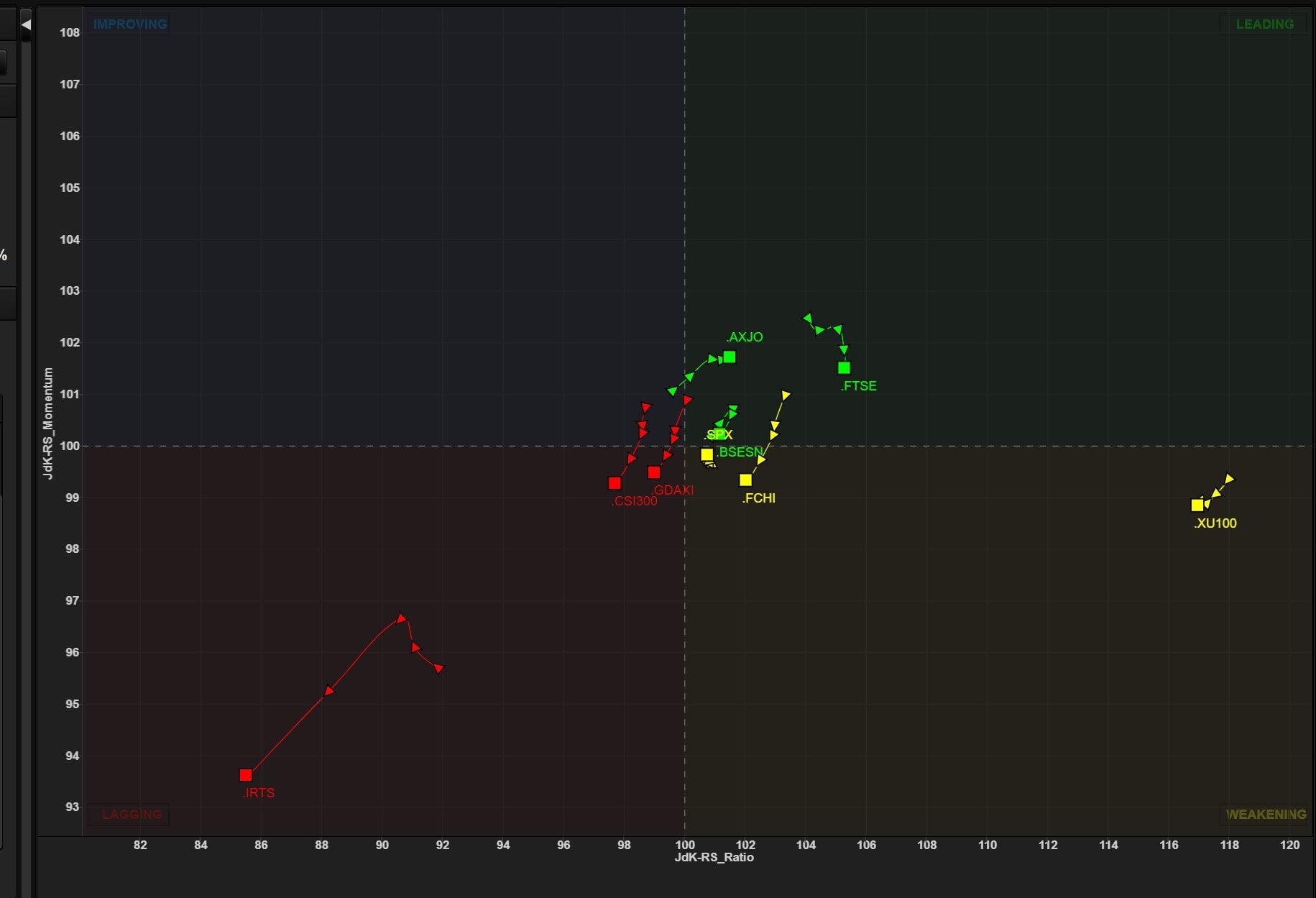

This week we look at global indices using a Relative Rotation Graph® (RRG) from Refinitiv Eikon®.

The RRG below shows the rotation for some major stock market indices against the Morgan Stanley Capital International (MSCI) world index as the benchmark. The chart indicates how markets around the world are moving relative to each other and against the benchmark in the centre. The sampling is weekly.

Figure 1: Weekly RRG of major indices versus the MSCI World Index

The green tails on the right-hand side are in relative uptrends against the MSCI world index, while the red tails on the left are in relative downtrends.

First, the two outliers: Turkey’s ISE 100 (XU100) on the right and Russia’s RTS (RTS) on the left. Due to their currency situations, nether is attractive. The RTS particularly so, given the weak rouble.

Next, I want to look at two tails. The first one is for Australia’s ASX 200 (AXJO). This one is inside the leading quadrant. Rotations where a tail is on one side of the RRG usually indicate that a strong trend is at work. This tail moved across into the leading quadrant and is currently climbing on both scales of the RRG which indicates a continuing pickup in relative strength, which is backed by positive momentum.

The second tail I’d like to look at is the one for Germany’s DAX (GDAXI). This tail just moved into the lagging quadrant and is currently falling on both scales of the RRG which indicates a continuing loss in relative strength, which is backed by a lack of positive momentum.

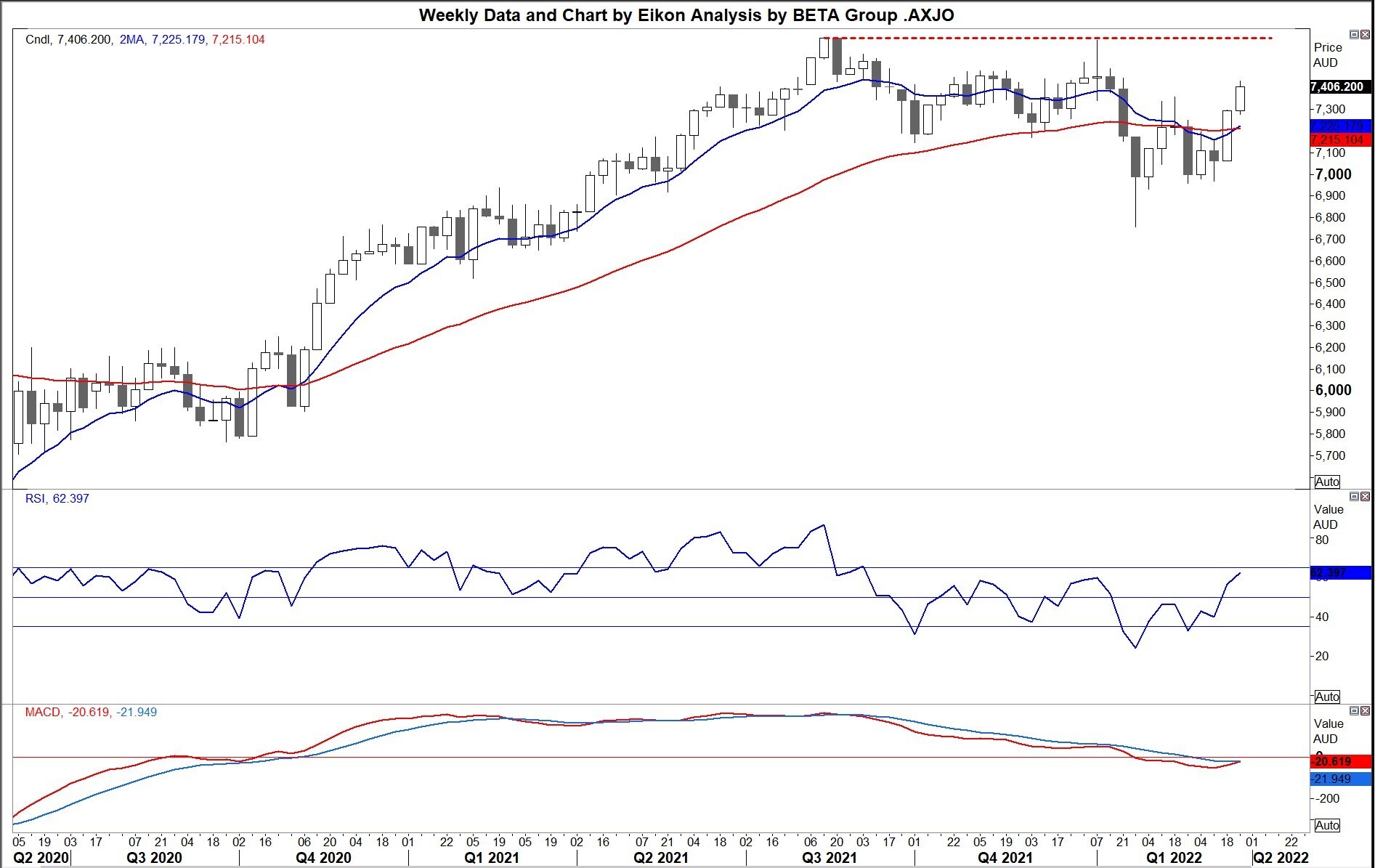

Finally, let’s check the price charts. For Australia’s ASX 200, the weekly chart above shows that this index has stabilised and is moving up. There is resistance above here to 7,630, but it is passing through it purposefully. The 50-day moving average has just recrossed the 200-day positively, making the ASX 200 one of the few major indices currently enjoying a “golden moment”. The more sensitive moving average convergence-divergence at the bottom is crossing up, and the relative strength index (RSI) is powering up too, indicating that this move has strong positive momentum.

Although there is resistance, it is getting lighter as we go up and should cause less friction if the advance continues.

For stock index bulls, the ASX 200 may be your index of choice.

Germany’s DAX looks very different. The daily chart for this market, above, shows its participation in the global stock market bounce has been laboured.

There is substantial resistance between 15,000 and 16,000 ahead. This was formed between November and February. There are many disappointed longs in there who are hoping to have the opportunity to break even on positions which have been losers for months. If there is progress through there it is likely to be slow, meaning the DAX remains unattractive on a relative basis.

The 50-day and 200-day moving averages are still in a bearish state despite the strong recent advance. The moving average convergence-divergence is recognising the strong advance. The RSI is high and sagging, indicating that the recent upside momentum is leaving the DAX.

For stock index bears, this may be your index of choice. We see the bullishness of the ASX 200 and the bearishness of the DAX as a pair opportunity – a potential hedge to the general direction of the stock markets.

CMC Markets erbjuder sin tjänst som ”execution only”. Detta material (antingen uttryckt eller inte) är endast för allmän information och tar inte hänsyn till dina personliga omständigheter eller mål. Ingenting i detta material är (eller bör anses vara) finansiella, investeringar eller andra råd som beroende bör läggas på. Inget yttrande i materialet utgör en rekommendation från CMC Markets eller författaren om en viss investering, säkerhet, transaktion eller investeringsstrategi. Detta innehåll har inte skapats i enlighet med de regler som finns för oberoende investeringsrådgivning. Även om vi inte uttryckligen hindras från att handla innan vi har tillhandhållit detta innehåll försöker vi inte dra nytta av det innan det sprids.