Welcome to Michael Kramer’s pick of the top three market events to look out for in the week ahead.

The coming week will be light on economic data, but heavy on central bank and monetary policy news. The minutes from the US Federal Reserve’s recent rate-setting meeting, which took place from 30-31 July, are due to be published on Wednesday and could provide insights into how close the Fed is to cutting rates. Then, from Thursday to Saturday, central bankers, policymakers, academics and economists from around the world will gather in Jackson Hole, Wyoming, for the Kansas City Fed’s annual economic symposium. The theme of this year’s get-together is “reassessing the effectiveness and transmission of monetary policy”, and speakers will include Fed chair Jay Powell and Bank of England governor Andrew Bailey (both of whom will address delegates on Friday). One central banker who may struggle to attend this year’s event is Bank of Japan governor Kazuo Ueda, who on Friday will take part in a special parliamentary session in Tokyo to discuss the decision last month to raise interest rates.

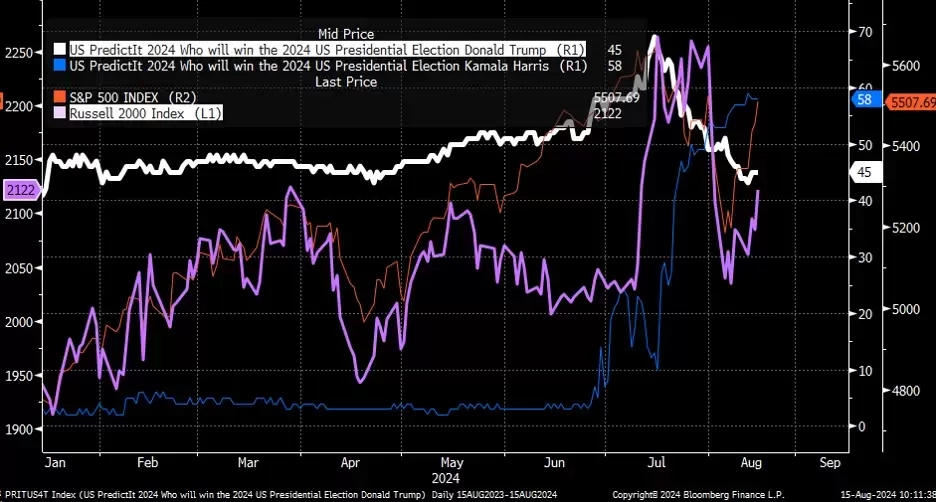

Plus, with 11 weeks to go until the US presidential election on 5 November, support for Kamala Harris is surging, according to the latest polls, giving her a timely boost ahead of the Democratic Party convention that begins on Monday. Betting markets now give the Democratic candidate and current vice-president a substantial lead over her Republican rival and former president Donald Trump, as the chart below shows. The graph also shows that the S&P 500 is on the rise, having apparently decoupled from Trump’s poll numbers, with which it was previously aligned. Small-cap stocks, represented below by the Russell 2000, also appear to be making gains. However, with polling day still more than two months away, there are likely to be further twists and turns ahead.

US election poll tracker, Jan 2024 - present

Palo Alto Q4 results

Monday 19 August

Analysts expect Palo Alto Networks [PANW] to report that its fourth-quarter earnings declined 2.2% year-on-year to $1.41 a share. However, revenue is forecast to have grown 10.7% year-on-year to $2.2bn, with total billings increasing 9.3% to $3.5bn. For the fiscal first quarter of 2025, earnings are projected to rise 3.4% to $1.43 a share, driven by revenue growing an estimated 12.4% to $2.1bn and total billings growing an estimated 6.4% to $2.2bn. Options pricing suggests that the shares could move up or down by about 8.8% following the results announcement.

The Nasdaq-listed cybersecurity company’s stock has risen more than 16% since Monday 5 August, when US recession fears contributed to a market slump. The shares, which closed at $343.27 on Thursday, are now approaching resistance at $345. A break above this level could push the stock higher, potentially filling a gap around $370 that was created in mid-February. However, a poor set of results could mean the stock fails to overcome that resistance level at $345, which may send the shares down towards $285, a low last visited in May.

Palo Alto Networks share price, September 2023 - present

Global PMIs

Thursday 22 August

Thursday sees the release of purchasing managers’ index (PMI) readings from a host of countries, including the UK, the US, Germany and others. The preliminary data for August will cover manufacturing, services, and composite measures. Data from the UK and the US may hold particular significance for forex traders, given the volatility in GBP/USD in recent weeks that was in part caused by concerns over economic growth.

The British pound has recently been trading around the $1.28 level against the dollar. If the PMI data indicates that the UK economy is performing better than the US economy, it could provide the catalyst for GBP/USD to break out of its current trading range. Recently, the pair has been trending higher, posting a series of higher highs and higher lows, highlighting positive upwards momentum. If the UK’s PMI readings remain above 50 points, indicating economic expansion, while the US data continues to paint a mixed picture of the American economy, the pound may continue to make gains against the dollar.

GBP/USD, March 2023 - present

Jackson Hole economic symposium

Thursday 22-Saturday 24 August

While various central bankers, among them Andrew Bailey, are scheduled to speak at the three-day event in western Wyoming, it will probably be Jay Powell’s remarks on US monetary policy that grab the headlines. Yet regardless of whether Powell plans to say something significant or offer only vague platitudes about monitoring the economic data, US stock markets are likely to experience higher implied volatility levels leading up to his speech.

For traders, monitoring indicators like the VIX 1-day volatility index – often referred to by the financial press as Wall Street’s “fear gauge” – before Powell's speech could provide insights into how stocks might behave during his speech. We often observe this pattern around Powell’s press conferences when the Fed meets to set interest rates. Typically, implied volatility rises before the meeting, then begins to drop about 10 minutes into Powell’s subsequent press conference.

If the VIX rises to around 20 points or higher leading up to Powell's speech at Jackson Hole, watch for it to start dropping once he begins speaking. This could signal that equities are likely to move higher, at least initially, irrespective of what Powell says, as implied volatility falls.

The chart below shows that volatility levels (the candlesticks) spiked ahead of the Fed’s interest rate announcement on 31 July, then fell once Powell began discussing the decision to keep rates unchanged. As volatility dropped, the S&P 500 (the orange line) moved higher during Powell’s speech.

VIX 1-day volatility index, 31 July to 1 August 2024

Key economic and company events

Here’s our rundown of notable economic announcements and US and UK company reports scheduled for the coming week:

Monday 19 August

• Germany: Bundesbank monthly report

• New Zealand: July imports, exports and trade balance

• Results: Estée Lauder (Q4), Palo Alto Networks (Q4), Plus500 (HY)

Tuesday 20 August

• Australia: Reserve Bank of Australia meeting minutes

• Canada: July consumer price index (CPI)

• China: People’s Bank of China interest rate decision

• Eurozone: July CPI

• Germany: July producer price index (PPI)

• Japan: July imports, exports and trade balance

• Results: Antofagasta (HY), John Wood Group (HY), Keysight Technologies (Q3), Lowe’s Companies (Q2), Medtronic (Q1)

Wednesday 21 August

• Australia: July Westpac leading index; August Judo Bank purchasing managers’ index (PMI)

• UK: July public sector net borrowing

• US: Federal Open Market Committee (FOMC) meeting minutes

• Results: Agilent Technologies (Q3), Analog Devices (Q3), Snowflake (Q2), Synopsys (Q3), Target (Q2), TJX (Q2), Zoom Video Communications (Q2)

Thursday 22 August

• Eurozone: August manufacturing, services and composite PMI; August consumer confidence

• France: August manufacturing, services and composite PMI

• Germany: August manufacturing, services and composite PMI

• Japan: July CPI

• New Zealand: Q2 retail sales

• UK: August manufacturing services and composite PMI

• US: August manufacturing, services and composite PMI; initial jobless claims to 16 August; Jackson Hole economic symposium begins (running until 24 August)

• Results: Baidu (Q2), Hays (FY), Intuit (Q4), NetEase (Q2), Ross Stores (Q2), Workday (Q2)

Friday 23 August

• Canada: June retail sales

• UK: Bank of England governor Andrew Bailey speech at Jackson Hole

• US: Fed chair Jay Powell speech at Jackson Hole

• Results: No major scheduled earnings announcements

Note: While we check all dates carefully to ensure that they are correct at the time of writing, the above announcements are subject to change.

CMC Markets erbjuder sin tjänst som ”execution only”. Detta material (antingen uttryckt eller inte) är endast för allmän information och tar inte hänsyn till dina personliga omständigheter eller mål. Ingenting i detta material är (eller bör anses vara) finansiella, investeringar eller andra råd som beroende bör läggas på. Inget yttrande i materialet utgör en rekommendation från CMC Markets eller författaren om en viss investering, säkerhet, transaktion eller investeringsstrategi. Detta innehåll har inte skapats i enlighet med de regler som finns för oberoende investeringsrådgivning. Även om vi inte uttryckligen hindras från att handla innan vi har tillhandhållit detta innehåll försöker vi inte dra nytta av det innan det sprids.