The latest 13F filings are in, revealing the key trades made by top investors during Q3 2024. These reports offer insight into where the “smart money” is moving, from Warren Buffett’s growing cash reserves and reduced Apple stake to Michael Burry’s expanded bets on Chinese tech. Here’s a breakdown of the most significant portfolio shifts from last quarter.

Warren Buffett – Berkshire Hathaway

Buffett has been unloading a substantial portion of his holdings, with notable reductions in Apple (AAPL:US) and Bank of America (BAC:US). He trimmed his Apple position by 25% and Bank of America by 22.77%. These stocks now represent 26.24% and 11.88% of his portfolio, respectively. Amid the wave of sales, there were two new buys: Domino's Pizza (DPZ:US) and Pool Corp. (POOL:US). Additionally, Buffett increased his stake in HEICO (HEI:US).

Over the past two years through September 30, Berkshire Hathaway (BRK/B:US) has roughly tripled its holdings in cash, Treasury bills, and other liquid assets, reaching a record $325 billion. This cash reserve now surpasses the market caps of companies like Coca-Cola, Adobe, Chevron, and ASML. What is Buffett doing with this mountain of cash? It may signal that he’s holding off on major moves due to high current valuations. Historically, Buffett has built up cash reserves in similar periods, like before the 2008 crisis, keeping “dry powder” for future opportunities. Back then, he used Berkshire’s cash to invest in high-quality companies that had become undervalued amidst market panic. Berkshire’s current cash pile now exceeds the company’s total market cap from just over a decade ago, making up at least 27% of its $1.15 trillion in assets at the end of the quarter. The last time it reached this level as a percentage of total assets was around June 2005 in the lead-up to the GFC.

As it stands, Buffett's top three holdings are Apple (AAPL:US) (26.24%), American Express (AXP:US) (15.44%), and Bank of America (BA:US) (11.88%). Apple, at its peak, made up about 50% of Berkshire Hathaway's equity portfolio.

Michael Burry – Scion Asset Management

Michael Burry continued his investing spree in China last quarter, increasing his stakes in JD.com (JD:US), Alibaba (BABA:US), and Baidu (BIDU:US). After a strong rally in September, all three of these stocks have now fallen over 20% from their peak. However, this hasn't deterred Burry, as his outlook on these companies appears to remain positive. JD.com saw the most substantial increase in Burry's portfolio, with him doubling his position, bringing it to 24.08% of his holdings. His stake in Baidu also grew by 66.6%, now making up 15.85% of his portfolio. Additionally, Burry increased his Alibaba position by 29.3% for the quarter, and it now accounts for 25.55% of his overall portfolio.

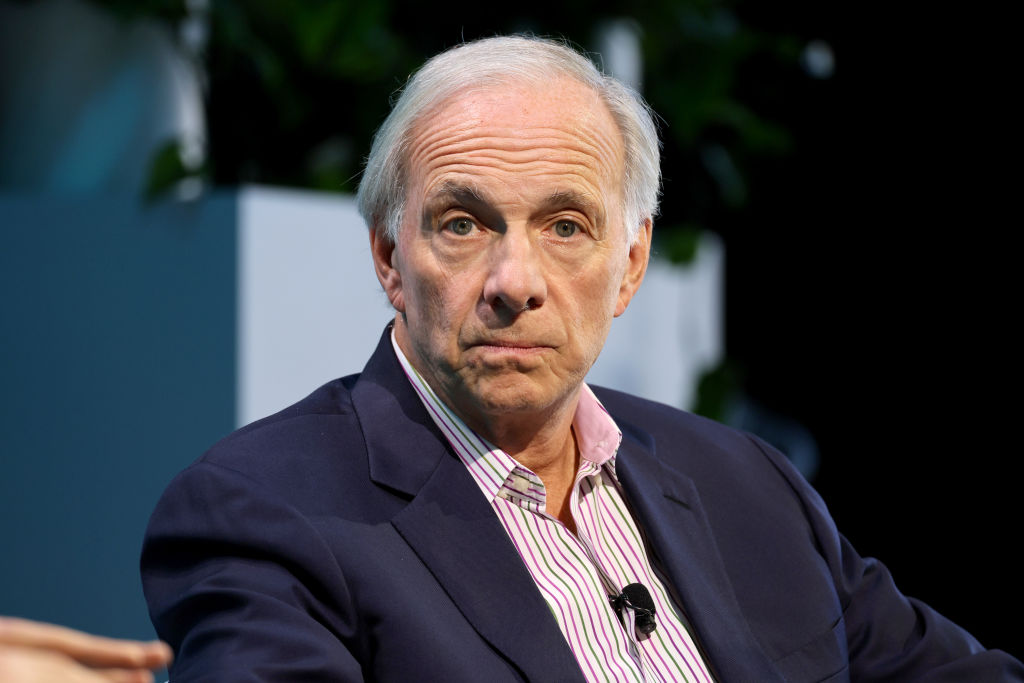

Ray Dalio – Bridgewater Associates

Bridgewater initiated new positions in semiconductors, China, and Mexico. Notable additions included Micron (MU:US), Alibaba (BABA:US), and the iShares MSCI Mexico ETF (EWW:US). Although each of these new holdings represents less than 1% of the portfolio, such as Micron at 0.58%, this is still a relatively large allocation within a portfolio of 773 positions. Significant increases were seen in Lam Research (LRCX:US) and Constellation Energy (CEG:US). Meanwhile, the 13F filing revealed reduced positions in Nvidia (NVDA:US), Microsoft (MSFT:US), and Amazon (AMZN:US), although these remain among Bridgewater's top holdings. Currently, the firm’s largest positions are in the iShares Core S&P 500 ETF (IVV:US) (7.26%), iShares Core MSCI Emerging Markets ETF (IEMG:US) (5.78%), and Alphabet (GOOGL:US) (4.11%).

Bill Ackman – Pershing Square Capital Management

During Q3 2024, Bill Ackman boosted his stake in Brookfield Corporation (NYSE: BN) with an addition of 25.9 million shares, raising his total holdings to 32.7 million shares. This now accounts for 13.48% of Pershing Square's portfolio, making it the fund's largest position.Brookfield, a leading alternative investment manager with over US$900 billion in assets, has surged around 60% year-to-date. He also boosted his stake in Nike (NKE:US) by 435.51%, adding 13.2 million shares for a total of 16.3 million shares, which now makes up 11.15% of his portfolio. Nike has fallen nearly 60% since November 2021 due to strategic missteps and rising competition. This significant drop raises the question: is Nike now an undervalued opportunity or a potential value trap?