Welcome to Michael Kramer’s pick of the top three market events to look out for in the week ahead, plus his latest US election betting market update.

UK consumer price data out on Wednesday is expected to show that inflation cooled in September, while Thursday’s US retail sales announcement should give traders an insight into the health of the American consumer in the run-up to next month’s presidential election. Plus, earnings season in the US will gather pace this week with Q3 reports from Netflix, whose results are previewed below, and major financial institutions, including Bank of America, Citigroup, Goldman Sachs, Morgan Stanley, Blackstone and American Express.

US election update

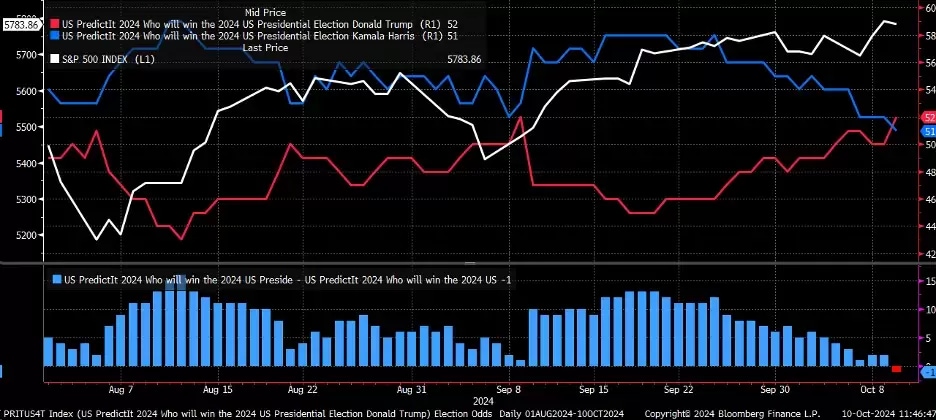

The race for the White House remains incredibly tight. Data from PredictIt, an online betting site that covers political events, indicates that the Republican candidate Donald Trump edged marginally ahead of his Democratic rival Kamala Harris in the past week, with the site giving Trump a 52% chance of winning the election compared to Harris' 51%. Meanwhile, the S&P 500 ended Wednesday at a record closing high of 5,792.04.

PredictIt’s data shows that 52% of Trump bettors back him to win while the other 48% bet he’ll lose. Among those betting on Harris, 51% back her to win and 49% bet she’ll lose. The election result, which is likely to hinge on the votes cast in six swing states, is essentially a toss-up at this point.

The betting market suggests that the US presidential election is neck and neck

UK September CPI

Wednesday 16 October

UK inflation is expected to have cooled further in September, with analysts forecasting that the headline consumer price index (CPI) rose 1.9% year-on-year, down from 2.2% in both July and August. A September reading below 2% could pave the way for further interest rate cuts from the Bank of England. The Bank’s next rate meeting is scheduled for 7 November.

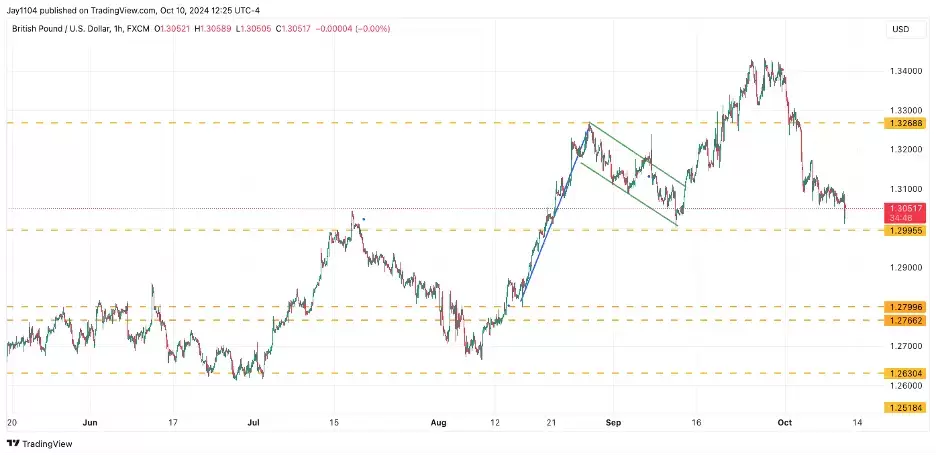

The surprisingly strong US jobs data that came out on 4 October, and the hotter-than-expected US September inflation figure of 2.4% on Thursday, have already moved the dial for USD/GBP. The pound is now on the cusp of breaking below a significant support level at $1.30. If a low UK CPI print supports the case for further BoE rate cuts, the pound could weaken to around $1.26, potentially erasing the gains that the pound has made against the dollar since mid-August.

GBP/USD, May 2024 - present

US September retail sales

Thursday 17 October

Analysts estimate that US retail sales expanded 0.2% month-on-month in September, up from an increase of 0.1% in August. Meanwhile, retail sales excluding volatile car and petrol station sales are forecast to have grown 0.3% month-on-month, up from 0.2% in August. Given investors’ ongoing concerns about a slowdown in US consumer spending, retail sales remain an important metric to monitor.

An uptick in monthly retail sales could boost the dollar, particularly against the euro. The EUR/USD pair has broken to the downside of an important uptrend and is approaching support near $1.09. Positive US retail sales data could lead to further dollar strength, potentially sending EUR/USD below that $1.09 support level and perhaps towards $1.079.

EUR/USD, April 2024 - present

Netflix Q3 results

Thursday 17 October

Analysts are forecasting that Netflix’s third-quarter earnings grew 37.3% to $5.12 a share, with revenue increasing 14.4% to $9.8bn. Meanwhile, net subscriber additions are expected to come in at 4.26 million, down from 8 million in Q2. Looking ahead to Q4, analysts expect the company to guide earnings of $3.90 a share on revenue of $10bn. Net subscriber additions are expected to be around 7 million, a sharp decline from the 13.1 million reported in Q4 2023.

Options market pricing suggests that the streaming platform’s stock price – which closed on Thursday at $730.29, up 56% year-to-date – could move higher or lower by about 7% following the Q3 earnings announcement. The price level with the most significant amount of gamma in the options market is $700, suggesting that after the results are released and implied volatility resets, the stock may be drawn lower to that price, assuming that earnings are more or less in line with analyst expectations

Despite this year’s gains, the Netflix share price has seen upward momentum fade since August, as indicated by the declining relative strength index (RSI) – see the lower part of the below chart. Furthermore, a rising wedge pattern appears to be forming on the technical chart. Currently, the $700 mark offers some modest support. However, a break below $700 could be significant and might lead to a drop towards the next support level at around $660.

Netflix share price, May 2024 - present

Key economic and company events

Our rundown of notable economic announcements and US and UK company reports scheduled for the coming week:

Monday 14 October

• China: September imports, exports and trade balance

• Results: Karooooo (Q2)

Tuesday 15 October

• Canada: September consumer price index (CPI)

• Eurozone: European Central Bank lending survey

• France: September CPI

• New Zealand: Q3 CPI

• UK: August average earnings, August unemployment rate, September claimant count

• Results: Bank of America (Q3), Bellway (FY), Charles Schwab (Q3), Citigroup (Q3), Goldman Sachs (Q3), Johnson & Johnson (Q3), UnitedHealth (Q3)

Wednesday 16 October

• Italy: September CPI

• Japan: September imports, exports and trade balance

• UK: September CPI, producer price index (PPI) and retail price index (RPI)

• Results: Abbott Laboratories (Q3), Morgan Stanley (Q3), Prologis (Q3), Whitbread (HY)

Thursday 17 October

• Australia: September employment change, September unemployment rate

• Eurozone: ECB interest rate decision, September harmonised CPI, EU leaders summit

• Japan: September CPI

• US: September retail sales, initial jobless claims to 11 October

• Results: AJ Bell (FY), Blackstone (Q3), Elevance Health (Q3), Intuitive Surgical (Q3), Marsh & McLennan (Q3), Netflix (Q3), Rentokil Initial (Q3), St James’s Place (Q3)

Friday 18 October

• China: Q3 gross domestic product (GDP), September industrial production, September retail sales

• UK: September retail sales

• Results: American Express (Q3), Procter & Gamble (Q1)

Note: While we check all dates carefully to ensure that they are correct at the time of writing, the above announcements are subject to change.

CMC Markets erbjuder sin tjänst som ”execution only”. Detta material (antingen uttryckt eller inte) är endast för allmän information och tar inte hänsyn till dina personliga omständigheter eller mål. Ingenting i detta material är (eller bör anses vara) finansiella, investeringar eller andra råd som beroende bör läggas på. Inget yttrande i materialet utgör en rekommendation från CMC Markets eller författaren om en viss investering, säkerhet, transaktion eller investeringsstrategi. Detta innehåll har inte skapats i enlighet med de regler som finns för oberoende investeringsrådgivning. Även om vi inte uttryckligen hindras från att handla innan vi har tillhandhållit detta innehåll försöker vi inte dra nytta av det innan det sprids.