate decisions, the coming week looks comparatively quiet. That said, on Monday purchasing managers’ index (PMI) data from the US, the UK and elsewhere will check the pulse of manufacturing and service sector activity, offering insights on how the world’s major economies are faring in September. On Friday, the latest reading of the US personal consumption expenditures (PCE) price index – usually a closely watched measure of inflation – is likely to be less significant than normal after the US Federal Reserve on Wednesday lowered interest rates by a bumper 50 basis points and signalled that further cuts are imminent. That sent the S&P 500 to a record high on Thursday, but weakened the US dollar.

US election update

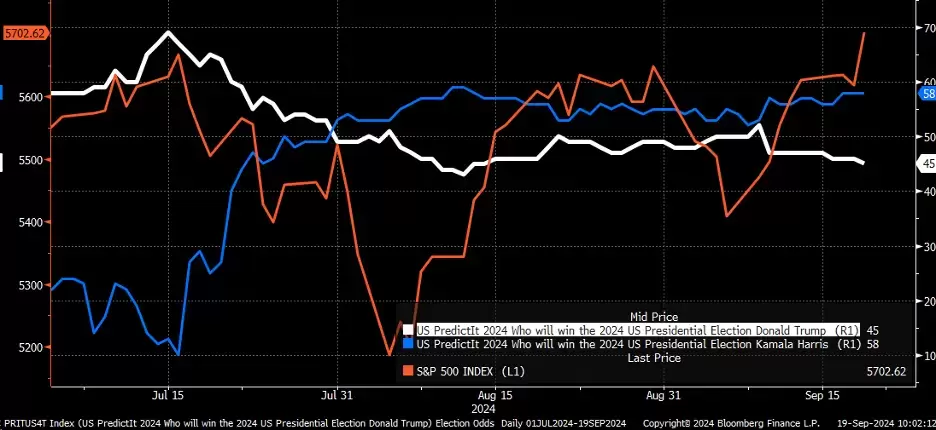

The betting market sees former president Donald Trump's odds of winning the US election slowly slipping away. PredictIt, an online betting site that covers political events, suggests that vice-president Kamala Harris has a commanding lead, with a 58% chance of winning the presidency compared to Trump’s 45%. This is a stunning turnaround given that Harris only entered the race in July, when Trump had a 70% chance of winning the election according to PredictIt.

Since then, the US equity market has been range-bound. However, Wall Street's benchmark index, the S&P 500, is at last breaking out of that range, suggesting that investors are becoming more comfortable with a Harris victory, though the index’s gains have primarily been driven by economic factors, particularly the Fed’s rate cut on Wednesday.

US election poll tracker, July 2024 - present