Welcome to Michael Kramer’s pick of the top market events to look out for in the week ahead, plus his latest US election betting market update.

The coming week will be one of the busiest of the quarter, teeming with company earnings reports and economic announcements – particularly from the US. Big Tech will be the focus, with quarterly results from Google parent company Alphabet (Q3), Facebook owner Meta Platforms (Q3), Microsoft (Q1), Amazon (Q3) and Apple (Q4) likely to move US markets, particularly the tech-heavy Nasdaq. Investors will be paying close attention to what the tech giants say about their AI spending plans and where they see the benefits. Traders will also be keeping an eye on US inflation and labour market data, the last round of such figures before the US election on 5 November and the Federal Reserve’s rate-setting meeting from 6-7 November. In the interests of full disclosure, please note that Michael Kramer and the clients of his company Mott Capital Management own shares of Amazon, Apple, Alphabet (Class A) and Microsoft.

US election update

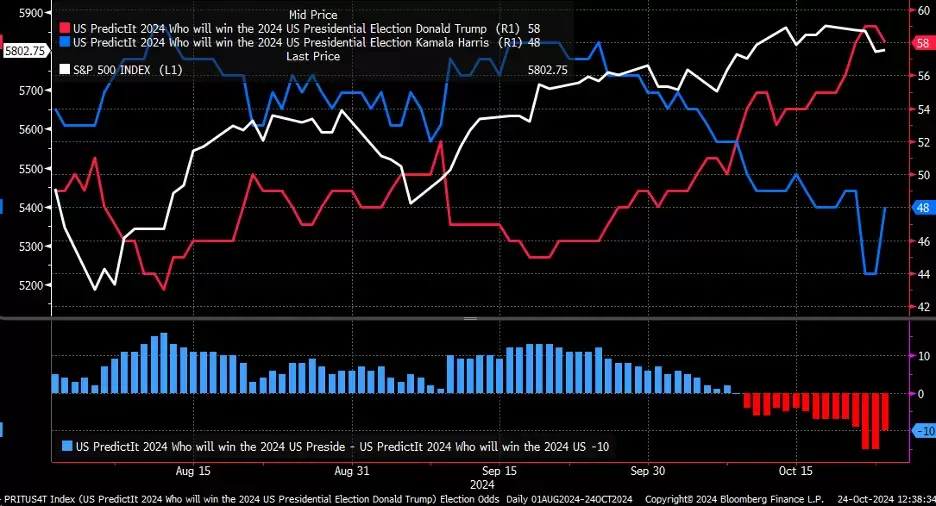

Former president Donald Trump’s lead over vice-president Kamala Harris in a key betting market widened over the past week. Data from the US betting site PredictIt indicates that 58% of those betting on Trump back him to win and 42% bet he’ll lose. Among those betting on Harris, 48% back her to win and 52% bet she’ll lose.

At this stage, the betting markets have Trump as the likely winner, but it’s possible that a small number of large stakes are skewing the data in his favour, perhaps in a bid by deep-pocketed Trump supporters to shape voter perceptions of his campaign momentum. It’s also possible that some sampling bias may be at play, as Trump supporters may be on the whole more likely to place bets than Harris supporters. In any case, whether the wisdom of the crowd will prove correct remains uncertain, since – as with any other market – nothing is guaranteed.

Trump is ahead of Harris in the US betting market