Quantitative approach

The quantitative equity rating section can be broken into five segments — the quantitative fair value estimate, quantitative economic moat, quantitative valuation, quantitative uncertainty and quantitative financial health. The quantitative metrics used to determine these scores are derived from a statistical model designed to mimic traditional analyst-driven ratings.

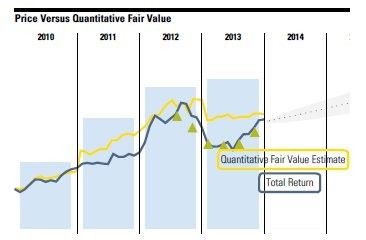

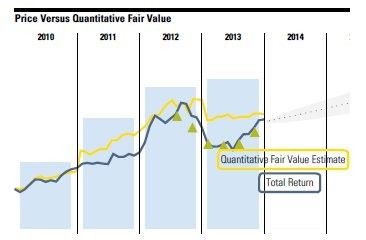

Quantitative fair value estimate

The quantitative fair value estimate is Morningstar's estimate of what the share price could be today. This is one of the most useful numbers on the report as it indicates whether the share may currently be undervalued or overvalued. For example, the underlying price of BHP Billiton might currently be 1550.0, while the Morningstar fair value estimate might be 2000.0. The figure is calculated using a statistical model similar to the that Morningstar equity analysts apply to companies.

Quantitative valuation

The quantitative valuation is the ratio of a stock's quantitative fair value estimate to its most recent close price. The rating is expressed as overvalued, fairly valued or undervalued.

Quantitative economic moat

The quantitative economic moat describes the strength of a company's competitive position. The quantitative rating is expressed as none, narrow or wide.

Quantitative uncertainty

Any equity valuation involves a certain degree of uncertainty. The quantitative uncertainty score shows Morningstar's level of uncertainty about the accuracy of the quantitative fair value estimate. The lower the quantitative uncertainty, the more reliable the fair value estimate for that particular company is likely to be. The rating is expressed as low, medium, high, very high or extreme.

Quantitative financial health

Morningstar's quantitative financial health rating reflects the likelihood that a company will face financial problems in the near future. This calculation uses a predictive model designed to anticipate when a company may default on its financial obligations. Financial health is expressed as weak, moderate or strong.

Learn more about shares CFD trading with us.

*These reports are provided by Morningstar for general information only and are not intended to provide investment advice. Neither CMC Markets nor Morningstar is responsible for any trading decisions, damages or losses related to the information or its use.